In a meeting about how to help build affordable housing in Falls Church, one potential solution proposed was increasing the meals tax by 1%.

Meals tax increases have been a go-to solution for finding more funding for affordable housing in neighboring jurisdictions like Arlington County. Meals tax increases are frequently contentious even in the best of times, but the Falls Church City Council noted that these are far from the best of times.

Representatives from the hired consultants National Housing Trust and Federal City Council offered 11 recommendations in what they described as a tool box in a City Council work session on Monday. A meals tax was only one of those suggestions, but one most likely to turn heads, as restaurants in the area face devastating losses in revenue.

The consultants argued that increasing the meals tax by 1%, from 4% to 5%, would bring Falls Church in line with the meals tax in other parts of the region and would generate $800,000 for the affordable housing fund annually.

According to the report:

A meals tax is levied on prepared food purchased for consumption at a restaurant or taken to-go. Falls Church already has a meals tax of 4%, which generated over $3 million in revenue annually from 2017-2019 . Currently, all the funds generated by the meals tax are directed into the City’s General Fund. To provide a dedicated and consistent revenue source for the Affordable Housing Fund, Falls Church should consider increasing the Meals Tax to 5%, dedicating the additional 1% in tax revenue to the Affordable Housing Fund. This would represent a much-needed consistent revenue source for the AHF and would generate approximately $800,000 annually for the Fund.

A 5% meals tax is in line with what is levied by other jurisdictions in the area. In the Commonwealth of Virginia, the median meals tax rate is 6%. While neighboring jurisdictions Arlington and Fairfax County currently levy a 4% meals tax, as of 2016, 108 localities in the Commonwealth have instituted a meals tax that is higher than 4%.

The report notes that Alexandria’s meals tax increase was aimed squarely at raising funding for affordable housing, though the report also acknowledged that recent factors could make the proposal untenable in the near term.

The consultants recognize that restaurants nationwide are struggling to survive on reduced revenue caused by COVID-19, and the subsequent limits and restrictions on service that have been imposed to stop the spread of the virus. An increase in the tax at this time could potentially discourage the purchase of food from restaurants at a time when restaurants are operating on extremely thin margins. The implementation of this recommendation should be considered in the long-term, once the restaurant and hospitality industry is under less financial pressure.

City Council member Letty Hardi struck down the idea as soon as the discussion was turned back over to the City Council.

“In regular times I’d be a fan of looking at things like the meals tax or carving funding out of the general fund,” Hardi said, “but I think neither of those would fly currently given how much suffering there is in the community.”

One proposed source of funding that sat better with the City Council was dipping into Amazon REACH Funds — a $75 million funding commitment to support affordable housing in the area and avoid the affordable housing loss associated with the tech giant elsewhere.

“The City of Falls Church should take the opportunity to engage with local housing development owners whose projects are eligible and are able to access the funds to increase housing affordability in the City,” the report said. “The final deadline for a project application is June 15, 2021.”

Maura Brophy, director of transportation and infrastructure for Federal City Council, also said that promoting accessory dwelling units can have a meaningful impact on housing affordability by increasing the supply, but without other interventions and requirements, there’s no guarantee that the accessory dwelling units would be affordable.

“If we can access all $3 million, that will allow us to buy down 60 units for about ten years, and that’s way more than we can produce in a year as-is,” Hardi said. “That feels like we should put pedal to the meddle and go after that free money.”

As the Tysons plan reaches its 10-year anniversary, Supervisors John Foust and Dalia Palchik spoke candidly to the McLean Citizens Association last night (Wednesday) about some of the challenges facing the Tysons plan today.

While many of the issues were Tysons-specific, they are also challenges the entire region faces as Northern Virginia becomes more urbanized:

- Walkability

- Schools

- Affordable Housing

For some of these, the recent pandemic has both brought the issues into focus and helped present new opportunities.

“One of my favorite topics is walkability,” Palchik said. “[We’re] looking now at how we make Tysons more walkable.”

Palchik pointed to a recent success in temporarily closing a section of Tysons Blvd to allow for more cycling and walking. Palchik pointed to it as a step in the right direction, but said it also took a lot of work to make it happen.

“It took a month to get Fairfax and the Department of Transportation to agree on a location,” Palchik said. “I hope to see more flexibility to create a sense of place.”

Palchik pointed to the planned pedestrian and bike bridge going over the beltway as another upcoming walkability success. Tysons is also slated for more investments to connect the blooming city’s street grid.

“Sometimes, new streets can feel in conflict with existing conditions, but [we’re] trying to make it more walkable,” Palchik said. “Change can be hard, but we’re looking at the upsides and really listening.”

Palchik and Foust both repeatedly praised the foundation of the Tysons plan, but said there are things that need tweaking.

“One issue that continues to bother me is the fact that we don’t have a plan for delivering school facilities in Tysons yet,” Foust said. “We have gotten a proffer of land for an elementary school. That’s an issue that’s going to head up, going forward.”

Palchik said the county needs to be more flexible on how schools are built, for example, building smaller schools with less grade levels than traditional elementary, middle, and high school models.

“We’ve been working on proffers, because the county can’t buy land,” Palchik said. “We’re looking at being more flexible, knowing this area is urbanizing. Can we get five acres? Can portions of development be dedicated to classrooms?”

Foust said another issue that’s really been prevalent during the pandemic is the lack of affordable housing in the area.

“Our challenge is delivering housing for 80% below and 60% below [Area Median Income],” Foust said. “We’re working on that challenge to increase the amount of housing that is truly affordable.”

COVID-19, Foust said, has hopefully helped to highlight the role essential workers play.

“COVID, if nothing else, has opened up our eyes to who is truly our essential workers, and they’re not the people making the income that can put you in a luxury apartment in Tysons,” Foust said. “They’re the kind of people working in the department stores and grocery stores, the service providers, and they deserve to live in the community where they work.”

Staff photo by Jay Westcott

A new task force dedicated to holding onto Fairfax’s limited affordable housing is scheduled to start meeting later today.

Tysons is trying to become a city, but one of the largest hurdles remains trying to create and preserve a range of affordable housing options. The new Affordable Housing Preservation Task Force is focused on drafting policies to keep the county’s limited affordable housing stock around as areas like Tysons start to develop.

According to the task force website:

Key issues to be addressed will include:

- Definitions for the types of preservation that can occur in communities

- Typology of properties at risk and characteristics to guide prioritizing properties or neighborhoods in need of action sooner

- A comprehensive set of preservation strategies the includes recommended policies and tools to achieve the goal of no net loss of affordability

The first meeting today is scheduled to focus on foundational work like setting the mission in stone and establishing a timeline for new policies and initiatives.

Most of the discussion around affordable housing in Tysons comes with new units added as part of development deals with the County, though some of those plans have stumbled and other redevelopment has pushed out previously affordable housing stock.

Northern Virginia community leaders are looking for affordable housing solutions as the Silver Line expansion gears up to bring more people to local urbanized areas.

The Dulles Chamber of Commerce brought together representatives from Fairfax and Loudoun counties to talk about what the expansion means for the future of affordable housing at a public meeting yesterday evening. The conversation focused on roadblocks to construction, current demand for units, land-use policies and who needs subsidized housing.

The Silver Line extension is expected to be completed in 2021 and will run from Fairfax County into Loudoun County.

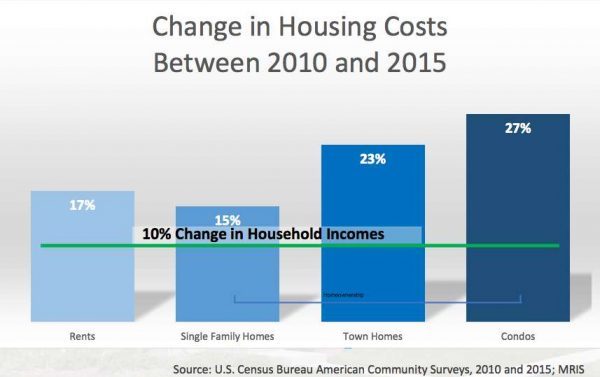

But, the cost of living is not sustainable for lower-income people working in the area, according to Tom Fleetwood, the director of Housing and Community Development for Fairfax County. The average income only increased by 10% while the cost of housing increased by 17% from 2010-2015 in Fairfax County.

Fairfax County will require at least 15,000 new affordable housing units in the next 15 years to support families earning 60% of the median income and below, according to Fleetwood.

Currently, there are 30,000 low-income renters in Fairfax County that are paying more than one-third of their income on housing. “This means that they’re what we call a ‘cost-burden’ and that they have less money to contribute to our economy,” he said.

According to the National Low Income Housing Coalition, four minimum wage jobs are needed in order to afford the average apartment in the county.

Once the Metro extension project is complete, the housing disparity is only expected to grow.

In Tysons and Reston specifically, Fleetwood said that the biggest challenge is the limited availability of land for affordable housing projects. To combat this, updated inclusionary zoning policies have been a large help in rethinking how space is used, he said.

“Visionary zoning policies have produced a substantial number of below-market units that are serving working families in Tysons and in Reston,” Fleetwood said but didn’t volunteer a specific number.

Stephen Wilson, the president of SCG Development, which has an office in Tysons, offered examples at the meeting of how his company has worked around small parcels of open land.

At Ovation at Arrowbrook in Herndon, SCG Development is branching out and working with community planners to incorporate affordable housing close to stations like Innovation Center.

“Land is a precious commodity everywhere, but particularly around high-density areas,” he said.

Image courtesy Fairfax County

Happy Friday! Here are the latest stories about the Tysons area that the Tysons Reporter team has been reading:

Answer to Affordable Housing? — “A unique zoning designation permitted a new duplex to spring up in the heart of the City of Falls Church, but the development may not be a one-off if proposed legislation to upzone all single-family lots to accommodate multifamily structures passes down in Richmond.” [Falls Church News-Press]

Art Center Proposed For McLean Park — “‘MPA envisions an all-inclusive art center which provides a creative respite for the community that is integrated into, yet distinct from, Clemyjontri Park,’ county officials said.” [Inside NoVa]

Falls Church Library Project Moves Forward — “By a split 4-3 vote, the Falls Church City Council gave a “first reading” preliminary approval to a $10.9 million project to renovate and expand the Mary Riley Styles Public Library… The vote on final approval for the plan is scheduled for Feb. 10.” [Falls Church News-Press]

Woman Struck in Falls Church — “A woman was struck by a vehicle while crossing the street at the corner of Little Falls Road and West Broad Street in the City of Falls Church Tuesday afternoon, the City reported.” [Falls Church News-Press]

Now that @TBiergarten closed. Where are the best spots to watch the #SuperBowl in and around Tysons?

— Tysons, Virginia (@TysonsVA) January 29, 2020

Fun Fact: The miniature fighter jet sculpture pictured above in Falls Church was made with 14,000 copper coins, according to Atlas Obscura.

Happy Friday! Here are the latest stories about the Tysons area that the Tysons Reporter team has been reading:

New Middle School Principal Teacher — “Amy Miller, who has served as principal of Saratoga Elementary since 2015, has been named the new principal of Kilmer Middle School, effective February 3.” [Fairfax County Public Schools]

Coronavirus Prompts FCPS Exchange Program Changes — “Exchange students who traveled to Fairfax County from China where the coronavirus outbreak is happening will not be attending classes at Longfellow Middle School, according to the school district.” [Patch]

Focus on Affordability in Tysons — “Developers are building thousands of residential units in Tysons as they look to create a vibrant area that remains busy after the workday ends, but some are concerned that the young people they are targeting can’t afford the apartments being built.” [Bisnow]

Why You Should Visit Vienna — Richmond Magazine took a cue from Billy Joel’s “Vienna” song and listed reasons why people should check out the suburbs outside Tysons. [Richmond Magazine]

The two candidates vying for the Providence District seat on the Fairfax County Board of Supervisors faced off last night at the Providence District Community Center.

The League of Women Voters, who hosted the debate, encouraged attendees to submit questions for Democratic Dalia Palchik and Republican Eric Jones, and the candidates didn’t hesitate to disagree when it came to the hot-button issues of the evening.

They compared thoughts on the importance of census data, budgets, sanctuary counties, immigration, renewable energy, panhandling and firearm regulation throughout the evening. Here are some highlights from the debate:

Affordable Housing and a Rising Cost of Living

When it comes to the panhandling in Fairfax County, Jones said people struggling financially in the area should move elsewhere in the country where the cost of living is lower, like Ohio.

“It’s very expensive to live here. there are other places where it’s not so expensive to live,” Jones said. “To some degree, it is simply a choice [on where to live.]”

Palchik took another approach. “I support that we took a step back and said, ‘No, we are not going to criminalize panhandling,'” she said, adding that the county should work to ensure there is enough affordable housing and job security.

On the topic of affordable housing, Palchik said she is looking into coordinating with faith-based organizations to expand affordable housing options, especially for seniors.

While Fairfax County has been highlighting its recent affordable housing efforts — especially in Tysons — the candidates stressed the importance of financial security.

Dalia said she wants to focus on fighting for fair wages for county employees, while Jones said he would rethinking policies for zoning and regulation to help small businesses.

Immigration and the Census

Immigration and the U.S. Census were popular topics during the debate.

Palchik said she was pleased when the citizenship question was removed from the census, saying that it encourages more participation. Without responses accurately representing the population of the district, the county would lose out on tax revenue that benefits the community, she said.

“We still have families who fear coming to school to sending their kids to preschool or going to a food pantry, because they are afraid we are collaborating and sharing their information with police,” she said.

Meanwhile, Jones said he believes undocumented immigrants are a danger to the community. “I am especially against sanctuary countries,” he said. “These are especially harmful to our legal immigrants.”

During his time with the U.S. State Department, Jones said he conducted interviews for the immigration process and granted thousands of people citizenship or permanent resident status.

“I believe we should cooperate completely with federal authorities,” he said.

Renewable Energy

One of the largest issues the candidates clashed on was the implementation of renewable energy. Palchik seemed to be in full support while Jones said the cost would outweigh the benefits.

“I think the so-called New Green Deal is unrealistic,” Jones said, referring to the Green New Deal. “You cannot run the Metro system on wind power, solar power and batteries.”

Instead, he told the audience that he believes in natural gas and nuclear power.

Palchik shifted the conversation, noting her endorsement by the Sierra Club and other environmental groups around the area. Palchik pointed to her time on the Fairfax County School Board, where she launched a joint environmental taskforce with the school board, students and Board of Supervisors.

She said that, if elected, she will be spending time in Richmond working to eliminate solar energy roadblocks.

New Republican Candidate

Jones was a new face for voters. After candidate Paul Bolon’s death in August, Jones was chosen as the new conservative candidate to run against Palchik.

“I’m running to give voters a choice in Providence District,” Jones said during his opening statement. “I wish my friend Bolon was here today.”

Palchik gave her respects after the debate. “I want to thank Mr. Jones for stepping up, I know it was a tragedy.”

The election is on Nov. 5.

As residential use explodes in Tysons, Fairfax County officials are quick to point to a growing amount of affordable housing in the area.

Chris Caperton, the director of the Urban Centers Section, updated the Board of Supervisors today (Oct. 8) on the progress in Tysons in the last year.

One of the biggest takeaways — “Residential is hot in Tysons,” Caperton said.

Currently, Tysons has 53.1 million square feet of development and is projected to reach 56.9 million square feet by 2021 — about 5.5. million square feet under the project in the comprehensive plan.

“We’re sort of catching up to that number,” Caperton said.

Of the 53 million square feet, more than half of it is office space, while about a quarter is residential.

“We do see an increase in residential use,” he said, saying that the jobs to household ratio jumped from 2.5:1 in 2005 to 6.8:1 now. (The comprehensive plan calls for a 4:1 ratio.)

Providence District Supervisor Linda Smyth was quick to note that affordable housing units have increased, saying that more than 200 have been recently added to Tysons.

Caperton added 750 affordable housing units have been completed, while 4,220 are expected in the near future. It is unclear if Caperton’s calculations included just approved developments or also unapproved ones as well.

When Tysons Reporter wrote about Affordable and Workforce Dwelling Units (ADUs and WDUs) in May, Tysons had 536 units at the time with an average occupancy rate of 94% and 3,919 were committed by developers.

Residential uses aren’t the only increases in Tysons. Caperton shared that transit options — like an 8% increase of Metro ridership in the Tyson area since April — are flourishing. The Tysons Corner station is now the busiest one for Capital Bikeshare in Fairfax County since May — surpassing the Wiehle-Reston one, Caperton said.

Caperton and several supervisors pointed to growing connectivity in Tysons — from the new Vesper Trail to the Jones Branch Connector — that will hopefully get Tysons to reach the county’s vision as a place to work, live and play.

Falls Church city officials say now that the city’s housing guidelines have been updated, the real work begins.

On Aug. 12, the City Council unanimously voted in favor of new affordable housing and demographics chapters as the city staff works to update its Comprehensive Plan.

“Revisiting the city’s zoning ordinances is an appropriate thing to do to make sure the rules of the game support the goals the city is trying to work toward,” Paul Stoddard, the city’s planning director, said. “Housing doesn’t operate in a free market. It is heavily constrained by local regulation.”

These approved changes come after months of work and revisions from committees, including the Housing Commission and Planning Commission. Now, city leaders are calling on the public to speak up — to ensure that the plan is implemented.

Housing Commissioner Pete Davis, who acted as an ally for the plan throughout its development, said he emphasized the importance of affordable hosing amendments that will address Falls Church’s “crisis.”

He asked the Planning Commission to “keep affordable housing in the forefront of [its] mind” during an address on Aug, 5.

At the same meeting, commissioners noted changes to the proposal since the group last met, with key adaptions including the addition of religious organizations as a partner to ease housing burdens, a revised definition of median income, the inclusion of accessory dwellings as a solution and acknowledgment that it will take the entire community to solve the issue.

Davis said that the next steps require community members to speak up about affordable housing and continue to put pressure on the Falls Church City Council.

Within increasing pressure from Amazon’s HQ2 coming into the area, Davis said that city officials and community members can no longer remain passive and wait to see how the market reacts — they must act now and push for more affordable housing units.

“We cannot take a hands-off approach anymore,” Davis said.

The City of Falls Church mayor is fighting a federal tax law change that he warns will put a strain on local residents.

In December 2017, Congress passed a new law that limits the amount of state and local taxes (SALT) that people can deduct from their federal income tax return to $10,000.

Known as the SALT deduction cap, this law has stirred up controversy.

Some people claim it puts people in areas with a higher cost of living at a disadvantage because they will likely pay more in taxes, while others say that SALT deductions disproportionately benefit a small proportion of wealthy taxpayers.

In June, Mayor David Tarter spoke in front of the House Ways and Means Subcommittee by invitation of Rep. Don Beyer (D-Va.) regarding the recent cap on the SALT deduction policy.

Tarter said he is one of a few politicians across the country that are spearheading an effort to reverse the decision or minimize the damage they say it will have on their communities in the near future.

“The new cap on the SALT deduction double taxes citizens on these payments and penalizes workers in high-cost areas, like my city, where wages and income are high but are fully matched by the cost of living,” Tarter told the committee, adding that the new law takes away more tax dollars from the city.

Falls Church City Manager Wyatt Shields, who manages the city’s finances, told Tysons Reporter that Falls Church residents spend more on housing comparative to anyone else in the country. He added that this new legislation only “exacerbates” the city’s lack of affordable housing.

According to Tarter’s statement to the committee, the median home price in the city is around $825,000 — “That doesn’t buy you a mansion but likely a modest brick rambler built in the 1950s.”

That median home price is drastically more than the $229,000 median home price across the U.S., according to Zillow.

Despite the fact that Fairfax County is among the richest counties in the nation, it still has problematic financial burdens that lawmakers are attempting to solve.

“I’ve heard from a fair amount of people how their taxes have gone up and not at first realized implications,” Tarter told Tysons Reporter while talking about the fallout from the law.

The Internal Revenue Service (IRS) announced Wednesday, Aug. 14, that they will waive the tax underpayment penalty for more than 400,00 people who did not claim a special penalty waiver when they filed their federal income tax returns this year.

“Earlier this year, the IRS lowered the usual 90% penalty threshold to 80% to help taxpayers whose withholding and estimated tax payments fell short of their total 2018 tax liability,” according to an IRS press release.

Locally, this may help residents in the Northern Virginia area who were hit with unforeseen financial burdens recently because of the SALT deduction cap.

“There are no yachts in Falls Church, just lots of hard-working families trying to get by in the high-rent district,” Tarter said. “Most of the folks that I know are two-income families who serve their country through work in government or the military and want the best education possible for their children.”

Ultimately, Tarter hopes that the SALT deduction cap, currently sitting at $10,000 per household, is heightened or eliminated entirely.

“The next steps are up to Congress,” Tarter said. “I suspect, given the way things are right now, there probably won’t be any immediate action.”

Image via C-Span