Woman Hospitalized After Stabbing at Ritz Carlton — “Officers are on scene of a stabbing at the Ritz Carlton, 1700 Tysons Blvd, in McLean. A woman was taken to the hospital with life-threatening injuries. A person of interest, a man, is detained and receiving treatment for non-life-threatening injuries.” [Fairfax County Police Department/Twitter]

Virginia Sales Tax Holiday Starts Tomorrow — “Virginia’s annual sales tax holiday is this weekend. Stock up on qualifying school supplies, clothing, hurricane and emergency preparedness supplies, and certain ENERGY STAR™ and WaterSense™ products without paying state sales tax starting Friday, Aug. 6, at 12:01 a.m. and ending Sunday, Aug. 8, at 11:59 p.m.” [Fairfax County Emergency Information]

Redistricting Commission Holds Public Hearing — “Northern Virginia residents on July 27 told the Virginia Redistricting Commission to redraw congressional and state legislative boundaries in ways that are logical, protect minority voting rights and do not split communities…The 11th U.S. House of Representatives District, occupied since 2009 by Gerald Connolly (D), was a frequently cited example at the meeting of a poorly district. Speakers said voters living in Reston, Vienna and Tysons had nothing in common with those in Triangle on the district’s southern edge.” [Sun Gazette/Inside NoVA]

Vienna Opens Parks and Rec Fall Program Registration — “Fall Class and Camp registration is now open for Town residents! Check out the program guide and reserve your spot today! Registration for non-Town residents opens on Monday, Aug. 9.” [Town of Vienna/Twitter]

Plastic Bag Tax Public Hearing Scheduled — The Fairfax County Board of Supervisors authorized a public hearing for 4:30 p.m. on Sept. 14 to gather community input on a proposed five-cent tax on disposable plastic bags. If the ordinance is approved, Fairfax County would be the second locality in Virginia to adopt a bag tax. [Fairfax County Government]

Tysons Partnership Funding Approved — The Board of Supervisors approved $250,000 in Economic Opportunity Reserve funds for the Tysons Partnership, which will use the money to support branding efforts, install a mural on the former Container Store property, and position itself for long-term financial health. The board nominated the organization for up to $1 million in EOR funds in December. [Sun Gazette]

McLean Area Is a Hotspot for Rich Politicians — Virginia’s gubernatorial candidates both call Fairfax County’s most affluent zip codes home, with Democratic nominee Terry McAuliffe living in a $1.1 million McLean mansion and Republican Glenn Youngkin boasting a $1.7 million estate in Great Falls. More notably, former Speaker of the House Newt Gingrich says he moved to McLean because he and his wife saw “an alcoholic” sleeping on the ground in Old Town Alexandria. [The Washington Post]

Vienna Restaurants Up for RAMMYs — The Restaurant Association Metropolitan Washington tweaked its 2021 RAMMY awards to recognize how the industry adapted to the COVID-19 pandemic. Finalists include Clarity (Outstanding Covid-Safe Redesign), Caboose Brewing Company (Prime Pandemic Patio Scene), and Taco Bamba (Standout Family Meal Packages To-Go). The latter two categories will be open for a public vote from Aug. 2 to Sept. 2. [Patch]

Virginia is reconsidering the future of funding for transportation infrastructure, as the rise of electric and more fuel-efficient vehicles has cut into the gas tax revenue that helps pay for those projects.

One option the Commonwealth has started pursuing is a “mileage-based user fee” that drivers would pay depending on how much or little they travel. Drivers could opt into the voluntary system in lieu of paying a mandatory highway use fee that first took effect on July 1, 2020.

State Sen. Janet Howell (D-32nd District) says the highway use fee — which applies to cars that average at least 25 miles per gallon and is calculated based on the fuels tax at the time of a vehicle’s registration and the average number of miles it travels in the state — is a precursor to Virginia’s planned mileage-based user fee program.

“For most of the past decade, Virginia, like the rest of the country, has been wrestling with the challenge of identifying the best approach to generating sufficient revenues to support transportation investments,” she said in a statement. “As cars have become more fuel efficient and electric vehicle adoption increases, it is increasingly difficult to strike the right balance of raising adequate revenues from traditional sources and adhering to a usage-based philosophy of highway financing.”

The Virginia Department of Motor Vehicles is currently fielding requests from private contractors to operate the program, which it anticipates rolling out in July 2022. Led by the DMV, a workgroup tasked with developing the program is slated to deliver an interim report to the Commonwealth this December.

The working group is identifying all requirements to Virginia’s mileage-based user fee program with “a priority on consumer privacy protection and equity,” DMV spokesperson Jessica Cowardin said in a statement.

Seeking new ways to fund road repairs and transit projects, Virginia established the mileage-based fee program in April 2020 when the General Assembly adopted a major transportation bill that also established the highway use fee and raised gas taxes for the first time in more than three decades.

The bill also lowered vehicle registration fees by $10 and repealed an annual $64 fee for electric and alternative fuel vehicles.

The changes, which include tying the gas tax rate to the Consumer Price Index to keep up with inflation starting next year, will help Virginia diversify its funding sources to offset stagnant or declining gas tax revenue, state legislators say.

The consultant KPMG previously estimated that Virginia would lose nearly 33% of its gas tax revenues by 2030 due to fuel efficiency, or approximately $260 million.

“Neither the [Highway Use Fee] nor the EV Registration fee are intended to suppress the sales of fuel efficient or electric vehicles, but simply recapture the average annual revenue from the foregone gas taxes,” Howell said.

The idea of taxing drivers based on how much they travel instead of the fuel they use has been gaining traction throughout the U.S. over the past decade.

Despite inflation, the federal gas tax rate has been locked in at 18.4 cents per gallon since it went up from 14.1 cents in 1993, meaning there’s less money to fund highway improvements.

“Many cars are not using gas at all, such as electric, so that system of highway finance has been coming apart for a long time,” said Jonathan Gifford, director of George Mason University’s Center for Transportation Public-Private Partnership Policy in Arlington.

If Virginia wants to encourage a transition to clean energy and electric vehicles, which “is absolutely essential to addressing climate change, we will need to look to other options” to pay for transportation projects, Northern Virginia Transportation Alliance President Jason Stanford says. Read More

Fairfax County took a first step yesterday toward potentially taxing plastic bags used by grocery stores and other retailers.

The Board of Supervisors voted 9-1 yesterday (Tuesday) to direct county staff to draft an plastic bag tax ordinance, but even supporters of the measure allowed that there remains some uncertainty around how exactly the tax would be implemented if approved.

“Let’s definitely try this, but we may end up back in the General Assembly in the foreseeable future to try to get clarification,” Hunter Mill District Supervisor Walter Alcorn said, noting that the county is subject to the Dillon rule. “…This is probably a prime example of when we probably need a little more flexibility, but I’m all for it.”

The Virginia General Assembly passed legislation during its 2020 session giving localities the authority to impose a five-cent tax on disposable plastic bags, starting on Jan. 1, 2021.

Roanoke became the first jurisdiction to take advantage of the new law when it adopted an ordinance in May that’s set to take effect on Jan. 1, 2022.

Under House Bill 534, which was identical to Senate Bill 11, cities and counties can tax each disposable plastic bag provided to customers by grocery stores, convenience stores, and drugstores. The tax would not apply to plastic bags designed to be reused, garbage bags, bags used to hold or package food to avoid damage or contamination, and ones used to carry prescription drugs or dry cleaning.

The legislation allows retailers to retain two cents from the imposed tax on each bag until Jan. 1, 2023, when the amount that goes to retailers drops to one cent.

That “dealer discount” provision is intended to help offset additional expenses retailers might incur from adjusting their operations, but it also puts added pressure on localities to adopt an ordinance as soon as possible, according to Board of Supervisors Chairman Jeff McKay.

“We want to start the process of the ordinance review, looking at the language, the public input, because the clock literally is ticking,” McKay said.

Complicating matters is the fact that the Virginia Department of Taxation has not yet released guidelines clarifying what a plastic bag tax ordinance should look like, leaving questions around the definition of a grocery or convenience store, how the tax will be enforced, and other issues, County Executive Bryan Hill told the board in a Nov. 30 memorandum.

Braddock District Supervisor James Walkinshaw, who introduced the board matter on Tuesday, said the draft guidance that county staff has seen and provided input on through the Northern Virginia Regional Commission will clear up many of those questions.

He hopes the guidelines will be finalized soon so county staff can incorporate them into the ordinance that they have now been directed to draft and present to the board in September.

Springfield District Supervisor Pat Herrity, the lone Republican on the board, opposed the board matter, taking issue with the timing of the proposal. Read More

County Demobilizes Community COVID-19 Testing Sites — The Fairfax County Health Department closed its COVID-19 community testing sites at the end of the day on Friday (June 4). Testing is still available through health care providers, urgent cares centers, and pharmacies, and starting today (Monday), residents who exhibit COVID symptoms can schedule appointments at an FCHD clinic by calling 703-324-7404. [FCHD]

Carjacking Attempt Reported in Falls Church — Two men, one of them armed with a handgun, approached a man in the 3000 block of Graham Road on May 29 and demanded his car keys and property, police say. They attempted to leave in the victim’s car but took another vehicle instead when they were unable to drive it. No injuries were reported. [FCPD]

D.C. Area Slow to Distribute Rent Relief — “At least $300 million in emergency funds intended to help struggling renters in the Washington area remain unspent even as a federal ban on evictions is set to expire at the end of this month, according to a Washington Post analysis…Fairfax County, the largest county in Virginia, opened its portal to applications the last week of May. The county quickly received more than 700 applications.” [The Washington Post]

Falls Church Real Estate Taxes Due Today — Real estate taxes are due today for property owners in the City of Falls Church. Payments can be made at City Hall, online, or by text, and questions can be directed to the Treasurer’s Office at [email protected] or 703-248-5046. Late payments incur a 10% penalty. [City of Falls Church/Twitter]

The Vienna Town Council adopted a new budget for the 2021-2022 fiscal year last night (Monday) that decreases the town’s real estate tax rate for the first time in eight years.

At $43.2 million, the new budget increases funding by 5.4% over the adopted FY 2020-2021 budget, including a 6.9% increase in the General Fund to $26.5 million, but revenues remain 3.1% below the budget that had been proposed for FY 2020-2021 before the COVID-19 pandemic forced the town to revise its plans.

In a press release, the town says the funding increase in the budget for the next fiscal year “reflects a return to more normal post-pandemic operations” as Virginia rolls back public health restrictions amid an ongoing vaccination campaign.

“Last year at this time it was difficult to determine if we had budgeted sufficiently to meet the economic challenges of the pandemic,” Vienna Town Manager Mercury Payton said. “We were pleasantly surprised at how well Vienna survived the initial challenges and how well we are positioned to handle improving conditions.”

In particular, the Town of Vienna anticipates increases in revenue from real estate taxes and parks and recreation fees.

The new real estate tax rate of 22.25 cents per $100 of assessed value represents a quarter-cent drop from the current rate of 22.5 cents — the town’s first rate decrease since 2013 — but residents will still see a $72 increase in their tax bill, on average, due to rising property values.

Residents should also brace for higher water and sewer bills after the town council approved raising the rates by 4.3% to support a 6.1% increase in the water and sewer fund budget, which will be $10.8 million for the upcoming fiscal year.

According to the town, the increase in rates is necessary “to offset increasing costs of sewer treatment and to fund necessary infrastructure replacement.” The average resident’s water and sewer bill will go up by about $11.75 per quarter, amounting to a $47 annual increase.

While the budget was passed unanimously, Councilmember Ray Brill suggested the town should look for ways to reduce the water and sewer rates in the future as much as possible while still addressing the need to repair and refurbish infrastructure.

Federal relief from the American Rescue Plan Act could potentially assist with that goal, but the town is still awaiting guidance for how those funds can be used, Vienna Director of Finance Marion Serfass says.

“We’ll be looking for those opportunities,” she told the council.

The Town of Vienna will receive an estimated $14.9 million from the stimulus package, including approximately $46,900 that has been budgeted for the costs of software to support virtual meetings, but the remaining funds are not expected to arrive until fiscal year 2022, which starts on July 1.

The town says lans for utilizing the funds will be shared in a public hearing when the exact amount and distribution date are determined, and it will require an appropriation and budget amendment by the town council.

As part of the budget adoption, the town council voted to keep $97,000 in reserve for the Parks and Recreation Department with the expectation that the money will become available once COVID-19 restrictions lift and the department can ramp up its operations.

The council also moved to unfreeze $434,300 in funds that had been in reserve for the current fiscal year, including $359,300 for worker compensation increases and $75,000 to cover education and travel expenses for required recertification training for town police officers.

Thanks to efforts to conserve costs by having existing staff cover vacant positions and unexpected budget surpluses in business license and state revenues, the Town of Vienna is projecting a $294,000 surplus for FY 2020-21 of $294,000.

About $125,000 of those surplus funds will go to giving eligible employees a 3% salary increase retroactive to April 1 of this year.

“I’m glad we’re doing that. I think our employees need a raise,” Vienna Mayor Linda Colbert said. “I think they’ve been patient and understanding, but they’ve worked hard this year, so I’d like to see that happen.”

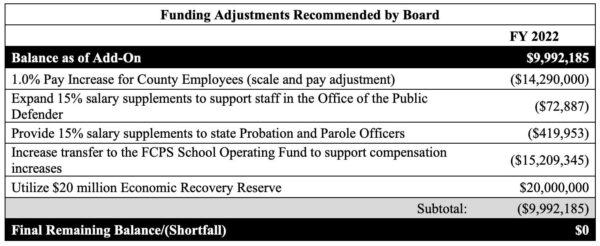

The Fairfax County Board of Supervisors adopted a balanced budget for fiscal year 2022 yesterday (Tuesday).

It includes some funding adjustments that the board incorporated into the proposed budget during the board’s markup session last week.

The newly adopted budget supports a 1% pay increase for county employees, a 2% raise for Fairfax County Public Schools employees, and 15% salary supplements for staff in the Office of the Public Defender and state probation and parole officers.

“While there were many constraints on this year’s budget, I am tremendously proud of what this Board was able to accomplish,” Board Chairman Jeff McKay said. “My goal was to look for balance in lowering the tax rate, with the understanding of skyrocketing property assessments, while also supporting our County employees and teachers and furthering our priorities in education, affordable housing, environmental protection, and community resources. I am pleased we were able to achieve that.”

The proposed budget from February did not include pay increases for employees, whose pay was frozen in this year’s budget. The new 1% pay increase comes after Fairfax County employees advocated for salary bumps last month.

“The 1% wage increase and one-time bonus come as a response to union members making it clear that two years of frozen pay for essential county workers was unacceptable,” SEIU Virginia 512 Fairfax Chapter President Tammie Wondong said. “We appreciate the approved change. That being said, the concessions fall short of the agreed-upon pay plan and workers are falling behind.”

The county employees’ union will now focus on its push for Fairfax County to adopt a collective bargaining ordinance. A new state law permitting localities to establish collective bargaining procedures took effect on May 1.

McKay told Tysons Reporter last week that county staff is currently drafting an ordinance that will be discussed at the board’s personnel committee meeting on May 25.

“Meaningful collective bargaining is the only way workers can ensure that the county keeps their promise on our pay plans so that we have the resources to provide the best services to the Fairfax community,” Wondong said.

The increase will be funded using $20 million that County Executive Bryan Hill had recommended setting aside in an “Economic Recovery Reserve.” As the county looks to rebuild, it will instead lean on the $222 million in federal relief funds it expects to receive from the American Rescue Plan Act.

“The redirection of this reserve does not exacerbate budgetary challenges in FY 2023,” the final budget document reads. “With this reserve, funding just shy of $30 million is available to be utilized for employee pay in FY 2022.”

Here are some other highlights:

As proposed in February, the real estate tax rate will decrease from $1.15 per $100 of assessed value to $1.14 per $100 of assessed value. Personal property tax rates and stormwater fees will remain the same, at $4.57 per $100 of assessed value and $0.0325 per $100 of assessed value, respectively.

As considered during the budget markup last week, the refuse disposal fee will decrease from $68 to $66 per ton, but the refuse collection fee will increase from $370 to $400 per household. The rate was reduced from $385 last year because of a reduction in yard waste collection services during the pandemic.

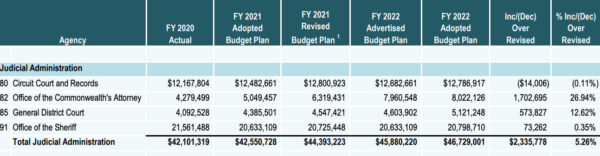

Funding for county government operations and contributions to Metro and Fairfax County Public Schools, or general fund disbursements, totals $4.53 billion. That marks a slight increase from the advertised $4.48 million, and an increase of $55.40 million over the current fiscal year’s disbursements.

More than half of those disbursements (52.6%, or $2.38 billion) support Fairfax County Public Schools. This includes $2.17 billion for operations, $197.12 million for debt service and $13.10 million for school construction.

Fairfax County will create 109 additional positions in FY 2022 to staff new facilities, such as the South County Police Station, a new 61,000-square-foot police station and animal shelter, and the Scotts Run Fire Station. Positions are also being added for the county’s opioid task force and Diversion First initiative.

Fairfax County Commonwealth’s Attorney Steve Descano says the budget marks an important first step toward solving Fairfax’s “longstanding justice crisis,” adding that the 15 new positions his office has been allocated will enable prosecutors to take on more cases.

“As the budget takes effect in July and we fill those, we will be able to expand our caseload to encompass all cases other than minor traffic infractions,” the Commonwealth Attorney’s office said. “We are already scaling up our caseload now and are prioritizing cases that contain an indication of violence between now and July.”

Descano says his office will complement its expanded case load with a “growing use of diversion and alternative sentencing to ensure we are keeping the community safe in a manner that accords with our values.”

Additional staffing alone won’t solve the problem, however. Descano says a multi-year investment is needed to address the “chronic shortcomings that plagued our system,” including a culture of producing as many convictions as quickly and cheaply as possible.

Charts via Fairfax County

First Lady Northam Visits Tysons Mass Vaccine Site — “@FirstLadyVA Pamela Northam is visiting the mass vaccination site at Tysons Corner Mall, which just this week became the first vaccination site in Northern Virginia to allow walk up appointments. They are doing them Monday through Saturday, 9 AM to 4 PM.” [Tom Roussey ABC7/Twitter]

Primark Coming to Tysons Corner — The London-based clothing retailer Primark has signed a lease for a two-story, 37,100 square-foot store at Tysons Corner Center. Expected to open sometime between September 2023 and September 2024, the store will be Primark’s first in Virginia. The retailer prides itself on offering “amazing fashion at amazing prices,” but like other “fast fashion” brands, it has been criticized for exploitative labor practices. [Press release]

Vienna Plans to Lower Tax Rate — The Vienna Town Council signaled on Monday (April 26) that it supports reducing the town’s real estate tax rate by a quarter of a cent to 22.25 cents per $100 of assessed value. This would be the first time that the tax rate has changed from 22.5 cents per $100 in six years, but higher assessments mean that most homeowners will still see higher tax bills. [Sun Gazette/Inside NoVA]

Thoreau Principal Selection Process Underway — Fairfax County Public Schools officials held a community and staff meeting on the process to select a new principal for Thoreau Middle School. The school’s last principal, Yusef Azimi, was let go after police arrested him for reportedly failing to report child abuse allegations against a teacher. [Karl Frisch/Twitter]

Attorney General Allows Vaccination Requirements for Colleges — “In an official opinion Monday, Virginia Attorney General Mark Herring has concluded that Virginia colleges and universities ‘may condition in-person attendance on receipt of an approved COVID-19 vaccine during this time of pandemic.'” [Falls Church News-Press]

The Fairfax County Board of Supervisors won’t approve a budget for the next fiscal year until May 4, but the bulk of the work to get to that final document will be done today (Tuesday) when the board meets at 10 a.m. to mark up the proposed budget.

Unveiled during a budget committee meeting on Friday (April 23), Board of Supervisors Chairman Jeff McKay’s proposed adjustments to the advertised fiscal year 2022 budget include a small raise for county employees and support for County Executive Bryan Hill’s recommendation of a one-cent decrease in the real estate tax rate.

The proposed cut would put the tax rate at $1.14 per $100 of assessed value, but rising residential property values mean that county homeowners will still see their tax bills go up by $224 on average.

“We all know that many families are struggling because of the impacts of COVID-19,” McKay said. “While the one-cent decrease isn’t a tax reduction for most families, I chose to support it because it provides some relief to families while still allowing the County sufficient funds, particularly with the stimulus dollars, to continue to stand up the programs that I know are needed in the community.”

The county is also considering lowering its refuse disposal fee from $68 to $66 per ton, but the board has proposed increases in sewer charges and for the refuse collection fee, which would go from $370 to $400 per household.

“It should be noted that this rate was reduced last year from $385 per household based on the inability to provide yard waste collection during the pandemic,” the proposed mark-up summary says.

With Fairfax County expecting a total of $222 million in federal relief funds from the American Rescue Plan Act, McKay has suggested redirecting $20 million that Hill had recommended setting aside as an economic recovery reserve fund to instead give county government employees a 1% pay raise.

The proposed mark-up doubles the increase in transfer funds to Fairfax County Public Schools from $14.1 million to $29.3 million — mainly to cover a 2% pay raise for school employees — and includes salary supplements for state probation and parole officers and support staff in the Public Defender’s Office.

“The Board remains committed to both acknowledging the hard work of our employees and maintaining competitive salaries relative to the market,” McKay said when outlining his mark-up proposal.

The board also plans to amend in its FY 2021 third-quarter review package to include $12.6 million for one-time bonuses for employees, along with funding for Celebrate Fairfax Inc., planning studies, athletic scholarships for at-risk kids, and environmental initiatives, including a green bank and zero-waste policies.

The county government employees’ union SEIU Virginia 512 said in a statement that it was “heartened” to see the board respond to the concerns that workers raised at public hearings on the FY 2022 budget last week about the possibility of having their pay frozen for a second consecutive year.

“However, the basic fact remains: the cost of living continues to rise, while Fairfax County workers continue to fall behind,” SEIU Virginia 512 Fairfax Chapter President Tammie Wondong said. “We urge the Board of Supervisors to continue to work to fund the county’s agreed-to pay plans.”

The union has also been advocating for the Board of Supervisors to adopt an ordinance allowing county employees to engage in collective bargaining.

“A union contract would bring consistency, improve recruitment and retention, and improve services for the community,” Wondong said.

According to McKay’s office, county staff are currently drafting a proposed ordinance, and the board will discuss the issue during its personnel committee meeting on May 25.

While the mark-up package mostly focuses on employee compensation, the Board of Supervisors also hopes to address affordable housing needs by allocating at least an additional half-penny from real estate tax revenues to the county’s affordable housing fund, which currently receives one half-cent, in FY 2022 and FY 2023.

Hunter Mill District Supervisor Walter Alcorn said he was glad to see that guidance in McKay’s mark-up proposal, even if it would still fall short of the two-cent allocation he campaigned on when running for office in 2019.

“Getting us back to a penny, at least historically, has been on the agenda for a long time,” he said. “I see the federal money as the opportunity, if you will, to pay back a lot of what we weren’t able to do in some previous years, so I do want to see us get to one penny as soon as possible.”

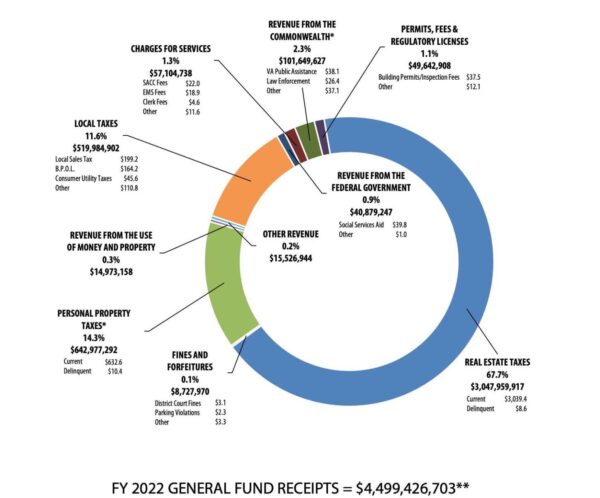

With tax season in full swing and Fairfax County plugging away at its latest budget proposal, you may wonder where exactly your tax dollars go.

Fairfax County is hammering out the details of its spending for the 2022 fiscal year, which is expected to gross more than $8.5 billion. But your tax dollars go to a smaller piece of the pie that encompasses funding for county government operations and contributions to Metro and Fairfax County Public Schools.

Totaling $4.48 billion, the general fund disbursements money comes from taxes — primarily real estate and personal property taxes, but also taxes on hotels and retail sales — as well as fees for licenses and permits. About $1.6 billion of this bucket sustains the operations of all county departments.

Real estate taxes paid by individuals and businesses contribute about $3 billion (or 68%) of the money needed to support county departments, schools, Metro, and debt services. In fact, residents’ property taxes make up about 74% of the county’s real estate tax income. The rest comes from commercial properties, such as apartments, offices, retail spaces, and hotels.

While homeowners could see their real estate tax rate lowered by one cent to $1.14 per $100 of assessed value in the upcoming budget, they will likely still see their bill increase due to rising property values. The one-cent reduction, however, will bring in $27 million less than if the current rate remained in place.

The county, meanwhile, is contending with falling commercial property values for its income from non-residential real estate taxes, a nationwide phenomenon.

But where does this tax revenue go?

After schools, which receive slightly more than half of the general fund disbursements, the county’s next two largest allocations go to public safety, including police and fire, and health and welfare, including family and neighborhood services.

Within those areas, much of the recurring spending is tied to personnel, both existing staff and requests for additional hires. The county government says an additional 109 positions are needed to staff new facilities and continue initiatives previously funded by grants and stimulus funding.

County Executive Bryan Hill’s proposed FY 2022 budget devotes $11.91 million to fund 46 positions to continue implementing the police department’s body-worn camera program and to staff the South County Police Station, a new 61,000-square-foot police station and animal shelter, and the Scotts Run Fire Station.

There is also additional funding to support the Fairfax County Office of the Commonwealth’s Attorney, which Commonwealth’s Attorney Steve Descano said last year is in a state of crisis and needs more staff, especially to handle the body-worn camera program.

The proposed budget adds seven positions to the county’s opioid task force and five positions for the Diversion First initiative.

Police and fire are the biggest drivers of the public safety budget, each accounting for around 41% of expenses, or $219 and $218 million, respectively. Overall, public safety accounts for 33% of the total general fund direct expenditures of $1.6 billion. Fairfax County lands in the middle of Virginia localities for how much it spends per person on public safety ($671 per person). Read More