Vienna residents’ next property tax bills won’t be quite as high as anticipated, even as the town commits to raising employee salaries and other additional costs.

The Vienna Town Council voted unanimously last night (Monday) to adopt a $48.7 million budget for fiscal year 2022-2023 with a real estate tax rate of 20.5 cents per $100 of assessed value — a 1.75-cent cut from the current rate. The new budget will be in effect from July 1 through June 30, 2023.

This will be the 10th consecutive year that the town has reduced or maintained its real estate tax rate, according to a news release.

Clothing Stores to Fill Former L.L. Bean — The now-closed L.L. Bean at Tysons Corner Center will be divided into smaller parts, including a two-story store for the fast fashion chain Primark. Plans indicate that Old Navy and Lululemon Athletica will also relocate to new spaces, leaving about 10,000 square feet left for other tenants. [Washington Business Journal]

Firefighters Flock to Woodson High School — “An early morning fire on damaged at least one building in Fairfax County Public Schools’ Woodson Complex off of Main Street on the eastern border of Fairfax City on Sunday. The complex is home to the school district’s Office of Facilities Management, which houses FCPS’ central operations, grounds operations, receiving, and food service.” [Patch]

FCPS Recognizes More Religious Holidays — The Fairfax County School Board approved a calendar for the 2022-2023 school year that designates Rosh Hashanah, Yom Kippur, Diwali, and Orthodox Good Friday as student holidays. The year will start on Aug. 22, and Veterans Day is also now a student holiday and staff work day. [FCPS]

Tysons-Based ID.me Partners with IRS — “You’ll soon have to prove your identity to a Virginia-based security company called ID.me in order to file a return, check tax records, or make payments on the Internal Revenue Service (IRS) website. Your old username and password credentials–if they still work–will stop working in the summer of 2022.” [Fast Company]

GMU Changes COVID-19 Vaccine Policy — George Mason University students are now “strongly encouraged,” rather than required, to get vaccinated against COVID-19 after new Attorney General Jason Miyares said on Friday (Jan. 28) that state universities can’t mandate the vaccine without enabling legislation. About 96% of the university’s students are vaccinated. [The Washington Post]

Let speculation about the future of the Sheraton Tysons Hotel begin, as the conclusion of a tax dispute that ended up in court could allow the property to move forward.

The Fairfax County Board of Supervisors agreed to accept a settlement agreement following a closed-door meeting on Tuesday (Dec. 7) to resolve lawsuits filed by the owner of the 449-room hotel (8661 Leesburg Pike), which permanently closed in April 2020.

Constructed in the mid-1980s, the Sheraton was one of a handful of union-run hotels in the Commonwealth, which contributed to higher operating costs, including for employee benefits.

Sheraton property owner JBG Smith, a Maryland-based real estate development and investment firm, filed lawsuits against Fairfax County in 2019 and 2020, contesting years-old property tax assessments.

The company’s lawyers argued that the county’s mass appraisal process failed to take the site’s higher operating costs into account. The suits had been headed for trials in 2022.

The county declined to comment on whether it has changed any appraisal policies or procedures due to the error. Board of Supervisors Chairman Jeff McKay’s office deferred questions to a county attorney, who cited a tax law, arguing settlement details couldn’t be released due to confidentiality.

The county also said the matter “remains in litigation.” The county suggested yesterday (Thursday) that the property’s assessments in 2016 and 2017 would be modified.

A county property database has stated the owner’s annual real estate taxes were around $252,092 for 2021.

Court records indicate that JBG Smith, identified as JBG Tysons Hotel LLC, sought compensation between $100,000 and $500,000 for each case.

Crescent Hotels & Resorts, which managed the Sheraton, issued a layoff notice for 171 workers, effective April 3, 2020, as the COVID-19 pandemic rocked the U.S. hospitality industry. Later that year, the hotel launched a liquidation sale of furniture and other items.

John Boardman, a representative for Unite Here Local 25, a union for D.C. area hospitality workers, said employees received closing pay as part of their now-expired collective bargaining agreement around six months ago.

“Our contract also provides that if all or part of the property is reopened as a hotel operation, then individuals who were formerly employed have a right to return to work in their previously held jobs,” Boardman said, adding that while the contract is no longer in force, the return-to-work provision runs in perpetuity.

The former Sheraton building occupies 5.8 acres of prime real estate off of Route 7 in Tysons West. JBG Smith has not publicly shared its future plans for the site, but rising property values could make it ripe for redevelopment.

Photo via Google Maps

Real Estate Taxes Due Today — Fairfax County property owners must pay the second installment of their real estate taxes by the end of today (Monday). Taxes can be paid through the Department of Tax Administration’s online portal. [Fairfax County Government/Twitter]

Vienna Man Arrested in Fatal Hit and Run — Carlos Alexander Torres Jr., 24, of Vienna was arrested in Montgomery County on Friday (Dec. 3) after police detectives determined that he was allegedly the driver in a Sept. 1 hit-and-run crash in Reston that killed the other driver. Police believe alcohol may have been a factor in the crash. [FCPD]

Asian Restaurant in Vienna Closes — Red Galanga at 144 Church Street NW closed its doors for the last time on Dec. 1, citing challenges with filling positions during the pandemic. Sister restaurant Sweet Ginger (120 Branch Road SE) will honor outstanding gift certificates from Red Galanga, which says an Italian restaurant will take its place on Church Street. [Patch]

Former WFT Quarterback Sells McLean House — “Alex Smith, quarterback for the Washington Football Team until earlier this year, has sold his 6,300-square-foot mansion in McLean for $5,800,000. He first listed the property for $6,750,000 in June, a few months after he was released from the team.” [Washingtonian]

Leaf Vacuum Careens into Vienna Garage — “Town of Vienna employees were working in the 400 block of Center Street, N., on Nov. 30 at 2:59 p.m. and had parked a leaf-vacuum trailer on the roadway with a wheel stop in place to secure it. Due to the steep incline, the trailer went over the wheel stop, proceeded down a hill and struck the garage of a residence, Vienna police said.” [Sun Gazette]

Vice President Praises Local Candle Maker — 11-year-old entrepreneur Alejandro got a boost from Vice President Kamala Harris when she visited the stall that his company Smell of Love Candles had at the Downtown Holiday Market in D.C. last weekend. Based in Fairfax County, the company crafts and delivers soy candles, and it now offers the ones bought by Harris and second gentleman Doug Emhoff as a package. [WUSA9]

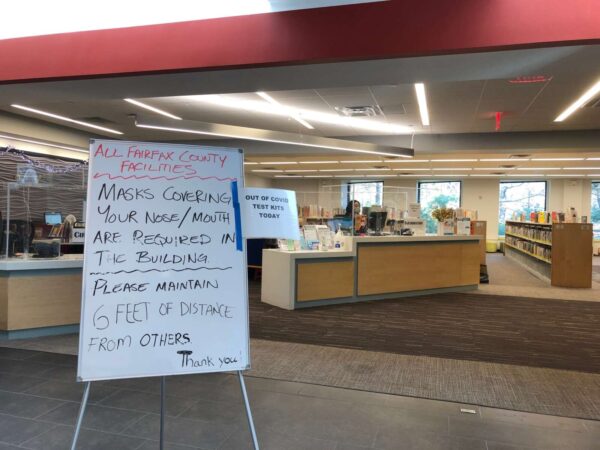

COVID-19 Diagnostic Testing Available to Students — Fairfax County Public Schools students and staff who have COVID-19 symptoms or have been in close contact with a COVID-positive person can now get diagnostic testing at six drive-through sites around the county. Appointments aren’t needed, but a parent or guardian must provide consent and their children’s information through the school system’s online portal. [FCPS]

County Recommends Getting COVID-19 Booster — “The Fairfax County Health Department joins the Centers for Disease Control and Prevention (CDC) in strengthening their recommendation on booster doses for individuals who are 18 years and older. Everyone aged 18 and older should get a booster shot either six months after their initial Pfizer or Moderna series or two months after their initial J&J vaccine.” [FCHD]

Four People Killed in Thanksgiving Weekend Traffic Crashes — “Four people died in traffic crashes in Virginia over the Thanksgiving weekend, the smallest number of traffic fatalities during the holiday weekend in the past 10 years, according to preliminary data released by the Virginia State Police. The fatal crashes occurred in the counties of Albemarle, Chesterfield, Fairfax and Spotsylvania.” [Patch]

Fairfax County Collects Record Taxes — “Fairfax County collected more than $4 billion in total taxes in fiscal 2021 for the first time ever, a staggering figure made possible not by rising tax rates, but soaring property assessments. Of the $4.05 billion collected in the fiscal year that ended June 30, $3.02 billion, or roughly 75%, came from real property tax levies, according to the county’s recently released Comprehensive Annual Financial Report.” [Washington Business Journal]

County Leaders Consider Staff Pay Increases — “Fairfax County supervisors and School Board members next year hope to give county and school employees large pay raises to make up for ones lost last year to the pandemic. But supervisors added quickly they did not want homeowners to feel the full brunt of skyrocketing property assessments.” [Sun Gazette]

Bring out the tote bags, Wegmans shoppers.

The grocery store chain announced this morning (Monday) that, starting on Dec. 1, it will no longer offer single-use plastic bags at its four Fairfax County stores, including the one at Capital One Center in Tysons (1835 Capital One Drive South).

Plastic bags will also be removed from stores in Fairfax, Alexandria, and Chantilly.

The move comes in anticipation of Fairfax County’s new 5-cent tax on disposable plastic bags, which will take effect on Jan. 1.

Wegmans will still have paper grocery bags available for a 5-cent fee that will be donated to the nonprofit United Way and each store’s food bank, according to the news release.

“We’ve always understood the need to reduce single-use grocery bags,” Jason Wadsworth, Wegmans packaging, energy, and sustainability merchant, said. “By eliminating plastic bags and adding a charge for each paper bag, our hope is to incentivize the adoption of reusable bags, an approach that has proven successful for us in New York State and Richmond.”

Since introducing reusable bags in 2007, Wegmans has stopped using single-use plastic bags in New York and, as of 2019, at two stores in Richmond.

Local grocers took different stances at a public hearing before the Fairfax County Board of Supervisors voted to adopt a plastic bag tax ordinance on Sept. 14. The county was the first locality in Northern Virginia to implement the new tax but was soon joined by Arlington County and the City of Alexandria.

Enabled by a state law passed by the Virginia General Assembly in 2020, the measure is also being considered in the City of Falls Church and Loudoun County.

County Proposes Expanding Tax Relief Program — “Today, the Fairfax County Board of Supervisors approved a public hearing on Dec. 7 to consider expanding the real estate tax relief program for seniors and people with disabilities…The expanded program would allow people with higher incomes and net worth to qualify, add a new 75% tax relief bracket and offer an option to defer tax payments.” [Fairfax County Government]

Man Sentenced in Falls Church Woman’s Drug-Related Death — “A former medical student from Ontario, Canada, was sentenced on Tuesday to one year in prison for distributing MDA — a psychedelic drug similar to MDMA, or “molly” — that resulted in the fatal overdose of a 21-year-old Falls Church woman in 2019, according to the U.S. attorney’s office.” [Patch]

MCA Takes Position on Tree Presevation Proposal — “McLean Citizens Association (MCA) board members on Nov. 3 commended the Fairfax County Tree Commission for crafting proposals to preserve the county’s tree canopy, but did not agree with all of the group’s recommendations…MCA’s resolution expressed concerns about the proposals regarding property setbacks and taller buildings.” [Sun Gazette]

Lewinsville Park Eyed for Pickleball Facilities — The Fairfax County Park Authority will present options to improve the park’s six existing tennis courts and introduce pickleball with a virtual public meeting at 7 p.m. on Dec. 1. The potential project aims to address growing demand for pickleball facilities in the greater McLean area. [FCPA]

Local Veterans’ Job Fair Is Big Draw — “One week before Veterans Day, representatives of 66 companies interviewed job-seekers at the first annual Veteran and Military Career Fair on Nov. 4, 2021…Geared toward assisting veterans, active-duty service members transitioning out of the military, and military spouses, the hybrid event was attended by 250 job-seekers at the museum, and 259 virtually attendees located around the world.” [Fairfax County Economic Development Authority]

Compensation increases for employees and real estate tax cuts for residents are on the table, as the extra money keeps rolling in for the Town of Vienna.

In addition to receiving $8.5 million in federal COVID-19 relief funds this summer, the town ended the last fiscal year (July 1, 2020 to June 30, 2021) with $900,000 in surplus revenue, staff told the Vienna Town Council in a conference session on Monday (Oct. 18).

“We’re in this position because we cut our budget. We cut our revenues to deal with the pandemic. We had to cut our expenditures,” Finance Director Marion Serfass said. “But then our revenues came in in some key areas pretty darn close to what we had budgeted, so that gave us a nice surplus.”

According to town staff, Vienna got higher-than-expected revenue from sales taxes, business licenses, zoning permit fees, and state and federal revenues in FY 2020-2021. In addition, position vacancies helped keep costs down.

Vienna’s budget committee presented three options for allocating the surplus funds.

Scenario 1

The town could follow its traditional practice of putting half of any surplus in a rainy day fund and using the other half to cover currently unfunded priorities:

- $125,000 to fix pay compression for 41 employees

- $175,000 for street paving work

- $50,000 for tree maintenance and beautification

- $100,000 to address 2022 budget corrections

Scenario 2

Because the rainy day reserve is already above where it needs to be, town staff proposed instead “returning” some money to employees and taxpayers. If the town allocates all $900,000 in the current fiscal year, it could:

- Cover the unfunded priorities above, except paving would get just $75,000

- $280,000 to give residents a half-cent tax rebate

- $270,000 to give employees a 3% salary increase starting on Jan. 1, 2022

Scenario 3

The town could also hold $550,000 to spend next fiscal year, while still covering the unfunded priorities now:

- $280,000 to reduce the real estate tax rate by half a cent

- $270,000 to increase employee salaries by 3% starting on July 1, 2022

Serfass noted that the surplus could be spent on any priorities, but she suggested paving and tree maintenance because the town council had previously floated those as areas that could use more money.

“Here’s some things that fall into the category of things we wanted to do but haven’t had enough money to do them,” she said. “We could always put more money in paving. We’re only getting the index of ‘fair’…We know we have issues with trees.”

The council gave its support for funding those needs as well as holding money for a tax rate reduction in July instead of an immediate rebate.

“I know it’s not much either way, but I think [a rate reduction] has more value than mailing somebody a pretty small check,” Councilmember Ed Somers said.

The council proved skeptical, however, when it came to the proposed 3% salary increase, since it would be a recurring expense paid for with a one-time surplus.

“If you are using long-term money for short-term gain, I have never seen that work,” Councilmember Steve Potter said, adding that he would be more comfortable offering bonuses or another incentive to help recruit and retain workers.

According to Michelle Crabtree, Vienna’s human resources director, other jurisidictions have seen some success in using bonuses to recruit employees, particularly police officers and commercially licensed drivers.

“We’ve had a high turnover in public works,” she said. “We’ve lost eight people this year, and seven of them said it was one hundred percent because they could find more money elsewhere.”

Noting that Vienna is hardly alone in having labor challenges, Councilmember Nisha Patel said she would support bonuses targeted toward the positions facing the biggest hiring and retention issues.

“If we have additional funds that can go to staff, maybe we should use those more wisely to attract and retain, as opposed to just spreading it out,” Patel said.

The Vienna Town Council will hold a public hearing on the surplus funds on Nov. 15.

Car Taxes Due Today — Personal property taxes are due today (Tuesday) for Fairfax County residents, who can pay online or in person at the Fairfax County Government Center until 6 p.m. About 12% of owners saw an increase in their car tax bill this year due pandemic-related supply chain issues. [Fairfax County Government]

Lane Closures Prompted by Pipe Work for New Vienna Police Station — Construction workers started installing stormwater pipes for the new Vienna Police Station yesterday (Monday), necessitating lane closures on Center and Locust streets. The pipe work is expected to be completed by Thursday (Oct. 7). [Town of Vienna/Twitter]

Virginia DMVs Resume Walk-in Service — “After nearly a year and a half of appointment-only service, walk-ins will again be welcome at the Virginia Department of Motor Vehicles…When it expands options on Tuesday, customers can choose to either schedule an appointment for services, or opt for walk-in service on alternating days. The changes will be in effect at all 75 of the DMV customer service centers.” [WTOP]

Winning Lottery Ticket Bought in Vienna — “A Powerball ticket purchased in Vienna is one of three that won a $50,000 prize. The three Virginia tickets won prizes in the Sept. 29 drawing. These tickets were bought at the Vienna Shell at 252 Maple Avenue in Vienna, Harris Teeter at 19350 Winmeade Drive in Leesburg, and Kenbridge Market Express at 216 South Broad Street in Kenbridge.” [Patch]

Fairfax County residents who drive used cars may get a higher vehicle tax bill this year than they were anticipating.

An unusual rise in the value of used cars will result in an average tax increase of $25 for about 12% of county residents, primarily those who own vehicles valued at $20,000 or less, the Fairfax County Department of Tax Administration (DTA) said in a news release yesterday (Tuesday).

“This COVID thing is really making an impact on everything here,” said Juan Rengel, director of the DTA’s Personal Property and Business License Division. “What’s happening with vehicles [is] we are experiencing an increase of about 5% in vehicle values of used cars. Typically, used cars depreciate in value year over year. That’s not the case this year.”

According to Fairfax County, the increase in assessments stems from a reduced supply of vehicles due to global shortages in automobile parts, particularly microchips, and an uptick in demand for used cars over newly manufactured cars from both customers and dealerships.

People holding onto their used cars instead of selling them, low turnover in fleets for rental car companies, and dealerships compensating for the shortage in new vehicles by filling out their lots with used ones are all putting pressure on the used car market, driving up prices, Rengel says.

He added that low interest rates have also been a factor, enabling more people to obtain loans to purchase cars.

Like the rest of Virginia, Fairfax County calculates a vehicle’s assessed value based not on the purchase price, but rather, on the market value of its specific year, make, and model over all the sales for that vehicle as of Jan. 1.

“Whatever the car value is as of January 1, that’s what we use,” Rengel said.

Vehicle taxes can be appealed if the owner believes their vehicle has been overassessed based on body damage, rusting, or high mileage, according to the DTA.

Fairfax County’s current vehicle tax rate is $4.57 per $100 of assessed value. Personal property tax bills will start to go out in the mail soon, with payment for existing and new vehicles registered in the county prior to July 1 due on Oct. 5.

Rengel notes that Virginia partially relieves the tax burden on owners by subsidizing a portion of the first $20,000 of assessed value for vehicles utilized for personal use. This year, the state will pay 57.5% of the tax bill, though owners are required to certify to the county annually that their vehicle remains qualified to receive the subsidy.

According to Rengel, Fairfax County projects that it will collect $496.7 million in personal property tax revenues this year, all of which will go into the county’s general fund that supports schools, public safety, human services, and other government functions.

Though it’s unusual for car values to go up over the course of a year, the ongoing uncertainty of the pandemic means vehicle taxes could increase again next year.

“If things continue the way they are, we can see prices going up again in 2022, but of course, we’re speculating for 2022 at this point,” Rengel said.

Photo via Obi Onyeador/Unsplash