A new report shows that minority-owned businesses in Fairfax County and Northern Virginia as a region suffered more acutely due to the COVID-19 pandemic than businesses owned by their white counterparts.

The Community Foundation of Northern Virginia released a report in late June detailing findings and recommendations from their minority-owned business working group.

They found that at the end of 2019, there were 128,000 minority-owned businesses in Northern Virginia, which encompasses five counties, including Fairfax. That’s approximately 42% of all establishments in the region, well above the national average of 29%.

Of the 128,000 minority-owned businesses in Northern Virginia, about 55,000 are in Fairfax County, according to statistics provided by the Fairfax County Economic Development Authority (EDA).

More than 8,000 non-farm businesses with paid employees in the county are owned by people of color, representing about a third of all such businesses in the county.

“It’s turned out to be one of our winning hands,” says EDA’s CEO and President Victor Hoskins about the number and contributions of minority-owned businesses in the county. “It’s something grown up here over time…just part of the DNA of not just Fairfax, but Northern Virginia.”

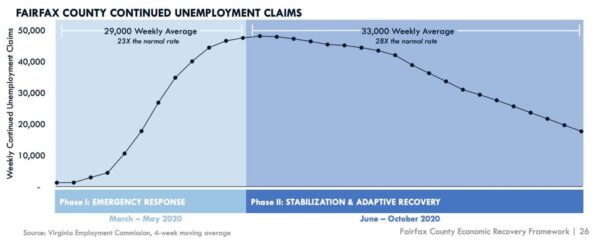

While the number of minority-owned businesses remained essentially flat throughout 2020, revenue and staffing at those businesses has decreased dramatically, while unemployment insurance claims have gone up.

According to the report, minority-owned businesses are more likely to be smaller in size, concentrated in high-risk industries such as accommodation and food service, and face more difficulties in securing capital. Due to these factors, minority-owned businesses are more likely to have “poor or fair” financial health.

Consistent with the rest of the region, Fairfax County minority-owned businesses have also suffered more acutely due to the pandemic. Because these businesses tend to be smaller in size, they simply have had less ability to overcome the economic hardships brought by the pandemic.

“Smaller businesses were disproportionately impacted by not having the financial wherewithal to weather the storm that this pandemic caused,” said Stephen Tarditi, EDA’s director of marketing intelligence. “They tend to be concentrated in industries more adversely…impacted by the pandemic.”

The report offered a number of recommendations for ways to better support these businesses, including better tracking of data and information to understand more specifically which businesses need help and when.

It also notes that more financial help is needed, including with grant funding and better strategies to improve access to capital for these businesses.

Officials agree with the report that more can be done. For example, specific data, like numbers related to revenue and number of paid staff, can drive policy, but there’s often a lack of up-to-date information.

“I was just surprised at how little…or regularly updated data that we have on hand to make these decisions,” Tarditi said. “I’m having a tough time knowing what the pandemic’s impact has been on our minority business community. This data drives the decisions and drives the strategy, which is extremely important, especially in this past year.”

EDA officials say the plan going forward is to disseminate more surveys more often with better outreach to be able to compile more and better data.

Last year, Fairfax County distributed more than $52 million in relief funding to small businesses through its RISE program, about half of which went to minority-owned businesses.

“We actually designed the RISE program to target a portion of small and minority-owned businesses,” says Hoskins. “I think the target was 30%, but we ended up [with] 72% [going to] women, veteran, or minority-owned businesses.”

The county is currently accepting applications for its new PIVOT program, but that doesn’t have any provisions directly dedicating a certain portion of funds to minority-owned businesses.

The Northern Virginia Black Chamber of Commerce told Tysons Reporter last month that they’ve felt neglected in the development of some of Fairfax County’s major business grant programs.

When asked about this, Hoskins said the EDA works with the Northern Virginia Black Chamber of Commerce all the time and are located in the same building. Beyond that, he wasn’t familiar with the details of their comments or complaints.

Photo via Tim Mossholder/Unsplash

About a month after Virginia lifted all COVID-19 capacity and social distancing requirements, in-person dining is starting to make a comeback at local restaurants, even as evolving guidance around masks suggests the pandemic may not be entirely in the rearview mirror.

From D.C. to northern Virginia, restaurants throughout the region look much different than they did a year ago, when many venues were either temporarily closed or just starting to invite customers back inside.

Now, restaurants are free to return to full occupancy, and patrons can eat and drink without fumbling with a mask, though individual businesses can still require masks if they choose to keep a policy in place.

“Carryout and to-go sales of alcohol are still continuing to help our restaurants, but yet, we are definitely seeing a shift in the return of more and more in-person dining,” said Barry Biggar, president and CEO of the Fairfax County tourism agency Visit Fairfax. “The future is bright and we are on a forward trajectory towards full recovery.”

At Agora Tysons (7911 Westpark Drive), carryout with Uber and DoorDash is still busy, but after May, in-person dining demand increased to the point that the Mediterranean restaurant had to turn people away, restaurant manager Hasan Kaya said.

They’re getting 80 to 90 people per night on weeknights and exceeding 150 people per night on weekends, he said Thursday.

“Most of the offices around our restaurant [are] closed still,” Kaya said. “We are hoping to be open back for lunch once they move their office back.”

Shuttered offices are among the many challenges that the food service industry has faced over the past year, along with significant job losses, stay-at-home orders, and ever-changing public health rules. A reckoning over the industry’s conditions for workers poses another complication to recovery efforts.

“The positive news is that many of our restaurants are starting to see around 80 to 90 percent of pre-COVID numbers,” Biggar said in an email. “And while that sounds great, and sales are up, it does not always translate to straight profit. Many restaurants are still paying deferred rent, utilities, and other expenses that they had to hold off on paying due to the pandemic.”

While Virginia’s state of emergency is set to expire today (Wednesday), health officials have recently started raising new concerns about the spread of more dangerous COVID-19 variants, even for fully vaccinated people.

The Commonwealth followed the Centers for Disease Control and Prevention’s lead in May in easing mask requirements for fully vaccinated individuals in most places. But the World Health Organization suggested Friday (June 25) that even vaccinated individuals should still wear masks to reduce the spread of the highly transmissible Delta variant.

Experts who talked with the Miami Herald advised caution regarding whether or not to wear masks, and the CDC hasn’t adjusted masking guidance based on the Delta variant, which was first detected in India and is estimated to contribute to one in five U.S. cases now.

The CDC says there’s evidence that the variant causes more severe disease and has increased transmissibility.

A federal relief program that recently ended contributed over $1.1 billion to the Tysons area to help workers.

The money came through the CARES Act, the COVID-19 relief package passed by Congress in 2020 that created the Paycheck Protection Program. In the area, it helped around 1,700 businesses, nonprofits, and sole proprietors with forgivable loans of $150,000 and more.

According to data from the Small Business Administration, which oversaw the program, the Tysons-area businesses and nonprofits that landed the most money in terms of a single award were:

- Digital Intelligence Systems (8270 Greensboro Dr.): the temp agency supported 500 jobs with a $10 million loan, the most that could be received

- Team Washington (1600 Spring Hill Rd.): the local Domino’s Pizza franchisee received $7.9 million for 500 jobs

- Favor TechConsulting (8075 Leesburg Pike): the information technology contractor got $7.9 million for 437 jobs

- SourceAmerica (8401 Old Courthouse Rd.): the nonprofit, which helps connect people with disabilities to jobs, received nearly $7.3 million for 397 jobs

- SecTek (1650 Tysons Blvd.): the private security guard firm got $7.1 million for 500 jobs

Businesses that received less than $150,000 weren’t included in the $1.1 billion figure that Tysons Reporter calculated using SBA data. Other businesses may have also received multiple awards but aren’t part of the list of top awards for an individual loan.

The money was given in the form of forgivable loans. To be forgiven, at least 60% of the money must have gone to payroll.

Details regarding businesses that received the money are available through online databases, such as ProPublica and the SBA. The program ended Monday (May 31).

“The Paycheck Protection Program provided over 8.5 million small businesses and nonprofits the lifeline they needed to survive during a once-in-[a]-generation economic crisis,” SBA administrator Isabella Casillas Guzman said in a news release on Tuesday (June 1). “I’ve heard story after story from small business owners across the country about how PPP funds helped them keep the lights on, pay their employees — and gave them hope.”

The PPP rollout came with some controversy. After reports showed that some loans went to large corporations, hundreds of companies returned the money. The SBA says that 96% of the loans went to businesses with fewer than 20 employees.

Companies that received an initial PPP loan and met other criteria were able to get a second loan. The average amount awarded this year by the program overall was $42,000.

A consultant is recommending a dozen ways Fairfax County can uplift people whose livelihoods have been harmed by the pandemic in the short-term and promote long-term economic resilience.

Specific short-term measures include launching “Buy Local” and “Made in Fairfax” campaigns, focusing on women- and minority-owned businesses, and finding ways to reduce rent or other costs for struggling small businesses.

Other recommendations target those hit hardest — including people without high school degrees, women with children, and people of color — with services like career centers, workforce training programs, and affordable childcare.

“A lot of these things have ongoing aspects, but tying them together and focusing on economic recovery is really going to be an effective approach,” Dranesville District Supervisor John Foust said.

County staff presented plans for implementing the consultant’s recommendations and assisting small businesses during the Fairfax County Board of Supervisors economic initiatives committee meeting on Tuesday (March 16).

Fairfax County has up to $15 million in reserves to support economic recovery efforts and could also use some of the anticipated $222.56 million in federal funds coming from the American Rescue Plan, according to Foust, who chairs the committee.

Hunter Mill District Supervisor Walter Alcorn called the staff proposal “fantastic” but added that transportation — which did not figure into staff planning — should play a role in the county’s recovery efforts.

“Since we’re doing something new, I would just recommend putting more structure into collaboration across agencies,” Providence Supervisor Dalia Palchik said.

Fairfax County hired the consultant HR&A last summer to analyze how the COVID-19 pandemic has affected its economy and what the county government could do to expedite a more just recovery. More than 65 organizations and small businesses participated in the study, providing input on perceived barriers to and strategies for economic recovery.

According to the consultant’s report, before COVID-19, flourishing technology and government sectors contributed to a decade of strong economic growth for Fairfax County. The total number of jobs grew by 9% annually, and employment had reached its lowest level since the Great Recession.

In 2018, the county had the third-highest median household income in the D.C. area, but significant racial disparities lurked just below the surface: The median household income for white residents was about $140,000, exceeding that of Black households (~$86,000) and Hispanic households (~$81,000).

The pandemic reversed that job growth and exacerbated the existing disparities.

Through December 2020, Fairfax County lost an estimated 48,200 jobs, mainly in food service, hospitality, retail, and the arts. Small businesses in these three sectors will have a particularly long road to recovery, HR&A said.

The consultant also reported that job losses were most acutely felt by low-income people, people of color, and people with lower levels of formal education and training, which will make “the road to economic stability longer and more challenging.” Read More

Some big changes are coming to McLean, and Dranesville Supervisor John Foust says he supports many — but not all — of them.

During a “Good Morning, McLean” breakfast hosted by the Greater McLean Chamber of Commerce yesterday morning (Thursday), Foust highlighted ongoing redevelopment work to the downtown area and Chain Bridge Road, but expressed caution about proposed zoning changes.

He repeated his support for the McLean Commercial Business Center revitalization plan despite some vocal opposition, saying it encourages development while protecting those who do not want McLean to become the next Tysons. The Fairfax County Planning Commission will hold a public hearing on the plan on April 28, and it will go before the Board of Supervisors on May 18.

Foust also spoke favorably about Tri-State Development’s proposal to build a 35-unit senior living facility with townhouses on a Chain Bridge Road site that would otherwise fit nine single-family homes. Earlier this month, the planning commission deferred a decision on the plan until next Wednesday (March 17).

“It’s exactly what McLean residents are looking for who want to downsize but don’t want to leave McLean,” Foust said. “Fundamentally, it’s a good application, and I think it’ll probably get approved.”

The project has received some pushback from nearby residents who say the project extends the business district into their residential area and will cause transportation and parking problems.

Foust acknowledged these complaints, adding that a dedicated left turn lane at the Chain Bridge and Davidson Road intersection could be needed to account for car and foot traffic. Ultimately, though, he believes it is better than the alternative for developers.

“Building nine houses would’ve been miserable,” he said.

McLean is also bracing for the potential impact of Fairfax County’s Zoning Ordinance Modernization project. Most of the changes proposed by county staff are “non-controversial” and will simplify frustrating ordinances, Foust said.

But he opposes a few elements that have also consternated the public, including proposed regulations on flags and changes to the permits required to operate a business from home.

Foust says loosening customer and signage rules for home-based businesses could lead to more businesses in residential areas.

“Staff prepared, I think, a very liberalized version,” he said. “I’m not excited about the direction staff is trying to take this.”

Outside of development and zoning issues, Foust says that, as chair of the Board of Supervisors’ economic initiatives committee, he has been focused on how Fairfax County will recover from the COVID-19 pandemic once it’s over.

The committee will receive a presentation on Tuesday from a consultant that the county hired last year to develop recommendations for its road to recovery. Right now, about $15 million are earmarked for implementing recovery programs, but Foust predicts “that number will increase dramatically” when Fairfax County receives federal funding through the American Rescue Plan Act.

According to Fairfax County, that sum could be $222.56 million, although the exact amount has not yet been confirmed by the federal government.

In the meantime, the vaccine process is picking up, even with more than 103,000 people currently on Fairfax County’s waitlist.

“We’re getting through it,” Foust said. “…I get so frustrated sometimes with the failures we’ve encountered, the bumps in the road, but when I step back and look at what staff and others are accomplishing, it’s just amazing.”

Staff photo by Jay Westcott

Commercial office development will be essential to future economic recovery efforts in Tysons and Fairfax County, a new study says.

Released last Thursday (March 4) by the Tysons Partnership, an economic report and market study developed by the consulting firms HR&A Advisors, Toole Design, and Wells & Associates argues that Tysons will need at least 1.9 million square feet of new office space over the next 10 years — despite predictions that the COVID-19 pandemic could permanently alter white-collar workplaces.

“In early 2021, we remain in the midst of the global COVID-19 pandemic, with fallout still being measured,” the economic report says. “However, office investments to date are seeing a strong performance return and will certainly play a key role in County and regional pandemic economic recovery efforts.”

According to the report, Tysons saw a 40 to 75% drop in the use of office space after COVID-19 arrived, following regional and national trends, but prior to the pandemic, vacancy rates had been declining, dipping four percentage points between 2015 and 2019.

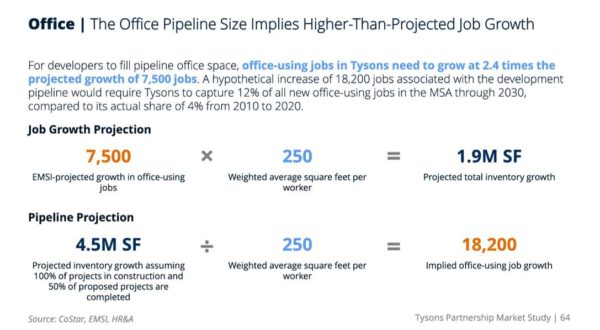

In addition, the study projects that office-based employment in Tysons will grow by 7%, or 7,500 jobs, by 2030.

Office work is already integral to Tysons’ economy. Office workers constitute 81% of the total 107,000-person workforce, with the largest sector — the professional services industry — employing two of every five workers in the area. Tysons accounts for 17% of Fairfax County’s office-using jobs.

Tysons outpaced the rest of the county with a 9% job growth between 2015 and 2020, and that faster growth is expected to continue over the next five years, albeit at a slower rate of 5%. Professional services will still be the largest sector, but the biggest area of growth will be in healthcare, which is projected to grow by 24% through 2025.

However, the projected office-using job market growth is far short of what developers would need to fill all of the office space that is in the works for the Tysons area.

If all projects in construction and 50% of all proposed projects in Tysons are completed, that would result in 4.5 million square feet of new office space that could accommodate an estimated 18,200 workers, according to the market study.

In comparison, driven by the opening of the Metro Silver Line in 2014, Tysons added 1.9 million square feet of office space between 2015 and 2020, a 7% growth in inventory that surpassed the rate for both Fairfax County overall (4.7%) and Arlington County (4%).

Though they anticipate future job growth, the economic report and market study acknowledge that “long-term trends remain uncertain” due to the pandemic, which triggered a 5% climb in office vacancy rates and sent the leasing market plummeting from 81 deals in the first quarter of 2019 to just five in the fourth quarter of 2020 so far.

“Tysons Partnership leaders understand much work remains to be done as recovery efforts begin post COVID-19 and in identified areas where continued investment and resources are essential, including housing affordability, mobility, and implementation,” the partnership said in a news release.

Outside the office market, the report says that Tysons has cemented its role as a regional retail hub over the past decade, generating $3.5 billion in annual retail spending, which represents 17% of Fairfax County’s total retail spending.

As reported at the Tysons Partnership’s “State of Tysons” event in December, Tysons’ residential population grew 39% from 2010 to 2018, a rate four times higher than the county’s average growth. Led by mid- and high-rise developments, Tysons has expanded its housing stock by 34% to 13,800 units since 2010, and it is projected to grow by 36% to nearly 19,000 units by 2025.

“The investment on behalf of the public and private sectors in smart, sustainable urbanization is working,” Tysons Partnership president and CEO Sol Glasner said.

The full report and market study can be found on the Tysons Partnership website. The nonprofit plans to use the collected data to develop a dashboard that “will serve as the go-to information hub for a wide range of stakeholders and promote the growth of Tysons,” according to the market study.

Staff photo by Jay Westcott, slide via Tysons Partnership

Hotel rooms have suddenly become difficult to come by in Fairfax County ahead of Inauguration Day on Wednesday.

That is a welcome problem for the lodging sector of the hospitality industry, which has been in a downward spiral since the COVID-19 pandemic prompted a slew of travel restrictions and stay-at-home health guidance.

But this inauguration will be unlike any other in recent political history. The general public’s ability to attend President-elect Joe Biden and Vice President-elect Kamala Harris’s Oath of Office ceremony has been sharply curtailed due to the pandemic, but hotels are hosting another large group of guests: the National Guard.

Up to 21,000 members of the National Guard have been authorized to come to D.C. and secure the city ahead of potential attacks, after Trump supporters stormed Capitol Hill on Jan. 6. Fairfax County hotels are reportedly housing some of the 15,000 guard members already in the D.C. metropolitan area.

“We are indeed hearing anecdotally from hoteliers that there has been an uptick in reservations compared with the past 11 months, but we are unable to ascertain whether those reservations are directly related to the inauguration and/or the National Guard or people who are visiting for leisure or business travel,” Visit Fairfax President and CEO Barry Biggar said in a statement.

The pandemic and ensuing shutdowns devastated the hospitality industry across the U.S. In Virginia, COVID-19 has resulted in the loss of about 100,000 jobs, according to the American Hotel and Lodging Association.

In November, the AHLA found that 71% of its member hotels said “they won’t make it another six months without further federal assistance given current and projected travel demand.” 47% of respondents said they would be forced to close hotels.

Many hotels were forced to layoff more staff this winter, even as access to the second round of the Paycheck Protection Program has expanded to all lenders.

But the employees who remain taking the sudden surge of guests in stride, Biggar explains.

“What we do know is that our hotels have been working tirelessly, even with staff shortages and for long hours, to ensure that our guests are treated with the utmost hospitality,” he said.

Photo courtesy Hilton McLean Tysons Corner

The Tysons Regional Chamber of Commerce has big plans for 2021.

As offices shuttered and pivoted to remote work when COVID-19 hit Fairfax County last spring, the chamber became a vital source of information and resources for local businesses scrambling to stay afloat and adjust to a new reality.

Now, with vaccines suggesting a potential end to the pandemic, the chamber faces the task of helping members recover from a year of economic upheaval, while recognizing that some of the changes to the workforce and business landscape introduced by the novel coronavirus may be here to stay.

“This is going to be a big year in transition,” Tysons Regional Chamber of Commerce board chairman Andrew Clark said in an interview on Jan. 4.

Like many of the businesses it represents, the chamber shifted its focus online last year in lieu of holding in-person meetings and events, but that did not make its schedule less busy.

Clark says the chamber organized more than 40 webinars last year on subjects ranging from brand management and networking to health protocols for businesses looking to reopen and ways that nonprofits could compensate for declines in charitable giving.

The organization hosted its signature Tysons 2050 event for the fourth year in a row, and it held the first-ever Tysons Restaurant Week in October. The initiative proved so successful that organizers are planning to revive it this spring.

Clark says the Tysons chamber will bring that same spirit of creativity and collaboration to the new year with initiatives like a Chocolate Safari that Visit Fairfax is currently promoting and a car show that is being organized with Tysons Corner Center.

A spokesperson for the mall confirmed that a car show is in the works, but the event is still in the preliminary planning stages. Clark says the chamber is tentatively aiming for a date around the end of February or early March.

“It’s a communal effect,” Clark said. “…The restaurants are supporting the buildings, the buildings are supporting the restaurants, and now that we have a sense of the community that’s coming to Tysons, it’s fun to be a part, as the chamber, of being a conduit for that.”

With a new board of directors set to be inducted on Thursday (Jan. 14), the chamber’s priorities for 2021 will include intensifying its focus on technology companies and government contractors, two industries that have a strong presence in Tysons, current board member Vicki Warker says.

The chamber will also continue working with companies that manage or provide services to commercial real estate as they prepare for a potential return of office workers while maintaining cleaning protocols and other health measures necessitated by COVID-19.

Clark says safety will be “paramount” to ensuring a successful transition to a new normal for Tysons. The chamber strives to keep members informed on everything from how to obtain personal protective equipment to the legal issues to consider when reopening a business.

“What’s relevant today? We try to position ourselves to get that information as quickly as we can to our constituents,” Clark said.

Photo by Michelle Goldchain

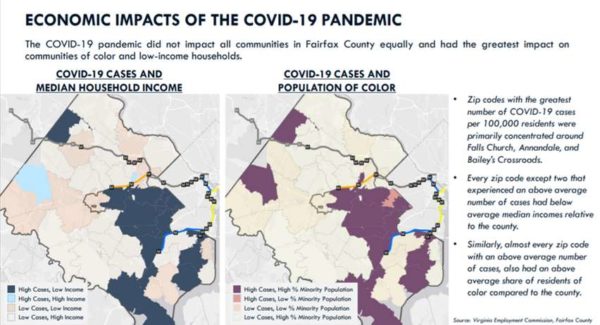

Like everywhere else in the U.S., the COVID-19 pandemic and ensuing economic fallout have hit Fairfax County hardest in its most disadvantaged communities, consultants confirmed in a presentation to the Fairfax County Board of Supervisors on Tuesday (Nov. 10).

With the exception of just two zip codes, the areas in Fairfax County with more COVID-19 cases also have more residents of color and lower average median incomes than the county as a whole, according to HR&A project manager Olivia Moss.

The zip codes with the most COVID-19 cases per 100,000 residents are concentrated primarily around Falls Church, Annandale, and Bailey’s Crossroads.

On top of that, low-income residents and people of color have been most affected by the national economic downturn that started this spring, when businesses and public spaces temporarily closed in an effort to control the spread of the novel coronavirus.

90% of all job losses in Fairfax County this year have occurred in industries like retail and food services, where average wages are less than 80% of the county’s area median income. 63% of the county’s job losses were in industries where the majority of workers are people of color.

“We know across the country, the pandemic and the resulting economic crisis has not been distributed equally across everyone and every business sector,” HR&A partner Jeff Hebert said. “So, really trying to understand what’s happening in Fairfax and how you can be part of creating a more just recovery in Fairfax is going to be really important to the community that will result after this pandemic is over.”

Fairfax County hired HR&A this summer to develop an economic recovery framework to guide the county’s response to the economic challenges presented by COVID-19.

To create a “new normal” that addresses the socioeconomic inequities exposed and deepened by the ongoing pandemic, Fairfax County needs recovery strategies targeted to different industries and populations based on their specific needs, Hebert and Moss say.

For instance, the county could assist the hardest-hit industries – led by the hospitality and food services sectors, which have shed 12,420 jobs or 26% of their entire workforce – by helping them reduce costs, evaluating regulatory requirements, and supporting programs to rebuild consumer confidence.

Initiatives like the RISE COVID-19 Small Business and Nonprofit Relief Grant Fund that the Board of Supervisors approved in May will be critical too. Through RISE, Fairfax County has awarded $52.5 million to 4,804 businesses so far, 72% of them owned by women, minorities, or veterans.

Lee District Supervisor Rodney Lusk says Fairfax County should adapt its recovery strategies to specific geographic areas as well as industries, noting that the pandemic’s economic impact in his district has been especially acute in the Richmond Highway corridor.

“Certain parts of Fairfax County are going to have different needs and issues,” Lusk said. “Tysons, Reston, Herndon are in a very different position than Bailey’s, Richmond Highway, and parts further south.”

Workforce development will also be essential to help people whose jobs may never return.

While 40,300 of the approximately 48,200 jobs lost during the pandemic are projected to be recovered by the end of the year, Fairfax County’s labor force has contracted by about 22,000 workers. Women in particular have been driven out by issues like inadequate or uncertain access to childcare, Hebert says.

“The reskilling piece is probably the important thing in here, from my standpoint. Not only if you’re going to help those most vulnerable in the community, you’re going to do that by making sure they have a skill set to take advantage of our future economy,” Board Chairman Jeff McKay said, suggesting the green economy as one industry with a lot of potential for growth.

HR&A will continue analyzing the impact of COVID-19 on Fairfax County before delivering a report with recommendations for recovery strategies and programs in January 2021.

Staff Photo by Jay Westcott

Barry Biggar, President and CEO of Visit Fairfax, has a somewhat frank assessment of the state of the hospitality industry in Fairfax: not great.

“There’s one particular industry that’s been devastated, and that’s travel and tourism,” Biggar said, “and when people aren’t travelling, there are many elements that are affected.”

Biggar isn’t alone in that assessment. In an Economic Advisory Commission meeting, local hospitality industry leaders spoke with Biggar and members of the Board of Supervisors about the impact the pandemic has had on hotels and other hospitality services.

“This has perhaps been the most heart-rending experience of my entire career,” said Mark Carrier, representing DoubleTree Hotel in Tysons. “Many hotels are paying to stay open. In Fairfax, all hotels combined had an occupancy of just 32 percent over last three months, less than half a year ago. Same period in 2019 was 76 percent. Revenue has declined by 73 percent across the entire county. Cash flow has evaporated basically, operators fighting to sustain their business. Frankly, the sustained nature of the crisis has been a source of stress.”

Biggar told Tysons Reporter that the D.C. area, including Fairfax, is one of four regions in the country seeing occupancy below 50%.

“From middle of March to end of August, hotel revenue (generated here in our county) has seen a loss of $278,987,000, just between mid-March and August,” Biggar said. “May is generally a good month. In May of 2018, the hotel revenue in Fairfax County was $70 million. This May, that figure was $9.1 million.”

Biggar noted that those figures are just based on revenue from occupancy and don’t include the total loss from related services, like food and beverage or catering.

“When you add those up, it’s significant,” Biggar said.