Fairfax County leaders would love to get a repeat of the Mosaic District, but future success with similar public-private partnerships is far from guaranteed.

The mixed-use project intended to kickstart Merrifield’s revitalization has been Fairfax County’s first and only use of tax increment financing, known as TIF, a process that governments across the country have used to help develop areas.

“It’s often called the self-funding tool,” Keenan Rice, president of the Maryland-based public financing consulting firm MuniCap, told the Fairfax County Board of Supervisors’ economic initiatives committee on Tuesday (Oct. 26). “It creates the money that you’re investing to make the project happen.”

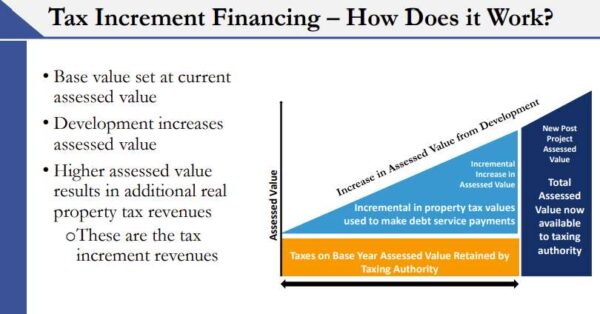

One of several tools available to the county for supporting development, a TIF can allow a developer to improve a property but freeze a tax rate for a certain period of time, keeping taxes the same as before the improvements are made.

The base tax rate is still paid, and the remaining money goes to pay off the financing, such as bonds that a government could issue.

It gives a developer money to launch a project, while the tax rate is fully restored later. A government authority can also require a project to have certain public elements.

“TIFs are risky…because they depend on new development,” Rice said. “Development’s always risky, and TIF projects are probably riskier because that’s why you’re using a TIF for those projects: There’s some unusual challenge to that project.”

To help reduce those risks, the county developed 16 financial principles in 2008 to guide decision-making, ranging from whether a project would have a “catalytic effect on…revitalization” to avoidance of a negative impact on the county’s bond rating.

Board Chairman Jeff McKay mentioned those principles could be updated and requested that county staff re-evaluate them on a 10-year, recurring basis.

Annual reports show the Mosaic District’s TIF generated over $5 million each year from 2017 to 2020, surpassing $5.5 million in some years.

The Board of Supervisors has heralded the Mosaic District as a model to replicate, but they also want to avoid pitfalls and being misled by previous results.

When a TIF fails to deliver

To see what happens when TIFs go wrong, look at Williamsburg in York County, Rice said.

The county approved the project in 2007 to help its Marquis development project, which was envisioned as a hub with a new library, office space, hotels, restaurants, retail, and entertainment, according to a county memo.

But shortly after the bonds were issued, the developer behind the project went bankrupt, Rice said.

The result was a 1980s-style “big box shopping center” featuring a Best Buy, Kohl’s, Dick’s Sporting Goods, and a JCPenney that closed in 2015 and has remained vacant, though the space has a new owner, York County noted.

Projections of a payoff within a decade and multimillion-dollar annual tax payments thereafter has turned to uncertainty over whether the privately held bonds will ever be paid off, York County administrator Neil Morgan said in a memo.

“I don’t think we can afford to fail,” Mason District Supervisor Penny Gross said.

Officials noted that Fairfax County has other options to help guide development. Rice said TIFs provide upfront capital or financing, but “not every project needs that.”

The Board of Supervisors adopted another tool in September 2020 called an Economic Incentive Program, which provides a potential 10-year tax abatement for properties in certain designated areas.

There are also special assessments and taxes. Mosaic District has both mechanisms in place but hasn’t had to use them, according to the county.

“To the District’s credit, the TIF revenues have exceeded the debt service needs every year, so we have not had to [go] down…option two, special assessment, or option three, special tax,” said Joe LaHait, debt coordinator with the county’s Department of Management and Budget. “We stand with the good fortune of the development in that district.”