When restrictions start to lessen for Virginia businesses, what will the demand be for indoor axe throwing? Not high, according to Mario Zelaya, the CEO and founder of Bad Axe Throwing.

Started in Canada in 2014, Bad Axe Throwing had been popping up in dozens of spots around the U.S. and Canada until the coronavirus pandemic prompted temporary closures for the locations.

The Mosaic District spot (2985 District Avenue, Suite 195) opened in August and allowed groups to reserve spots or drop-in to use axe throwing lanes with throwing coaches in pre-COVID-19 times.

Currently, Zelaya said that all of the Mosaic District employees are laid off and the location is temporarily closed under Gov. Ralph Northam’s orders.

Now that Northam has a proposed plan to ease business resections, Zelaya said data from other Bad Axe Throwing locations will help determine reopening plans in the Mosaic District and for the rest of his portfolio.

“I know for a fact that people are not going to flood in,” he said. “The data we have from Atlanta and Oklahoma City is quite solid in representing that statement.”

The big quandary is how comfortable people will be going to a place for the recreational sport of axe throwing before there’s a cure for the virus, extensive testing or data showing a lower death rate.

While Zelaya says the “very grim” data points to a “long and difficult road to recovery” for his business, he doesn’t plan on closing any of the locations for good.

“We are going to open up [the Mosaic District spot] when we are allowed to and we will comply with state level mandates and suggestions while also implementing our own measures,” he said.

Those measures include completely wiping down all of the dedicated lanes and axes between group events, using every other lane to keep people 6 feet apart, reducing staffing and requiring people to book appointments.

The appointment-only model will be a shift for the Mosaic District spot, which he said was one of the few spots designed to cater more to walk-ins.

Zelaya said he plans to rehire based on seniority, calling it the “most fair and equitable way of doing it.”

“The other thing we want to factor in too is we don’t want to call people back if we won’t have any shifts,” he said. “We can’t have any staff sitting around. That is no longer a viable business option. Otherwise we’re going to bleed out.”

Zelaya has struggled with the federal government’s Paycheck Protection Program, which he claims is because he is a Canadian citizen who owns a large U.S. entity.

While he said he’s glad the PPP loans help businesses cover salaries while they are closed in April and May, he said that there needs to be more relief to help get businesses back open.

“If there is no bridge program transitioning people out of this recessionary period, there is going to be a mass influx of bankruptcies,” he said.

Zelaya said Bad Axe Throwing is in the process of receiving the loan in the program’s second round of funding: “My hope is that the money will get funded and that will help us weather the storm.”

People who want to support Bad Axe Throwing now can book a spot in advance, which means they have to put a deposit between $75-$80 for two people down to guarantee a private spot, dedicated lane and specific time.

Zelaya remains hopeful that Bad Axe Throwing’s target demographic — people ages 20-45 and “outside the at-risk zone for the virus” — will come back out and help re-stimulate the economy.

“I think everyone realizes that the economy is going to open back up,” he said. “It has to open back up.”

While he understands concerns about lifting restrictions, he stresses that businesses need the customers and clients.

“Although people may not support the government’s decision to open up the economy, I think everyone knows at least one person who owns a small business,” he said. “[Owners] are doing it for survival… We essentially are offered to become more in debt for something that is completely outside our control.”

Photo via Facebook

(Updated at 2 p.m.) The Virginia Chamber of Commerce unveiled its list recognizing 50 small, fast-growing companies — and 10 businesses in Tysons and McLean are included.

Now in its 25th year, the “Fantastic 50” list highlights private Virginia companies that received high marks on their four-year revenue history, according to a press release from the chamber.

Eligible companies must have revenues between $200,000 and $200 million and demonstrate positive revenue growth and net income from last fiscal year to the most recent one, the press release said.

“Small business is the heart of our economy and we are pleased to honor the entrepreneurial spirit and hard work of Virginia’s fifty fastest growing businesses,” Barry DuVal, the president and CEO of the Virginia Chamber of Commerce, said in the press release.

Tysons-area businesses that are 2020 Virginia Fantastic 50 winners:

- Alpha Omega Integration, LLC, Tysons

- The Author Incubator, McLean

- Spatial Front Inc., Tysons

- Criterion Systems Inc., Tysons

- Artemis Consulting Inc., Tysons

- MicroHealth, LLC, Tysons

- DayBlink Consulting, Tysons

- ValidaTek, Inc., Tysons

- E3/Sentinel, Tysons

- M2 Strategy, Tysons

Additionally, Alpha Omega Integration, LLC in Vienna received the 2020 Virginia Vanguard Service Award.

“Although we are unable to honor these business leaders and their dedicated teams in-person, due to COVID-19, we applaud each of these companies who continue to set the bar higher every year and want to ensure they receive the recognition they deserve for their contributions to the commonwealth,” DuVal said.

The full list is available online.

Nightlife is zilch in Tysons at the moment due to the pandemic. After a brief hiatus, the “Tysons After Dark” series is back to highlight different online activities from local organizations that keep people busy once the sun goes down.

Animal parents can now commemorate their household companions with painted pottery.

Kiln & Co (138 Church Street NW) is offering take-home paint sets for customers to recreate a likeness of their furry friend on a piece of pottery.

Though the classes used to be in person at Kiln’s studios around Vienna, Falls Church and Reston, the business decided to allow customers to bring the experience home so they have something to do while in self-isolation, according to the Dmitry Shakhov, the manger of the Vienna studio.

The multi-step process begins when the customer sends in a picture of their pet, which Shakhov will sketch onto the pottery and return to the customer with directions and supplies.

“It’s almost like paint by number,” Shakhov said. “First you start with your lighter tones and then you go darker.”

Orders can be placed over the phone at 703-255-7155, online or using the website’s chatbox, according to Shakhov, who added that people can pick up their sets at the shop.

Though the pieces’ price tags vary, a large platter runs around $30, which includes the supplies, glazing at the studio and the sketch of the animal. If a customer wants to add specialized coloring or details, Shakhov said they can do that without an extra charge.

A spokesperson for the pottery shop also said that Shakhov is in the process of arranging other at-home workshops at well.

Photo courtesy Kiln & Co

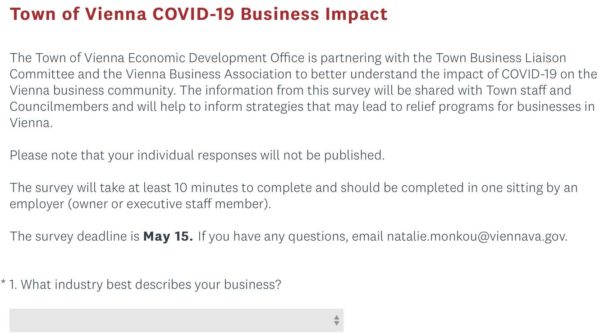

The Town of Vienna has a new survey to help town officials better understand how the coronavirus pandemic has affected local businesses.

The survey was created by the town’s economic development office with the input of the Town Business Liaison Committee and Vienna Business Association, according to a press release.

The survey includes questions about revenue losses, staffing capacities, preventative measures taken and any changes made since the pandemic started.

“Survey responses will be shared with town staff and councilmembers and will help inform strategies that may lead to relief programs for businesses in Vienna,” the press release said, adding that individual responses will not be published.

Business owners have until May 15 to complete the short survey.

Image via Survey Monkey

The Vienna Town Council has new measures to help businesses and residents struggling financially due to the coronavirus pandemic.

Last night (Monday), the council approved extending the deadline for real estate taxes, along with changing the town’s meal tax provision, according to a town press release.

“Even though the Town has its own significant, pandemic-related financial impacts to address, Town Council wants to make what temporary changes it can to assist our restaurants and property owners,” Mayor Laurie DiRocco said in the press release.

Now, the first 2020 installment of real estate taxes in the town will be due on Aug. 28. Fairfax County’s Board of Supervisors also extended its real estate tax deadline to August.

As for the meal tax, the town adopted an emergency ordinance that will be in effect from April 14 to June 13, the press release said.

“For the next 60 days, through June 13, the Town will waive any penalty and interest fees for late payments. In addition, the Town will increase the on-time payment discount from 3% to 10%,” the press release said, adding that restaurants pay collect meal tax payments from diners to the town.

Fairfax County officials have created a fund to support small businesses struggling due to the coronavirus pandemic.

The Board of Supervisors approved creating the “Fairfax County Small Business COVID-19 Recovery Microloan Fund” during their meeting today (Tuesday). The board expects the loan program to be ready by May 1, according to county documents.

The program allows the Community Business Partnership (CBP) to distribute roughly $1.2 million to eligible small businesses in the county. Businesses with fewer than 50 employees make up about 94 percent of businesses in the county, according to the documents.

Businesses who undergo a pre-submission counseling session will be able to apply for loans up to $20,000 and will be able to use the money for things like rent, equipment and critical cash operating expenses. The loans will be available on a first-come, first-serve basis, the documents say.

Fairfax County Board of Supervisors Chairman Jeff McKay said the county’s program complements federal aid, including financial assistance from the Small Business Administration.

Springfield District Supervisor Pat Herrity said he was concerned about the administrative costs of operating the county’s program. He also proposed an amendment requiring the CBP to direct small business owners to seek federal aid prior to seeking local assistance.

McKay said Herrity’s amendment, which did not pass, was not necessary because the CBP already encourages individuals to seek federal avenues for help. He also noted that many businesses are falling through the cracks due to the limits of federal assistance, including delays in the rollout of funds.

Other county officials encouraged the county to reach as many affected businesses as possible.

Mount Vernon District Supervisor Dan Storck said he hopes the program champions “administrative flexibility” in order to help out businesses with between two and 10 employees.

The funding for the program is coming from $2.5 million in the Economic Opportunity Reserve to support economic relief efforts.

Staff in the Department of Economic Initiatives will monitor the distribution of the funds to figure out how to use the remaining $1.28 million, according to county documents. After 45 days, staff will let the board know if they recommend additional funds for the program.

McKay also directed county staff to explore additional relief options for businesses and nonprofit organizations.

Catherine Douglas Moran and Fatimah Waseem contributed to this story.

Image via Fairfax County