Three Stones Residential agents pride ourselves on our consultative service approach, local expertise and real estate market knowledge. With over 26 years of business experience in the DMV, we have consistently performed in the top 2% of local Realtors and are currently the #1 group at Keller Williams Metro Center.

The following properties were recently listed in the Tysons, McLean, Vienna and Falls Church areas.

- 6251 N. Kensington Street, McLean — $1,975,000

- 10300 Dunn Meadow Road, Vienna — $979,000

- 10026 Glenoak Court, Vienna — $868,000

- 1104 Drake Street SW, Vienna — $1,569,888

- 2806 Emma Lee Street #304, Falls Church — $369,900

- 7416 Leighton Drive, Falls Church — $875,000

- 7204 Deborah Drive, Falls Church — $995,000

- 6218 Mori Street, McLean — $1,060,000

- 1814 Solitaire Lane, McLean – $1,490,000

Our role is to offer sound advice and guidance to our clients in order for them to achieve their goals in either buying, selling, leasing or managing real estate. We are truly “Your Home… for Everything Real Estate.” To schedule a private showing of these or any other properties of interest please do not hesitate to contact us here or email us at [email protected].

This regularly-scheduled sponsored Q&A column is written by Val Sotillo, Northern Virginia-based Realtor and Falls Church resident. Please submit your questions to her via email for response in future columns. Enjoy!

Question: With mortgage rates in the record lows, we have decided to buy our first home this year. Do you have any recommendations on how we should start the home buying process?

Answer: There’s plenty of advice on the topic all over the internet, so I’ll include some suggestions I don’t see on most sites and also put my own opinion on advice that you may have heard before.

Your Search Criteria

Challenge yourself early to come up with 12-15 things that are important to you. Then give yourself 100 points and allocate points to each based on how important they are to you and you’ll end up with a weighted criteria list to help you focus your search and objectively compare properties.

Length of Ownership

This is one of the most important conversations to have with yourself/your partner. You should focus on the following:

- Likely length of ownership

- Difference in criteria for a 3-5 year house vs a 10-12+ year house

- Difference in budget requirements for a 3-5 year house vs a 10-12+ year house

Appreciation is not guaranteed and difficult to predict, but the value of longer ownership periods is undisputed. One way longer ownership adds value is the potential for eliminating one or more real estate transactions, and the associated costs (fees, taxes, moving expenses, etc) and stress that comes with moving, over the course of your lifetime. If you have an opportunity to significantly increase your length of ownership by stretching your budget, it’s often justifiable.

Influencers (not the Instagram ones)

Family, friends, colleagues… they’re all happy to offer opinions and contribute to your home buying process, but the input can be overwhelming and unproductive if you don’t set boundaries. Try to determine up-front who you want involved in the process and how you’d like them to be involved.

Does Your Dream House Exist?

Spend a little bit of time searching For Sale and Sold homes on your favorite real estate search website to see if the homes selling in the area you want and within 10% of your upper budget are at least close to what you’re looking for. If not, try adjusting the price, location and non-critical criteria to figure out what compromises you’ll need to make and then compare those compromises to your current living situation.

Know Your Market

We’re in a strong seller’s market right now with low supply, high demand and increasing prices. Each sub-market behaves a bit differently and comes with its own unique set of challenges and opportunities, so take time early on to understand the sub-market(s) you’ll be involved in and what you’re likely to experience. This is something your agent should be able to assist with.

Pre-Approval & Budget

There is a lot of value in working with a lender early on in the search process. For starters, you’ll have somebody who can provide real rates and advice based on your specific financial situation and needs. A lender can only do this if they’ve reviewed your financial documents and credit. The more you put in, the more you get out.

You’ll need to have a lender pre-approval to submit an offer so if you have to do it anyway, why not doing it early on so you get the most value out of your lender? It also means that you’ll be prepared to make an offer if you find the right home before you expect to be ready.

Given how competitive the Northern Virginia real estate market is, the quality of your pre-approval can make a big difference when you make an offer. You should strongly consider partnering with a local lender with a great reputation to give yourself an advantage when making an offer. Pre-approval letters from big banks and online lenders don’t go over as well in our market. If you’re looking for a recommendation I’ll be happy to connect you with a great local lender.

Find an Agent

The least surprising suggestion on this list! Agents come in many different forms and finding somebody who suits your personality and goals is important. Ask friends, colleagues and family for referrals and meet with multiple people until you find the right fit.

The worst thing you can do is choose your agent based on whoever responds to an online showing request faster. A good agent can provide a ton of value being involved in your buying process months before you’re ready to buy. Be wary of anybody who wants you to “wait until you’re ready” before working with you.

If you’re considering buying (or selling) in the DMV in 2020 and would like to meet, feel free to email me at [email protected]!

Val Sotillo is a licensed Realtor in Virginia, Washington D.C., and Maryland with Real Living At Home, 4040 N. Fairfax Drive, Suite #10C Arlington, VA 22203, 703-390-9460.

Three Stones Residential agents pride ourselves on our consultative service approach, local expertise and real estate market knowledge. With over 26 years of business experience in the DMV, we have consistently performed in the top 2% of local Realtors and are currently the #1 group at Keller Williams Metro Center.

The following properties were recently listed in the Tysons, McLean, Vienna and Falls Church areas.

- 6251 N. Kensington Street, McLean — $1,975,000

- 2618 Occidental Drive, Vienna — $715,000

- 2203 Frank Street, Vienna — $1,275,000

- 9617 White Cedar Court, Vienna — $885,000

- 2829 Marshall Street, Falls Church — $574,900

- 6127 Brook Drive, Falls Church — $844,900

- 1737 Gilson Street, Falls Church — $1,239,000

- 1404 McLean Mews Court, McLean — $960,000

- 1469 Waggaman Circle, McLean — $1,999,000

Our role is to offer sound advice and guidance to our clients in order for them to achieve their goals in either buying, selling, leasing or managing real estate. We are truly “Your Home… for Everything Real Estate.” To schedule a private showing of these or any other properties of interest please do not hesitate to contact us here or email us at [email protected].

This regularly-scheduled sponsored Q&A column is written by Val Sotillo, Northern Virginia-based Realtor and Falls Church resident. Please submit your questions to her via email for response in future columns. Enjoy!

Question: I’ve heard the market is extremely competitive these days and sellers are getting multiple offers for their properties. What makes a winning offer?

Answer: Other than the sale price, there are other terms included in your offer that will determine its strength and the value it has to the seller. Of course, every home seller wants to get the most money possible, but they also want to accept a clean and safe offer that is going to make it to settlement without complications.

Flexibility and a willingness to budget are fundamental parts of the real estate negotiation process. In a multiple offer situation, your offer will need to shine above the rest, and the best way to do that is to make an offer favorable to the seller.

Here are some of the terms included in most contracts that have the biggest impact on the strength of an offer.

Price/Escalation Addendum

Higher price = stronger offer. Escalation Addendums are common when there are multiple offers, and allow you to beat any competing offer by a specified amount, up to the highest amount you’re willing to pay for a property. Used correctly, it prevents you from leaving money on the table, while not paying too far above what the rest of the market is willing to offer.

Contingencies

The three most common contingencies are for the home inspection, appraisal and loan. Each provide the buyer with a set of protections that allow them to renegotiate or terminate the contract, without losing the deposit. Removing a contingency or shortening the contingency timeline increases the strength of an offer.

- Home Inspection: It used to be standard for Northern Virginia buyers to include a negotiation period in the home inspection contingency, allowing them to negotiate for repairs or credits based on the results of the inspection or terminate the contract. Now it is much more common for buyers to forego the negotiation period and simply retain the right to void (aka a pass/fail inspection), which is much more attractive for a seller. Even more attractive is when buyers perform a pre-inspection on the property and remove the home inspection contingency altogether.

- Appraisal: If you’re using a mortgage to purchase a home, your lender will almost always require a property appraisal. The appraisal contingency allows you to renegotiate or terminate the contract in the event the home appraises for less than the purchase price. It is common for buyers to remove the appraisal contingency or agree to cover up to a certain amount on a low appraisal to increase the strength of an offer.

- Financing: The financing contingency allows you to terminate the contract without losing your deposit if your loan isn’t approved. Many buyers who have undergone a thorough pre-approval or underwriting process have enough confidence in their ability to secure the mortgage that they remove this protection.

Quick Closing

Most sellers want to close as quickly as possible so cash-buyers have the biggest advantage here because they can usually close in a week or less. Offering a quick-close to a seller can give your offer a significant boost.

Financing

If you’re relying on a mortgage, sellers are usually more drawn to higher down payments. That’s not to say that a 3-5% down payment (or 0% on a VA loan) can’t win in a competitive scenario, but you are at a disadvantage and will often get passed over when all other terms and pricing are relatively equal.

A thorough pre-approval process by a reputable lender can provide the seller with confidence that if they accept your offer, there is very little risk of the deal falling apart due to financial issues. Sometimes sellers take less money work with a buyer they have more confidence in.

Earnest Money Deposit

The EMD is money held in escrow by the Title Company as security for the seller that you’ll perform under the obligations of the contract. It gets applied against what you owe at closing for down payment and closing costs, but is at-risk if you default on the contract and terminate outside the legal contingencies.

Traditionally, a reasonable deposit ranged from 1-3% of the purchase price, but some buyers are electing to make substantially larger deposits in an effort to establish financial strength.

Rent-Back

If the homeowner is still living in the house during the sale, their preference is to close as quickly as possible and then have some time to move out after the sale is complete — this is called a rent-back. It used to be common for the seller to cover the buyer’s daily carrying cost (mortgage + taxes + insurance + HOA fee) for the length of the rent-back, but in this competitive market, a strong offer often includes a free rent-back for the seller.

Whether you’re buying your first home or your tenth, having a local professional on your side who is an expert in his or her market is your best bet in making sure the process goes smoothly. If you’d like to discuss buying or selling strategies, reach out to me at [email protected].

Val Sotillo is a licensed Realtor in Virginia, Washington D.C., and Maryland with Real Living At Home, 4040 N. Fairfax Drive, Suite #10C Arlington, VA 22203, 703-390-9460.

Three Stones Residential agents pride ourselves on our consultative service approach, local expertise and real estate market knowledge. With over 26 years of business experience in the DMV, we have consistently performed in the top 2% of local Realtors and are currently the #1 group at Keller Williams Metro Center.

The following properties were recently listed in the Tysons, McLean, Vienna and Falls Church areas.

- 6251 N. Kensington Street, McLean — $1,995,000

- 8878 Ashgrove House Lane, Vienna — $799,900

- 8213 Madrillon Estates Drive, Vienna — $1,159,000

- 10212 Browns Mill Road, Vienna — $1,100,000

- 3334 Ellis Court, Falls Church — $530,000

- 2165 Kings Garden Way, Falls Church — $807,000

- 7732 Camp Alger Avenue, Falls Church — $480,000

- 6419 Linway Terrace, McLean — $829,900

- 1129 Towlston Road, McLean — $2,150,000

Our role is to offer sound advice and guidance to our clients in order for them to achieve their goals in either buying, selling, leasing or managing real estate. We are truly “Your Home… for Everything Real Estate.” To schedule a private showing of these or any other properties of interest please do not hesitate to contact us here or email us at [email protected].

This regularly-scheduled sponsored Q&A column is written by Val Sotillo, Northern Virginia-based Realtor and Falls Church resident. Please submit your questions to her via email for response in future columns. Enjoy!

Question: What outdoor upgrades do you recommend now that vacation places are very limited and the whole family is home for the summer?

Answer: The summer of 2020 is shaping up to be a long one, especially since many outdoor venues and public pools remain closed due to the pandemic. Now that everyone is spending most of their time at home in the era of coronavirus, our backyards have become our havens, our places to soak up the sun, grill some food and sip some drinks, and where most of us will be celebrating the Fourth of July.

Other than giving some TLC to what you already have, such as power washing your deck, or painting the fence, here are some ideas to make your backyard more enjoyable for the whole summer. I’ve included some DIY links if you’d like to make the most of this time at home and save some money.

- Consider a large outdoor rug. Not only is this a good way to include a pop of color in your backyard, but it’s also an inexpensive way to change up a space without having to go through the process of painting or staining a deck.

- Try a gravel patio. You can save a ton of money by adding gravel instead of the more traditional patio materials, which makes this DIY project more appealing. Surrounding the gravel with lumber adds style and dimension to this space and makes it look much more expensive without the expense.

- A pergola is a fantastic idea for your dream backyard. Clear out an area on a deck or in your yard and build your own. Add curtains for extra shade to create the ultimate outdoor living room.

- Don’t forget about the outdoor lighting. Drape string lights down from a pergola or across your outdoor living space to give it a starry-night feel. You can also line any patio or garden path with torches and lanterns for soft lighting.

- Fire pits are a lovely way to add charm, coziness and relaxation to your backyard. You also don’t need a lot of space to create this cozy scene. Whether you want to cook your food over an open fire or cozy up to it with blankets on a cool night, fire pits make a great addition to your backyard. Here are some great DIY ideas.

- For a nice alfresco dinner, get a patio set that comes complete with table and chairs, or build your own outdoor table out of a few wine barrels and wooden boards for DIY yard decor.

- Let your backyard be the best spot for entertaining the whole family with a kitchen! There are plenty of ways to build an outdoor kitchen that fit within your budget. Add a charcoal grill and table on a patio for a simple look. You can also build a Grillzebo (A gazebo for your grill).

- Flowers are ideal for adding a natural pop of color to your landscape. Plant hydrangea bushes or tulip bulbs along the fence if you have a major green thumb. Or go to your local plant nursery and buy a few pots to fill with your favorite blossoms.

- Now that most public pools are closed, here are some above ground pools you can get on a budget that will be easy to remove once summer is over.

- You can bring family movie night outside, and try a DIY backyard movie theatre here.

- If you’re not into outdoor movies, but you’re into music, a simple outdoor Bluetooth speaker will help you set up the summer mood. This speaker is my favorite and it’s the best bang for your buck.

- If you have a front porch, make it look like an outdoor oasis by installing ceiling fans and hanging a set of sheer curtains.

I hope these backyard ideas inspire you to make your yard your favorite place this summer!

I also want to take a moment to wish a Happy Fourth of July to all! May this day be a symbol of hope, prosperity and happiness in your lives. Be safe, be kind, and take care of your family, friends and community.

If you’d like more information, or would like a question answered in my column, please reach out to [email protected]. I hope to hear from you soon.

Val Sotillo is a licensed Realtor in Virginia, Washington D.C., and Maryland with Real Living At Home, 4040 N. Fairfax Drive, Suite #10C Arlington, VA 22203, 703-390-9460.

Three Stones Residential agents pride ourselves on our consultative service approach, local expertise and real estate market knowledge. With over 26 years of business experience in the DMV, we have consistently performed in the top 2% of local Realtors and are currently the #1 group at Keller Williams Metro Center.

The following properties were recently listed in the Tysons, McLean, Vienna and Falls Church areas.

- 8878 Ashgrove House Lane, Vienna — $799,900

- 104 Moore Avenue SW, Vienna — $1,625,000

- 621 Pine Street SE, Vienna — $1,425,000

- 3106 Valley Lane, Falls Church — $899,950

- 304 Great Falls Street, Falls Church — $950,000

- 1100 Pine Hill Road, McLean — $865,000

- 1150 Old Gate Court, McLean — $1,499,900

- 8350 Greensboro Drive #218, McLean — $339,900

Our role is to offer sound advice and guidance to our clients in order for them to achieve their goals in either buying, selling, leasing or managing real estate. We are truly “Your Home… for Everything Real Estate.” To schedule a private showing of these or any other properties of interest please do not hesitate to contact us here or email us at [email protected].

This regularly-scheduled sponsored Q&A column is written by Val Sotillo, Northern Virginia-based Realtor and Falls Church resident. Please submit your questions to her via email for response in future columns. Enjoy!

Question: We’re considering buying a house and we’ve been attending a few virtual open houses. There is one property we really liked, and the agent mentioned the seller needs to do a rent-back for 4 weeks after selling. How does a rent-back work?

Answer: A Seller’s Post-Settlement Occupancy, more commonly referred to as a rent-back, allows a home owner to sell their home, collect the proceeds and continue living in the home for a pre-determined period of time after closing.

The most common scenarios for a rent-back are:

- The seller has a need for the sale proceeds quickly; such as applying them towards the purchase of their next home. A word of caution on this strategy for sellers — they have to make sure that they’ll be able to find and close on their next home before the rent-back period ends.

- Moving out is burdensome and/or highly disruptive to the seller’s family and/or job that they don’t want to start the process until they’re under contract and all buyer contingencies have expired.

- Sellers need to remain in their home until the school year is finished.

- Sellers want to avoid a double move, first to interim housing and then to a new home. It can be costly to store belongings, and moving twice can be a huge inconvenience.

- Buyers are flexible with their move-in date, or their current lease doesn’t end until weeks after settlement.

How Rent-Backs Work

The Northern Virginia Association of Realtors contracts (as well as other regional contracts) provide a standard form for a Seller’s Post-Settlement Occupancy Agreement so you don’t need to worry about hiring an attorney. It functions as a short-term lease including how much the seller will pay the buyer for the rent-back, how long the rent-back lasts, a security deposit and a penalty for staying past the rent-back period.

Buyers will conduct a pre-closing walk-through before they purchase the home where they have all the rights provided to them in a normal sale. At the end of the rent-back, the new owners will conduct another walk-through once the previous owners move out, which is similar to that of a walk-through at the end of a normal rental period.

If the buyers are financing the home as a primary residence, the rent-back has a limit of 60 days per the buyer’s loan regulations.

If the previous owners caused damage during the move-out, the new owners can make a claim against the security deposit, generally held by the Title Company who handled the sale.

Three Stones Residential agents pride ourselves on our consultative service approach, local expertise and real estate market knowledge. With over 26 years of business experience in the DMV, we have consistently performed in the top 2% of local Realtors and are currently the #1 group at Keller Williams Metro Center.

The following properties were recently listed in the Tysons, McLean, Vienna and Falls Church areas.

- 7422 Tillman Drive, Falls Church — $1,495,000

- 1570 Spring Gate Drive #7103, McLean — $424,900

- 1600 Great Falls Street, McLean — $1,475,000

- 1015 Salt Meadow Lane, McLean — $925,000

- 2606 Ogden Street, Falls Church — $975,000

- 3364 Annandale Road, Falls Church — $669,900

- 1677 Trap Road, Vienna — $824,900

- 10013 Murnane Street, Vienna — $789,900

- 1725 Fox Run Court, Vienna — $880,000

Our role is to offer sound advice and guidance to our clients in order for them to achieve their goals in either buying, selling, leasing or managing real estate. We are truly “Your Home… for Everything Real Estate.” To schedule a private showing of these or any other properties of interest please do not hesitate to contact us here or email us at [email protected].

This regularly-scheduled sponsored Q&A column is written by Val Sotillo, Northern Virginia-based Realtor and Falls Church resident. Please submit your questions to her via email for response in future columns. Enjoy!

Question: Do you foresee the real estate market going back to normal in the summer?

Answer: We made it to June! Can you believe it?! Spring has been full of uncertainty and we’ve all been adjusting to a whole “new normal”. Honestly, it’s impossible to predict the future but I’m very optimistic that we’re going in a positive direction now that coronavirus-related restrictions are easing and the economy is reopening.

Here’s why:

- While the number of transactions in the Tysons area is lower compared with last spring, they did not drop as much as many industry experts predicted. May has been more favorable, with increasing numbers of properties under contract and new listings, according to MLS data.

- Normally we see sales really ramp up in March and April, but amid the pandemic and widespread job losses, many buyers wanted to wait not only until they felt more secure in their jobs but also until they could physically step into the homes they were considering. As COVID-19 cases (hopefully) drop significantly and states are loosening restrictions, buyers are becoming more comfortable with the home buying process as they’ve gotten used to taking precautions such as wearing masks and keeping social distance.

- During these past months at home, homeowners had lots of time to figure what type of space is more valuable to them. Many people have found that they need a home with more space, while others have decided to downsize. What I’m seeing more often on my buyer clients must-have list, is a true home office and not just a desk area in the kitchen. The demand to work from home will remain strong motivating buyers to look for a separate space for that home office.

- Although home sales have declined due to social distancing and economic unpredictability, home prices are still strong in the Northern Virginia market. In the past couple of months, most of the buyers I represented were competing for properties with multiple offers and they either offered full asking price or above.

- Active sellers are key to a healthy market. We are seeing sellers getting their properties on the market as they are more confident with pricing than the last couple of months and they’re more comfortable as buyers and agents are taking health precautions when showing a property for sale.

- Another driver for a stronger third quarter is Millennials with families want to settle in new homes before the school year begins. Don’t expect an increase in sales to last into the fourth quarter though.

- The low mortgage rates, without a doubt, is helping to entice buyers back into the market.

While all these are signs of a market kicking into more of a recovery mode, there are still some challenges we’re still to overcome:

- Sellers haven’t come back as quickly to the market as buyers.

- Even if buyers can find a home, they may not be able to secure a loan. Mortgage rates are historic lows. But today’s reality is lenders are increasingly getting tougher on qualifying criteria.

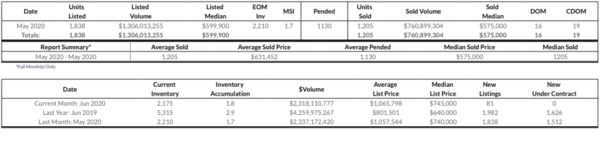

Tysons Market Update

Here are some numbers for April and May’s real estate transactions within 5 miles from Tysons:

April

- 235 Properties sold

- 192 Properties went under contract

- 26 Average days on the market

May

- 219 Properties sold

- 272 Properties went under contract (considering they close within 30 days, we should expect higher numbers in June)

- 21 Average days on the market

Fairfax County in May

In the chart below you can see our current inventory is about half of what it was in June 2019. However, the number of properties under contract is pretty close which means buyers are very active in this market.

Final Thoughts

We’ve seen a quick bounce back due to record-low mortgage rates and virtual home shopping options and I’m positive that our market will remain strong throughout this year. I will keep you posted!

If you’d like more information, or would like a question answered in my column, please reach out to [email protected]. I hope to hear from you soon.

Val Sotillo is a licensed Realtor in Virginia, Washington D.C., and Maryland with Real Living At Home, 4040 N. Fairfax Drive, Suite #10C Arlington, VA 22203, 703-390-9460.