This regularly-scheduled sponsored Q&A column is written by Val Sotillo, Northern Virginia-based Realtor and Falls Church resident. Please submit your questions to her via email for response in future columns. Enjoy!

Question: We’re on the market to buy a home and the house we love is under contract with another buyer. Does it make sense to submit a backup offer if the seller is taking them? Can we get out of it if we find another home that we love?

Answer: It happens so often in this market. You finally find your dream home, only to learn that the seller has accepted another offer. While many home buyers would feel disappointed and give up on such dream home, a backup offer is another strategy you can use to get the house you love.

How Does a Backup Offer Work?

A backup offer is an offer made on a home that already has an active contract, to be acted upon if the first contract falls through. It allows the interested buyer to make a financial agreement with the seller that becomes the official buying contract if something happens to impact the existing contract. A backup offer stops the seller from entertaining offers from other buyers or putting the home back on the market.

A backup offers may seem like a long shot, but can be a buyer’s ticket to their dream home given that contracts sometimes fall through.

A Backup Offer Is Good When

- You have your heart set on a particular home, a backup offer can help you get a foot in the door before the sellers relist.

- You have time to wait and you may be able to sweep in on the home at the last minute. If you’re currently renting, and you have a few months before your lease expire, you can go month-to-month, or you have alternate housing options while you wait for the right home.

Here Are a Few Potential Reasons Why Contracts Can Fall Through

- Home Inspection — (most common) if issues are uncovered a buyer may decide to walk away or ask for too many repairs or concessions that are not agreed to by the seller

- Contract is contingent on the buyer selling their home before closing

- Appraisals — If there’s an appraisal contingency in place, and the appraisal report does not support the contract price

- Financing — Buyer is no longer qualified to obtain financing for the purchase

- Condo/Home Owner Association (HOA) documents — The buyer has three days to cancel the contract upon receipt of the condo’s disclosure documents

- Buyer changed its mind. It happens…

While You Wait For That Contract To Fall Through

You have a timeline to follow so you’re not hanging on forever. Your agent should keep in touch with the listing agent and get the deadlines on the first offer and important dates when buyers are most likely to terminate.

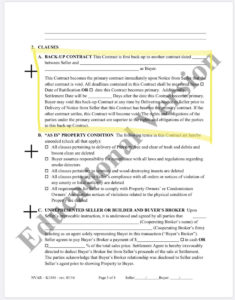

Having a backup contract does not prevent you from continuing looking at other homes. According to the NVAR Contingencies/Clauses Addendum, “Buyer may void this back-up Contract at any time by Delivering Notice to Seller prior to Delivery of Notice from Seller that this Contract has become the primary contract”. This allows you to void the backup offer should you find another property you’re interested in and you’re serious about making an offer.

If The First Contract Actually Falls Through

Before thinking it’s your lucky day, find out why it fell through. If the previous buyer cancelled the contract because there were serious issues found in the home inspection, ask yourself if you want to deal with that.

Make sure to do your own due diligence to detect any problems you don’t want to deal with. If so, as long as you include a home inspection contingency in your contract, you can walk away from the deal as well.

I don’t know what the odds are that a backup offer will succeed. But it’s a lot better odds than if you don’t submit one. It’s helpful to understand backup offers and how they can affect your chance of owning a home.

Talk to your agent to learn how to make your offer stronger and don’t get discouraged. A backup offer can work great if you are patient and have realistic expectations!

I hope you found this article informative and interesting! If you are considering buying, selling or investing in the Northern Virginia market in 2020 (or beyond), or if you have any real estate questions, don’t hesitate to email me at [email protected].

Val Sotillo is a licensed Realtor in Virginia, Washington D.C., and Maryland with Real Living At Home, 4040 N. Fairfax Drive, Suite #10C Arlington, VA 22203, 703-390-9460.