This regularly-scheduled sponsored Q&A column is written by Val Sotillo, Northern Virginia-based Realtor and Falls Church resident. Please submit your questions to her via email for response in future columns. Enjoy!

Question: Can you tell me more about Mosaic District? What housing options are available within walking distance?

Answer: The Mosaic District is a new urban neighborhood. It’s lively and vibrant, and no matter how often I am there, I always notice something new going on. It’s definitely one of my favorite neighborhoods and hangout spots. You really have everything there at the convenience of your fingertips.

Here’s why I’m a big fan:

Great Location — It’s perfectly situated where Route 50, 66 and the Beltway meet. The Dunn Loring Metro station is only 1 mile away, and you can be in D.C. in 25 minutes. You can drive to Tysons in less than 10 minutes. There’s free garage parking and when they have big events, they offer a free shuttle to the metro.

Environmentally Friendly — Mosaic’s architecture is much more contemporary than is typically found in Northern Virginia, with more flat roofs, glass and steel. The LEED (Leadership in Energy and Environmental Design, one of the most popular green building certification programs used worldwide) for Neighborhood Development pilot project is LEED-Silver certified; and all of the townhomes were built to LEED for Homes standards. Several of the District’s buildings also have green roofs.

Activities and Shopping — So convenient! From unique boutiques to Target, fitness studios, spas and salons, Mom’s Organic Market, banks, furniture stores, coffee shops, bars, a brewery and lots of restaurants for either a quick bite or a nice date. Check out my favorite spots: Sisters Thai, True Food Kitchen for brunch, B Side for amazing drinks, Sea Pearl has the best happy hour deal and Caboose Commons with their awesome dog friendly patio. You can see the full directory here.

The Angelika Film Center is a multiscreen cinema with reserved seating, a coffee shop, full bar, gourmet snacks and great digital projection and sound technology. There’s also a giant screen on the front of the theater facing the park, where people can watch family films for free.

Strawberry Park is usually where most of the outdoor activities are held. The turf is made of recycled components and it requires no water or chemicals. Outdoor activities include yoga, Lululemon run club, seasonal festivals and Farmer’s Market. See what’s on their schedule here.

This regularly-scheduled sponsored Q&A column is written by Val Sotillo, Northern Virginia-based Realtor and Falls Church resident. Please submit your questions to her via email for response in future columns. Enjoy!

Question: We are new homeowners and we’re trying to breathe new life into our outdated poorly-functioning kitchen. Do you have any tips for us?

Answer: The kitchen is my favorite room in the house, and not just because that’s where the food is! I believe the kitchen is the heart of the home and I think that’s a great place to start with your home updates.

I spoke with Caroline Goree, a Project Leader with BOWA, a local design build firm that specializes in luxury renovations from kitchens to whole-home remodels. Here are the answers to the most frequently asked questions about kitchen renovation projects:

How Much Does It Cost To Renovate My Kitchen?

There are many different factors that go into the cost of a kitchen renovation. The size of the space, level of finish, design details, appliance package, remodeling partner and trades needed (plumber, electrical, engineer, etc.) all impact what you will spend on your project.

Thinking about what you should invest in your kitchen remodel is about understanding your needs, scope of work and what is the appropriate level of finish for your home. If you want to avoid “budget creep” throughout the project, I recommend finding a partner that spends the time planning up front rather than making decisions as the project is being built.

This regularly-scheduled sponsored Q&A column is written by Val Sotillo, Northern Virginia-based Realtor and Falls Church resident. Please submit your questions to her via email for response in future columns. Enjoy!

Question: Can you tell me about some of the walkable neighborhoods you suggest living in around Tysons?

Answer: Falls Church City is a charming community with a Downtown vibe. It’s a roughly 2-square-mile city with so much to offer. It is a walkable, bike friendly, vibrant downtown so that people don’t have to leave their community to get services, goods and entertainment.

Top Reasons that Make Falls Church City an Awesome Neighborhood:

Great Location

Metro — The West Falls Church station and the East Falls Church station, both on the Orange Line, are about two miles and one mile away, respectively.

It’s located just a few minutes from I-66, 495, Dulles Access Toll Road and just 4 miles from Tysons.

For joggers and bikers, the W&OD Trail runs east/west through the northern part of the city with intersections at North Washington Street, Little Falls Street, Great Falls Street, North Oak Street, North Spring Street, North West Street, Grove Avenue and West Broad Street.

Many Things To Do Within The City Limits.

The area has many parks with climbing equipment, playgrounds, a public library and a Saturday morning farmers market. During holidays, the city sponsors events like a July 4th parade that runs along Broad Street, the area’s main street.

There’s also a range of ethnic restaurants. My favorite are Plaka Grill (Great Greek food. Try their beef souvlaki!), Northside Social (everything from great coffee and avocado toast, to amazing pizza and wine)and Lucky Thai. Plus a number of bars like Ireland’s Four Provinces, Mad Fox Brewing Company and Clare and Don’s Beach Shack (they have trivia on Wednesdays). There’s also the State Theater with great shows every week.

Many Housing Options

There are different options from detached homes, townhomes and condos. In Falls Church City, there are currently 22 properties for sale, ranging from a one bedroom condo for $397,000, to a $1.45M 6 bedroom home built in 2006. You can see all active listings here.

Twenty properties are currently under contract, ranging from a one bedroom condo condo at $385,000 to a 5 bedroom Craftman house at $1.6 million.

In the past 6 months, 15 condos were sold for a median price of $399,000, 10 townhouses were sold for a median price of $626,000, and 54 single family homes sold for a median price of $925,000.

One of my favorite buildings in Falls Church City is Spectrum, a Condominium built in 2008. It’s located in 444 W Broad Street and it features a “green” rooftop. The roof provides a great view and it is covered with sedum plants that provide a multitude of benefits including thermal insulation for reduced energy consumption, filtering storm water and increased sound insulation for residents.

Great Quality Of Life.

This small city Ranked as No. 1 Healthiest Community in U.S. in 2018. Need I say more?

Changes on the Horizon

While the area has a timeless quality to it, things will change a bit in the next few years. Founder’s Row is a mixed use project located at the corner of W. Broad and N. West Streets.

It will include a 6-8 screen dine-in movie theater with 850 seats, 5,000 square feet of office and 60,000 square feet of retail-restaurant space and 72 senior and 322 market rate apartments. I’ll tour it for you as soon as possible!

If you’d like more information, or would like a question answered in my weekly column, please reach out to [email protected]. I hope to hear from you soon.

Val Sotillo is a licensed Realtor in Virginia, Washington DC, and Maryland with Real Living At Home, 2420 Wilson Blvd #101 Arlington, VA 22201, 703-390-9460.

This regularly-scheduled sponsored Q&A column is written by Val Sotillo, Northern Virginia-based Realtor and Falls Church resident. Please submit your questions to her via email for response in future columns. Enjoy!

Question: I’ve submitted two offers on homes in the past couple of weeks and both times lost to multiple offers. Is the inventory going to increase? What can I expect as spring is approaching?

Answer: Periods of low inventory and high demand, like what we’re currently experiencing, can be frustrating for buyers. If you’ve been looking for homes and are concerned about the lack of options you’ve seen in the market, do not give up because the inventory is already increasing and will continue to increase over the next few months.

What To Expect From The Spring Market

The spring market can be a great time for buyers because you’ll see a significant increase in inventory and a better chance of finding that perfect home.

You will also see a very similar increase in the amount of properties going under contract, which is an indicator of the not-so-good news (for buyers) that there will be a lot more competition. Be ready to make your best offer.

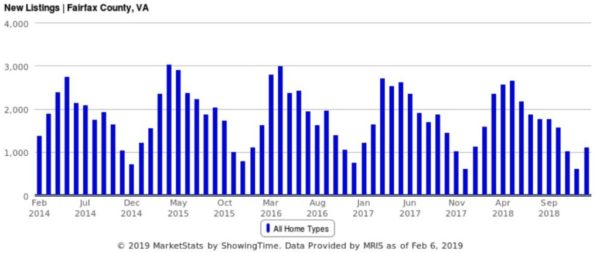

See the chart below for a month to month breakdown on New Listings in Fairfax County since 2014. This chart highlights how the lack of new inventory you’ve seen over the winter is going to increase significantly starting this month and will almost triple over the next few months.

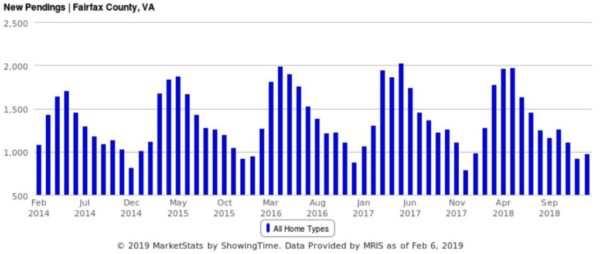

See the chart below for New Pending Contracts (properties going under contract) in Fairfax County since 2014. Contract activity is seasonal, just like new inventory.

What Can You Do To Get Ready For This Market?

Spring can be a frustrating season because you may watch your dream home go to other buyers who have made smarter, but not necessarily higher offers. So be prepared to make a strong offer with these tips:

- Financing — Have a pre-approval letter from a reputable local lender who has reviewed all relevant documents and is able to close quickly. A strong lender letter gives the seller confidence you will close on the home on time, without complications.

- Don’t Play Games — We all want to negotiate a great deal, but when a seller has multiple similar offers, they often put more weight in who they think is most likely to close with the least complications. In that scenario it pays off to make it clear how much you want the home instead of acting like you could take it or leave in an attempt to negotiate a lower price. This is not a hagglers market so don’t expect a lot of negotiations.

- Contingencies — Understand how an Escalation Addendum works and consider giving up your right to negotiate repairs using a Pass/Fail contingency or doing a pre-inspection instead to make sure there are no major issues with the property. You can also offer to cover up to a certain dollar amount in the event of a low appraisal, if you are offering to pay above the asking price.

Good luck on your house hunting! If you’d like more information, or would like a question answered in my weekly column, please reach out to [email protected]. I hope to hear from you soon.

Val Sotillo is a licensed Realtor in Virginia, Washington DC, and Maryland with Real Living At Home, 2420 Wilson Blvd #101 Arlington, VA 22201, 703-390-9460.

This regularly-scheduled sponsored Q&A column is written by Val Sotillo, Northern Virginia-based Realtor and Falls Church resident. Please submit your questions to her via email for response in future columns. Enjoy!

Question: I’m looking to purchase a home that’s less than a 10 minute walk to a Metro Station. What are the options around Dunn Loring?

Answer: The Dunn Loring neighborhood is one of the fastest changing areas in Fairfax County in a few short years. It is now a vibrant and walkable community with many different housing options to offer just a few steps from the metro.

Here’s what I love about the location:

Easy Commute

The Dunn Loring/Merrifield Metro is located between Interstate 66 at Gallows Road and it services the Orange Line which gets you to D.C. in about 25 minutes.

There’s also easy access to the Capital Beltway, I-66 and Route 50, making it convenient for public transportation and driving. And let’s not forget about cyclists! The W&OD Trail is in your backyard and it goes all the way from Shirlington to Purceville. The W&OD Trail has a maze of paths for hiking, biking, running and walking.

Everything Is Just Steps Away

You can walk to almost everything. From Home Depot, to Harris Teeter (this one has a wine bar, cheers), to a doggie day care, spa services, to the Merrifield Garden Center. You can also take a bit longer of a walk to the Mosaic District but I’ll cover that neighborhood in a separate column.

Here are some of my favorite food spots: Blackfinn Ameripub (great trivia, many tv’s for watching sports and live music), District Taco and the newest Peruvian restaurant Inca Social.

They also have a small dog park.

Bonus: There is free retail parking.

This regularly-scheduled sponsored Q&A column is written by Val Sotillo, Northern Virginia-based Realtor and Falls Church resident. Please submit your questions to her via email for response in future columns. Enjoy!

Question: My mortgage lender told me a homeowner’s policy was the last thing needed to fully approve our home loan. I want to shop around and make sure I get the coverage I need. What should I know before deciding on a home insurance policy?

Answer: It’s important to understand the basics of homeowners insurance so you can purchase a policy that meets your needs. It primarily covers your home and the stuff inside of it in the event of theft or some disasters (fire, windstorm, hail, lightning, smoke, explosion, theft, vandalism, riot and vehicle collision).

If your house is destroyed by a covered peril, a standard homeowner’s policy will go a long way toward repairing or rebuilding your home.

I’m not an insurance expert, so I talked to Matt Deadrick, with DDM Insurance, and he provided great insight that will help you understand basic insurance coverage and choose additional coverage that will fit your needs.

Dwelling Replacement Cost Coverage On Your Homeowners Policy

The value of your home may vary and this may cause concerns when you think about the amount of insurance you carry on your homeowner’s policy and whether it’s enough or too much. But the bottom line is that what your home can be rebuilt for versus what you can sell it for are two completely different things.

With Market Value, location, school district, distance to shopping and public transportation, etc. go into the calculations.

With Dwelling Replacement Cost, a completely different set of parameters is taken into account. The location is much less of a factor than the square footage of the house. The construction of your home and its features are what count.

When a new application is taken, your agent should ask questions about your home and it’s features such as square footage, age, number of rooms, if there is a finished basement, etc. This will be used to calculate an estimate of what your home can be rebuilt for, and determine the “Dwelling Coverage” on your policy.

Because there is no way to know exactly what a house costs to rebuild until it actually has to be rebuilt, it is imperative to include some coverage that takes into account that the “Dwelling Coverage” may need to be increased in the event of a catastrophic loss such as a fire.

No one wants to find out they didn’t carry enough homeowners insurance after their home is destroyed.

This is where the right homeowner’s policy can save the day. Basic homeowners policy will only pay up to the dwelling limit listed on the policy, even if it costs more to rebuild your home. However, there are several options available which help to make a homeowners policy much more flexible.

This regularly-scheduled sponsored Q&A column is written by Val Sotillo, Northern Virginia-based Realtor and Falls Church resident. Please submit your questions to her via email for response in future columns. Enjoy!

Question: Are there certain considerations to be aware of when re-listing your home in the spring/summer market if you listed and then pulled it during the fall/winter market? Are there things that you would need to fix up in a slow winter market that you could let slide in a hotter market?

Answer: You’ve been on the market for months, had a few interested buyers, but nothing has stuck. Your house is still for sale during the coldest and darkest days of the year so you’re asking if you should pull your listing and wait for the market to heat back up in the spring.

There are three scenarios that I’ll consider advising sellers to take their home off the market during the winter:

- You are living in the home, are under no pressure to sell, have been on the market for more than 60 days without an acceptable offer and have exhausted conversations with any buyers who have shown interest.

- You have received feedback from agents and potential buyers that the home needs work and you will take time over the winter to make the necessary improvements, providing that the cost of those improvements will net you better terms than an immediate price reduction and avoiding additional carry cost.

- A key selling point of your home is landscaping and/or a view that is difficult to recognize during the winter.

Pros & Cons Of Re-Listing

Pro: More Buyers. The number of homes that go under contract drops substantially from November-January and picks up quickly in February. On average, the number of new purchase contracts more than doubles by March compared to December and January.

Pro: Faster Sales. The increase is buyer activity (demand) results in homes selling a lot faster in the spring/summer.

Con: Not Necessarily Higher Prices. The increased buyer activity impacts days on market a lot more than it does pricing. The amount somebody is willing to pay or qualified to pay for a home often does not change based on the season, rather larger economic factors.

Con: If you decide to re-list in the spring, you are probably planning to do so at a higher price. Be careful with this decision because agents and buyers have easy access to previous asking prices and if you have not made any substantial capital investments to your home to justify the increase, most buyers will base their negotiations on your previous asking price, not the new one.

Pro: If you’re off-market for 60 days or more, your days on market count officially resets to zero when you re-list. This is a system rule for BRIGHT (the database of record for agents), although most buyers use sites that show the full listing history and can easily see that something was withdrawn and re-listed.

The Spring Isn’t Easier

Don’t ease up on the marketing of your home in the spring just because there are more active buyers than the winter. You will be competing against 2-3 times more homes for sale so you could make a case that you need to do even more to stand out in the spring, not less.

However, if you’re on a budget, you may want to allocate your repair, improvement and staging funds differently based on the season such as the warmth of the family room in the winter vs outdoor dining in the spring.

If You Decide To Keep It On The Market

This regularly-scheduled sponsored Q&A column is written by Val Sotillo, Northern Virginia-based Realtor and Falls Church resident. Please submit your questions to her via email for response in future columns. Enjoy!

Question: What are the differences between buying a new house versus an existing home? Should you still have a realtor if you’ve already picked out the new construction? Do you need to be pre-approved for a loan if you are using the home builder’s partnered lender? Are there still closing costs?

Answer: The decision to buy a newly built or resale home is ultimately best made by each home buyer. There are a number of key differences you should be aware of when buying new construction that may help you decide what’s best. Here’s what to expect:

Builder Contracts

Most builders use their own contracts, not the normal Northern VA Association of Realtors (NVAR) contracts. As such, the language tends to favor the developer and it’s very important to read their contract a few times, understand what you’re agreeing to and don’t be afraid to ask questions or contest specific language you’re not comfortable with.

Higher Earnest Money Deposit (EMD)

2-3% EMD is appropriate, but most developers usually require additional security of 5-10% EMD which makes sense when they’re doing a custom build because they want you to be more invested in the finishes you’re choosing.

Negotiations

In a normal re-sale negotiation, each counter is delivered in writing with the signature(s) of the seller. Most developers will only make verbal/email counters, but the buyer is expected to put their (counter) offers in writing with signature(s). Once all terms are agreed to, the developer will finally sign.

Custom Design

Being able to select your own finishes and design a custom home is one of the most appealing reasons to buy new construction (note: not all projects allow for customization), but it’s a blessing and curse.

For some, going to a showroom to select appliances, flooring, cabinets and countertops is thrilling. However, builders are on a tight schedule and require selections to be made on time, so indecisive buyers can get overwhelmed by these choices and end up disliking the process. This is particularly true if there isn’t a model unit or it’s not modeled after your tastes.

Determining Value

In many cases, developers deliver a community that’s the first of its kind in the neighborhood. Without true comps, it’s much more difficult to gauge value and the chances of the developer significantly over or under pricing a project increases.

Given that uncertainty, some of the best deals can be had in new construction, especially at the beginning of the sales period. When there are fewer comps, you should negotiate more aggressively.

Brand New

Of course, buying new construction means you’re buying brand-new everything, with fully intact warranties. In addition to the manufacturer warranties on the systems (water heater, stove, etc.), most developers also guarantee their work for years to come. You also have the benefit of the latest codes to maximize your home’s energy efficiency.

Do You Need A Realtor? Read More

This regularly-scheduled sponsored Q&A column is written by Val Sotillo, Northern Virginia-based Realtor and Falls Church resident. Please submit your questions to her via email for response in future columns. Enjoy!

Question: I am saving to buy a house in 2019. How can I be best prepared to qualify for a mortgage loan?

Answer: If home buying is on your to-do list in 2019, you need to be pre-approved for a loan before you can start viewing houses. A home is likely the biggest investment you’ll make in your lifetime, so you need to get a handle of your finances and take some steps to make sure you are in the best state financially to make the purchase.

The biggest and hardest part of the home buying process is saving for a down payment and other expenses such as closing costs, inspections, insurance and any immediate repairs you are responsible for. A common misconception keeping people from pursuing their dream of homeownership is the myth that you need to put down the traditional 20%.

Options may vary starting at just 3% depending on what type of loan you are planning to use. Additionally, closing costs can run anywhere between 2.5-5% of the total cost of the home.

Also, your credit score plays an important role in qualifying for a mortgage. Change your spending habits and boost your score.

If you check your credit report early, you’ll have ample time to correct any issues. You don’t want to have to address a bunch of mistakes on your credit report while actively looking for a home and trying to get approved for a mortgage loan. You can dispute an error by contacting the credit bureau directly

LET’S ASK A LENDER

For better guidance, I asked Chuck MacAnanny with Embrace Home Loans to give buyers some tips to be prepared and help secure the best mortgage options. Here’s his advice:

1. Avoid opening new accounts and making major purchases. Opening new credit cards, buying a car or increasing credit card balances can have a significant impact on your credit score and affect your qualifying debt ratios. So hold off on that new car and keep your debts as low as possible.

2. Know your credit score. The credit score mortgage companies use to make a credit decision determines which loan programs and what interest rate you will qualify for. Understanding what your score is and how you can possibly improve your score can help to save you a significant amount of money.

Avoid using free credit score services offered from credit card companies and other vendors like Credit Karma. These will not be the same scores that a mortgage company will use as they are derived using a different risk module.

Also good to know is the difference between a “soft” and “hard” credit pull. A few mortgage lenders now have technology that can do a “soft” pull with no impact on your score by using just the last 4 of your social security number. This is a great benefit in the early house hunting stages, so ask your lender if this is something they offer. A “hard” pull can negatively affect your score, so you will want to avoid giving your full social security number out to limit the amount of hard credit pulls you have done to protect your credit score.

3. Gather necessary financial documents. Add strength to your pre-approval by making sure you are prepared to provide your financial documents if requested. Sellers and their agents often ask if income and asset documents were verified as part of the pre-approval process.

Having your tax returns, bank statements, most recent pay stubs and other pertinent income and assent documents readily available to share is helpful.

This regularly-scheduled sponsored Q&A column is written by Val Sotillo, Northern Virginia-based Realtor and Falls Church resident. Please submit your questions to her via email for response in future columns. Enjoy!

On this Christmas Eve, I want to take just a quick moment to wish you a happy, safe and memorable holiday season.

I hope this season ends on a joyful note and continues into a positive and prosperous New Year for you and your family. Thank you for visiting this column and for submitting your questions. I am excited to be back in the New Year, bringing you more creative, informative and exciting posts!

Above are some of my favorite Christmas light displays. How did your neighborhood do?

I would love to see what other homes around Tysons did so feel free to send me photos of the best lights in your neighborhood to [email protected].

Merry Christmas and happy holidays to you all from the team at Eli Residential! Cheers to a cold season as you cozy up in the comfort of your warm home.

If you would like to discuss your Real Estate plans for 2019, or you’d like a question answered in my weekly column, please send an email to [email protected]. I hope to hear from you soon!

Val Sotillo is a licensed Realtor in Virginia, Washington D.C., and Maryland with Real Living At Home, 2420 Wilson Blvd #101 Arlington, VA 22201, 703-390-9460.