This regularly-scheduled sponsored Q&A column is written by Val Sotillo, Northern Virginia-based Realtor and Falls Church resident. Please submit your questions to her via email for response in future columns. Enjoy!

Question: We are preparing to put our house on the market this spring and wondering if you have any advice on what improvements we should make before listing.

Answer: The decisions you make on what money you do or do not spend improving your home prior to a sale often influence your bottom line more than any other decision you make during the sale process. They’re also the decisions you’re most in control of, so take your time and take them seriously.

Remodeling.com publishes an annual report showing the resale return of specific remodeling jobs, based on region of the country. Unfortunately, I can’t share the D.C. area report here because of copyright issues, but it’s worth going to the link (you have to provide them some basic info) to take a look yourself. The findings of their report show that the majority of projects, done individually, return just 50-80% of the cost.

Note that I said when “done individually” most projects return well below 100% of the money spent, but when you combine the right improvements you can create value/profit that can add to your bottom line.

Tier Your Improvements

After you prepare a full list of potential improvements, it’s important to put them into categories and analyze each category for cost, project timeline and impact on the expected resale value to determine which improvements make the most sense. Here are three categories:

- Clean-out, Clean-up: This focuses on the low cost, high return items to make a home more presentable such painting, deep cleaning, repairs, light landscaping, etc.

- Bring up to par: Investing in more expensive projects to bring them up to par with the rest of the home. For example, improving a dated kitchen if the rest of the home is updated so that the kitchen doesn’t drag down the value of the other improvements or replacing damaged hardwood floors.

- Remodel: Similar to what an investor might do to a dated home in an expensive neighborhood, a homeowner might choose to make a major investment into updates and benefit from a significant profit.

Consider All Costs

The cost of doing improvements goes beyond the cost of the labor and materials. Don’t forget to consider things like:

- Your time managing the work

- Inconvenience of having work done while you’re living in the home

- Carrying cost while work is being done, if the home is vacant

- Risk of something going wrong during the work (applies more to larger projects)

100%+ ROI

There’s no doubt that remodeling your bathroom will generate a higher sale price, but it’s rarely advisable to invest money into improvements if you won’t return more than 100% on the investment. Herein lies the challenge and strategy in planning your improvements. Understanding the profile of your likely buyers and what they value is crucial to making investments that generate profit, not just a higher price.

If you’d like to discuss buying or selling strategies, don’t hesitate to reach out to me at [email protected]. If you’d like a question answered in my column or to set-up a meeting to discuss local real estate, please send an email to [email protected].

Val Sotillo is a licensed Realtor in Virginia, Washington D.C., and Maryland with Real Living At Home, 4040 N. Fairfax Drive, Suite #10C Arlington, VA 22203, 703-390-9460.

This regularly-scheduled sponsored Q&A column is written by Val Sotillo, Northern Virginia-based Realtor and Falls Church resident. Please submit your questions to her via email for response in future columns. Enjoy!

Question: We’re closing on our new home in 2 weeks and we’re very excited! The one thing we’re not looking forward to is the stress of the actual moving process. Do you have any tips to make it easier?

Answer: You just went through the house shopping experience in this crazy market, and now you have to pack and move! Moving is never exactly fun but it usually leads to a positive outcome. Almost everyone does end up moving at some point, (and I have yet to meet someone who actually enjoys it!) so I gathered some moving tips and tricks from clients, friends and colleagues to make the whole process a bit easier.

Before Moving Day

- Schedule your utilities as soon as you know when you’re closing on your new home so they’re on by moving day. Sellers usually discontinue utilities on settlement date and if they haven’t been transferred by then, you may get charged for a reconnection fee. Also, some companies may take a few days to set up utilities and you don’t want to move into a house with no electricity or water.

- Purge items to sell or donate. If you’re selling them, you can use OfferUp, Mercari, Craigslist, Facebook Marketplace, or check for local Virtual Yard Sale groups on Facebook. If you’re donating, check the local COVID-19 safety protocols for the place you choose to give your donation to.

- Take a picture of the back of your TV before you unplug the cable box, game consoles, surround speakers, HDMI cables, and amazon fire stick so you remember where everything goes.

Packing

- Go green. U Haul has the Take a Box, Leave a Box program where you get free boxes. After your move is concluded you can drop your boxes off for someone else to reuse. Lend a Box delivers 100% recyclable plastic boxes to your door and picks them up after your move.

- Free boxes from liquor stores or big box retailers are a great way to save some cash. Just make sure you only get sturdy, good quality boxes. Avoid grocery store boxes as they may contain pests.

- Avoid mixing items from different rooms in the same box. It will make your packing quicker and your unpacking a lot easier, too.

- Go for small or medium sized boxes instead of big ones. It’s best to pack heavier items in small/medium boxes, and use the large boxes for lighter items such as pillows and linens so one person should be able to carry it. If two people need to carry the box, especially upstairs, you will lose time.

- Moving Labels are color coordinated and can easily be seen. Assign a color to each room and mark the boxes accordingly. Go the extra mile and label each box with its contents.

- Use a dry clean bag or plastic garbage bag to hold hanging clothes together. Then, simply carry the bundle from your old closet to your new closet!

- As you pack up your kitchen, put the sharp end of knives into an oven mitt or wrap them in a dish towel. Use some packing tape to secure them to prevent injuries when you unpack.

- If you take apart any furniture, keep all of the little pieces in a Ziplock bag. Then, tape the bag to the furniture so you know where it belongs when you need to put it back together.

If You’re Hiring Movers

- Hire movers as soon as you know your closing date. Good movers get booked months in advance.

- If possible, try to schedule it during the week day. Weekends tend to be the busiest. Moving during the week will not only save you time and money, but has more services open in the event you run into unforeseen circumstances.

- If the movers have to “squeeze you in”, find another company. If their schedule is too busy and they agree to “squeeze you in”, they may show up late, or exhausted from other moves before yours.

- Book the earliest morning time slot available. The moving crew will be fresh so they’ll get the job done faster and typically do a better job.

- Have plenty of hand sanitizer on hand for your movers and yourself and make sure to have soap in the bathroom of the house you’re moving from.

I hope you find at least some of these tips helpful! Moving takes a lot of work and I hope you use the excitement for your new home as a motivator to get everything done. If I missed any tips, please share them with me so I can add them to my list.

Val Sotillo is a licensed Realtor in Virginia, Washington D.C., and Maryland with Real Living At Home, 4040 N. Fairfax Drive, Suite #10C Arlington, VA 22203, 703-390-9460.

This regularly-scheduled sponsored Q&A column is written by Val Sotillo, Northern Virginia-based Realtor and Falls Church resident. Please submit your questions to her via email for response in future columns. Enjoy!

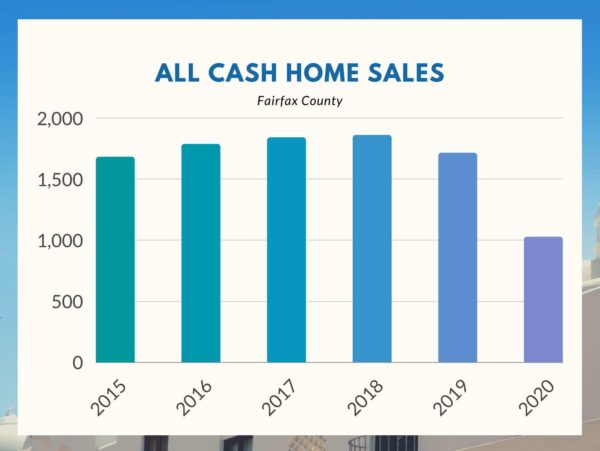

Question: I just lost a competitive offer to an all-cash buyer. How common are cash buyers in Fairfax County? How much of a disadvantage am I at?

Answer: I have personally experienced this last weekend when I helped buyers write a great offer that lost to an all-cash offer. When I ran the numbers I expected to find a significant increase in the number of cash deals over the last 12-18 months, but I learned that the percentage of homes purchased by all-cash buyers has actually decreased a few percent in the last couple of years. I believe this drop is partly due to the current record low interest rates.

The rate of all-cash purchases seems to be spread pretty evenly across all price-points and housing types. In the past five years, condo sales have steadily been only 30% of all-cash deals, and 80% of those were sub-$400k condos.

The chart below shows the number of homes sold in Fairfax County that were bought by all-cash buyers since 2015.

Cash vs Financing a Mortgage — What’s the Difference?

The idea of getting a cash offer sounds exciting, but what exactly does it mean? After all, a dollar from a lender is worth the same as a dollar from a savings account.

- Contingencies: Cash buyers don’t need the contractual protection of a financing or appraisal contingency because they don’t need a lender to approve/review anything. This is appealing for sellers because it decreases the possibility of something going wrong that disrupts the sale.

- Speed: Cash deals can close faster, often in one week or less, than financed deals which usually take at least 3-4 weeks due to the time it takes to process the loan.

- Security: Cash deals are considered more secure because the purchase funds are already available.

- Cost: Cash deals have lower buyer closing costs because there are no lender fees or lender’s title insurance. Lenders also require a substantial about (usually 1-1.5% of purchase price) of money be pre-paid into an escrow account for future property tax payments and homeowner’s insurance.

Given how competitive the current housing market is, many buyers using a mortgage take steps to make their offers as cash-like as possible by removing the appraisal and financing contingencies and/or working with lenders who can close quickly. For buyers that have taken these steps, there’s very little difference to sellers between their offer and a cash offer.

If you are a seller considering a cash offer, make sure you verify the existence of the cash funds the same way you would verify a buyer’s mortgage qualification with a pre-approval letter. The most common method of verification is to request bank statements, but a letter from the buyer’s bank should also suffice.

If you’d like to discuss buying or selling strategies, don’t hesitate to reach out to me at [email protected].

Val Sotillo is a licensed Realtor in Virginia, Washington D.C., and Maryland with Real Living At Home, 4040 N. Fairfax Drive, Suite #10C Arlington, VA 22203, 703-390-9460.

This regularly-scheduled sponsored Q&A column is written by Val Sotillo, Northern Virginia-based Realtor and Falls Church resident. Please submit your questions to her via email for response in future columns. Enjoy!

Question: Is it legal to list a room as a bedroom if it doesn’t have a closet?

Answer: That’s a common debate! Of all the misconceptions about bedroom requirements, closets may be the most common. There are no requirements in Northern Virginia that a bedroom must include a closet. You’ll be surprised at what else is missing from the requirements for a legal bedroom in Virginia.

Who Makes The Rules?

Fairfax County doesn’t have any local requirements for bedrooms and defaults to the current version of the Virginia Residential Code and Virginia Maintenance Code. In these codes, bedrooms are classified as “habitable rooms” and mostly found in Chapter 3: Building Planning of the Residential Code.

Here are some requirements for bedrooms that apply state-wide:

- Dimensions: Must be a minimum of 70 sq. ft., with no horizontal dimension under 7 ft. For example, in a rectangular room, if one side measures 7 ft, the other side must be at least 10 ft.

- Ceiling Height: Ceilings must be at least 7 ft tall. In rooms with sloping ceilings (i.e. upper level of Cape Cods), any area of the room underneath a ceiling less than 5 ft high cannot be counted towards the minimum dimensions.

- Emergency Escape: A bedroom must have two ways to exit: one that leads to the rest of the home and one that leads directly to the outside. In most cases, the outside egress will be a window with minimum requirements that include not being more than 44 inches off the floor, minimum 24 in height, minimum 20 in width, minimum 5.7 sq. ft. total opening, and if in a basement, a minimum window well of 9 sq. ft. and ability for window to open fully. It is illegal to have locking bars or grates covering an egress window.

- Heating and Ventilation: All rooms must have a window that can open to the outdoors and the open area must be at least 4% of the total floor area. Must be capable of maintaining a minimum room temperature of at least 68 degrees and have access to a heat source. Portable heaters do not count as an adequate heat source.

- Windows: Referred to as “glazed area” and must equal at least 8% of the floor area, meaning you can’t have a huge bedroom with one window.

- Ventilation: Outlets: Per the Virginia Maintenance Code, bedrooms must have at least two separate electrical outlets.

What The Code Doesn’t Include

According to the Building Code office of the Virginia Department of Housing and Community Development, the following common assumptions of bedrooms are not actually included in the code:

- Doors: The code makes no mention of having an actual door or second point of egress (Fairfax County has a local requirement for two points of egress). Presumably, this allows for an English Basement with one point of egress, not connected to the rest of the home, to be considered a legal bedroom.

- Lights

- Closets

What else do you think should be added to the minimum requirements for a bedroom in Virginia?

If you’d like a question answered in my weekly column, please send an email to [email protected]. I hope to hear from you soon!

Val Sotillo is a licensed Realtor in Virginia, Washington D.C., and Maryland with Real Living At Home, 4040 N. Fairfax Drive, Suite #10C Arlington, VA 22203, 703-390-9460.

This regularly-scheduled sponsored Q&A column is written by Val Sotillo, Northern Virginia-based Realtor and Falls Church resident. Please submit your questions to her via email for response in future columns. Enjoy!

Question: Are the sellers of a home supposed to leave appliances behind for the next owner?

Answer: Clients of mine moving from North Carolina to Virginia mentioned they were moving their washer and dryer to the new house, which I found odd, but apparently, it’s common in North Carolina and other parts of the country. My theory is that one day somebody decided to take their expensive washer and dryer with them and it created a chain reaction of everybody having to take their appliances with them after that!

Over the years, I’ve picked up on customs and contract terms that differ significantly here from other markets. I thought I’d come up with a list of standard customs and contract terms in Northern Virginia that often come as a surprise to buyers and homeowners who have transacted in other markets.

I’d love to hear from readers in the comments about other local practices that surprised you if you were used to real estate customs and contracts in another market.

- Appliances Convey — Unless specified by the sellers in the listing, all of the appliances, including washer/dryer, have conveyed (transferred to the next owner) in every transaction I’ve been part of. Buyers and sellers have to agree during negotiations what appliances and other items do or do not convey.

- No Individual Attorneys — It’s rare for an attorney outside of the Title Company to be involved in a transaction. The same Title Company almost always works on behalf of both parties (without bias).

- (Lack of) Seller Disclosures — Virginia is one of the few “Buyer Beware” states in the country; which essentially means that sellers in Virginia do not have to disclose any property defects, but they can’t hide them or lie about them either. For homes built before 1978, there’s a one-page lead disclosure form for a seller to note if they’re aware of the existence of lead paint on the property. Most states, including D.C. and MD, have lengthy seller-disclosure forms.

- Dual Agency Allowed But Not Common — Dual Agency, as defined in Virginia, is when one agent represents the buyer and seller on the same transaction. While allowed, if both parties sign-off, it is pretty uncommon.

- No Response/Counter Deadline — The contract does not require either party to respond to an offer or counter within a certain period of time unless one party writes in their own deadline.

- Earnest Money Deposits — It is customary for the deposit (EMD/Escrow) buyers make to secure the contract to be due within 3-5 days of ratification (terms accepted by both parties) and the deposit is usually 1-5% of the purchase price

- Days — Contractual obligations are usually measured in days from ratification. A “day” in Northern Virginia contracts is any calendar day, no skipping weekends or holidays, and ends at 9 p.m.

What’s the takeaway here? Even if you have real estate experience in other markets or past experience in our local market, it’s always good to refresh yourself on local customs and contracts.

If you’d like to discuss buying or selling strategies, don’t hesitate to reach out to me at [email protected].

Val Sotillo is a licensed Realtor in Virginia, Washington D.C., and Maryland with Real Living At Home, 4040 N. Fairfax Drive, Suite #10C Arlington, VA 22203, 703-390-9460.

This regularly-scheduled sponsored Q&A column is written by Val Sotillo, Northern Virginia-based Realtor and Falls Church resident. Please submit your questions to her via email for response in future columns. Enjoy!

Question: How do you choose a title company to work with when buying or selling real estate? What should I look for in a title company?

Answer: Title companies handle the legal side of the transaction such as ensuring the buyer has clear ownership, reviewing and recording the deed, issuing title insurance, and preparing paperwork for the buyer and seller to sign at closing. They operate in the background of transactions and usually the less you hear from them, the better. They are not legal representatives of either party and objectively support the buyer and seller.

In Virginia (and D.C./MD), buyers select the title company. In some cases, a seller may want to use their own firm/attorney and will request a “split settlement” but that is less common and should be done for a good reason.

Most people don’t know a title attorney or get a referral from a friend, so how do you go about choosing your title company?

Your Real Estate Agent

You shouldn’t be hiring a real estate agent just because they’re the first person to meet you at a property you found online. Among the reasons you hire an agent should be because you trust their advice and want access to their network of professionals who are relevant to a real estate transaction.

Your agent should be the first person you turn to for a recommendation on the title company because he/she has likely worked with dozens of title companies before and hopefully has one or two to recommend.

It’s perfectly fair to ask your agent why they’re recommending a specific title company.

Fees

The highest fee associated with a title company is title insurance and those prices are set by the insurance company, not the title company. Different title companies work with different title insurance companies, but rates are very similar amongst them. If you see big differences in title insurance between two title companies, one may be quoting a basic vs enhanced coverage (buyer’s choice).

I rarely see discretionary fees charged by the title company vary by more than a few hundred dollars. You can always find a cheaper option for title services, but the legal support on a real estate transaction worth hundreds of thousands or millions may not be a smart place to save a few hundred dollars and risk quality of service.

Location

It’s important to use a local title company who is familiar with local real estate and tax practices, not just licensed to practice here. I use one title company (Universal Title) for most of my Northern Virginia transactions.

Attorney Experience

Most sales follow a pretty standard, predictable process that inexperienced title companies/attorneys can handle but occasionally something unexpected comes up that requires experience and expertise to identify and resolve an issue. If problems do surface, having access to an experienced local title attorney can be the difference in whether or not the problem is even identified, whether a sale closes, and/or how much time and stress it takes to resolve the issue.

Back-Office Support

The quality and experience of the support staff is equally as important as the attorney. Look for a title company who has experienced processors who have been with the company for a while. Title companies who can afford to cut fees below their competition likely do so by not having a full supporting cast or not paying to hold onto experienced processors.

Insurance Provider

One of the key roles of a title company is that they issue title insurance, which protects your ownership interests in the property from any future claims. Most title companies have one insurance company they issue policies for such as First American, Old Republic and Chicago Title.

Most buyers are indifferent about their title insurance provider, but you may want to confirm who the title company uses to do some background on them such as size (market share) and how long they’ve been in business. I generally prefer larger insurers who have been in business for a long time.

If you’d like more information, or would like a question answered in my column, please reach out to [email protected]. I hope to hear from you soon.

Val Sotillo is a licensed Realtor in Virginia, Washington D.C., and Maryland with Real Living At Home, 4040 N. Fairfax Drive, Suite #10C Arlington, VA 22203, 703-390-9460.

This regularly-scheduled sponsored Q&A column is written by Val Sotillo, Northern Virginia-based Realtor and Falls Church resident. Please submit your questions to her via email for response in future columns. Enjoy!

Question: With mortgage rates in the record lows, we have decided to buy our first home this year. Do you have any recommendations on how we should start the home buying process?

Answer: There’s plenty of advice on the topic all over the internet, so I’ll include some suggestions I don’t see on most sites and also put my own opinion on advice that you may have heard before.

Your Search Criteria

Challenge yourself early to come up with 12-15 things that are important to you. Then give yourself 100 points and allocate points to each based on how important they are to you and you’ll end up with a weighted criteria list to help you focus your search and objectively compare properties.

Length of Ownership

This is one of the most important conversations to have with yourself/your partner. You should focus on the following:

- Likely length of ownership

- Difference in criteria for a 3-5 year house vs a 10-12+ year house

- Difference in budget requirements for a 3-5 year house vs a 10-12+ year house

Appreciation is not guaranteed and difficult to predict, but the value of longer ownership periods is undisputed. One way longer ownership adds value is the potential for eliminating one or more real estate transactions, and the associated costs (fees, taxes, moving expenses, etc) and stress that comes with moving, over the course of your lifetime. If you have an opportunity to significantly increase your length of ownership by stretching your budget, it’s often justifiable.

Influencers (not the Instagram ones)

Family, friends, colleagues… they’re all happy to offer opinions and contribute to your home buying process, but the input can be overwhelming and unproductive if you don’t set boundaries. Try to determine up-front who you want involved in the process and how you’d like them to be involved.

Does Your Dream House Exist?

Spend a little bit of time searching For Sale and Sold homes on your favorite real estate search website to see if the homes selling in the area you want and within 10% of your upper budget are at least close to what you’re looking for. If not, try adjusting the price, location and non-critical criteria to figure out what compromises you’ll need to make and then compare those compromises to your current living situation.

Know Your Market

We’re in a strong seller’s market right now with low supply, high demand and increasing prices. Each sub-market behaves a bit differently and comes with its own unique set of challenges and opportunities, so take time early on to understand the sub-market(s) you’ll be involved in and what you’re likely to experience. This is something your agent should be able to assist with.

Pre-Approval & Budget

There is a lot of value in working with a lender early on in the search process. For starters, you’ll have somebody who can provide real rates and advice based on your specific financial situation and needs. A lender can only do this if they’ve reviewed your financial documents and credit. The more you put in, the more you get out.

You’ll need to have a lender pre-approval to submit an offer so if you have to do it anyway, why not doing it early on so you get the most value out of your lender? It also means that you’ll be prepared to make an offer if you find the right home before you expect to be ready.

Given how competitive the Northern Virginia real estate market is, the quality of your pre-approval can make a big difference when you make an offer. You should strongly consider partnering with a local lender with a great reputation to give yourself an advantage when making an offer. Pre-approval letters from big banks and online lenders don’t go over as well in our market. If you’re looking for a recommendation I’ll be happy to connect you with a great local lender.

Find an Agent

The least surprising suggestion on this list! Agents come in many different forms and finding somebody who suits your personality and goals is important. Ask friends, colleagues and family for referrals and meet with multiple people until you find the right fit.

The worst thing you can do is choose your agent based on whoever responds to an online showing request faster. A good agent can provide a ton of value being involved in your buying process months before you’re ready to buy. Be wary of anybody who wants you to “wait until you’re ready” before working with you.

If you’re considering buying (or selling) in the DMV in 2020 and would like to meet, feel free to email me at [email protected]!

Val Sotillo is a licensed Realtor in Virginia, Washington D.C., and Maryland with Real Living At Home, 4040 N. Fairfax Drive, Suite #10C Arlington, VA 22203, 703-390-9460.

This regularly-scheduled sponsored Q&A column is written by Val Sotillo, Northern Virginia-based Realtor and Falls Church resident. Please submit your questions to her via email for response in future columns. Enjoy!

Question: I’ve heard the market is extremely competitive these days and sellers are getting multiple offers for their properties. What makes a winning offer?

Answer: Other than the sale price, there are other terms included in your offer that will determine its strength and the value it has to the seller. Of course, every home seller wants to get the most money possible, but they also want to accept a clean and safe offer that is going to make it to settlement without complications.

Flexibility and a willingness to budget are fundamental parts of the real estate negotiation process. In a multiple offer situation, your offer will need to shine above the rest, and the best way to do that is to make an offer favorable to the seller.

Here are some of the terms included in most contracts that have the biggest impact on the strength of an offer.

Price/Escalation Addendum

Higher price = stronger offer. Escalation Addendums are common when there are multiple offers, and allow you to beat any competing offer by a specified amount, up to the highest amount you’re willing to pay for a property. Used correctly, it prevents you from leaving money on the table, while not paying too far above what the rest of the market is willing to offer.

Contingencies

The three most common contingencies are for the home inspection, appraisal and loan. Each provide the buyer with a set of protections that allow them to renegotiate or terminate the contract, without losing the deposit. Removing a contingency or shortening the contingency timeline increases the strength of an offer.

- Home Inspection: It used to be standard for Northern Virginia buyers to include a negotiation period in the home inspection contingency, allowing them to negotiate for repairs or credits based on the results of the inspection or terminate the contract. Now it is much more common for buyers to forego the negotiation period and simply retain the right to void (aka a pass/fail inspection), which is much more attractive for a seller. Even more attractive is when buyers perform a pre-inspection on the property and remove the home inspection contingency altogether.

- Appraisal: If you’re using a mortgage to purchase a home, your lender will almost always require a property appraisal. The appraisal contingency allows you to renegotiate or terminate the contract in the event the home appraises for less than the purchase price. It is common for buyers to remove the appraisal contingency or agree to cover up to a certain amount on a low appraisal to increase the strength of an offer.

- Financing: The financing contingency allows you to terminate the contract without losing your deposit if your loan isn’t approved. Many buyers who have undergone a thorough pre-approval or underwriting process have enough confidence in their ability to secure the mortgage that they remove this protection.

Quick Closing

Most sellers want to close as quickly as possible so cash-buyers have the biggest advantage here because they can usually close in a week or less. Offering a quick-close to a seller can give your offer a significant boost.

Financing

If you’re relying on a mortgage, sellers are usually more drawn to higher down payments. That’s not to say that a 3-5% down payment (or 0% on a VA loan) can’t win in a competitive scenario, but you are at a disadvantage and will often get passed over when all other terms and pricing are relatively equal.

A thorough pre-approval process by a reputable lender can provide the seller with confidence that if they accept your offer, there is very little risk of the deal falling apart due to financial issues. Sometimes sellers take less money work with a buyer they have more confidence in.

Earnest Money Deposit

The EMD is money held in escrow by the Title Company as security for the seller that you’ll perform under the obligations of the contract. It gets applied against what you owe at closing for down payment and closing costs, but is at-risk if you default on the contract and terminate outside the legal contingencies.

Traditionally, a reasonable deposit ranged from 1-3% of the purchase price, but some buyers are electing to make substantially larger deposits in an effort to establish financial strength.

Rent-Back

If the homeowner is still living in the house during the sale, their preference is to close as quickly as possible and then have some time to move out after the sale is complete — this is called a rent-back. It used to be common for the seller to cover the buyer’s daily carrying cost (mortgage + taxes + insurance + HOA fee) for the length of the rent-back, but in this competitive market, a strong offer often includes a free rent-back for the seller.

Whether you’re buying your first home or your tenth, having a local professional on your side who is an expert in his or her market is your best bet in making sure the process goes smoothly. If you’d like to discuss buying or selling strategies, reach out to me at [email protected].

Val Sotillo is a licensed Realtor in Virginia, Washington D.C., and Maryland with Real Living At Home, 4040 N. Fairfax Drive, Suite #10C Arlington, VA 22203, 703-390-9460.

This regularly-scheduled sponsored Q&A column is written by Val Sotillo, Northern Virginia-based Realtor and Falls Church resident. Please submit your questions to her via email for response in future columns. Enjoy!

Question: What outdoor upgrades do you recommend now that vacation places are very limited and the whole family is home for the summer?

Answer: The summer of 2020 is shaping up to be a long one, especially since many outdoor venues and public pools remain closed due to the pandemic. Now that everyone is spending most of their time at home in the era of coronavirus, our backyards have become our havens, our places to soak up the sun, grill some food and sip some drinks, and where most of us will be celebrating the Fourth of July.

Other than giving some TLC to what you already have, such as power washing your deck, or painting the fence, here are some ideas to make your backyard more enjoyable for the whole summer. I’ve included some DIY links if you’d like to make the most of this time at home and save some money.

- Consider a large outdoor rug. Not only is this a good way to include a pop of color in your backyard, but it’s also an inexpensive way to change up a space without having to go through the process of painting or staining a deck.

- Try a gravel patio. You can save a ton of money by adding gravel instead of the more traditional patio materials, which makes this DIY project more appealing. Surrounding the gravel with lumber adds style and dimension to this space and makes it look much more expensive without the expense.

- A pergola is a fantastic idea for your dream backyard. Clear out an area on a deck or in your yard and build your own. Add curtains for extra shade to create the ultimate outdoor living room.

- Don’t forget about the outdoor lighting. Drape string lights down from a pergola or across your outdoor living space to give it a starry-night feel. You can also line any patio or garden path with torches and lanterns for soft lighting.

- Fire pits are a lovely way to add charm, coziness and relaxation to your backyard. You also don’t need a lot of space to create this cozy scene. Whether you want to cook your food over an open fire or cozy up to it with blankets on a cool night, fire pits make a great addition to your backyard. Here are some great DIY ideas.

- For a nice alfresco dinner, get a patio set that comes complete with table and chairs, or build your own outdoor table out of a few wine barrels and wooden boards for DIY yard decor.

- Let your backyard be the best spot for entertaining the whole family with a kitchen! There are plenty of ways to build an outdoor kitchen that fit within your budget. Add a charcoal grill and table on a patio for a simple look. You can also build a Grillzebo (A gazebo for your grill).

- Flowers are ideal for adding a natural pop of color to your landscape. Plant hydrangea bushes or tulip bulbs along the fence if you have a major green thumb. Or go to your local plant nursery and buy a few pots to fill with your favorite blossoms.

- Now that most public pools are closed, here are some above ground pools you can get on a budget that will be easy to remove once summer is over.

- You can bring family movie night outside, and try a DIY backyard movie theatre here.

- If you’re not into outdoor movies, but you’re into music, a simple outdoor Bluetooth speaker will help you set up the summer mood. This speaker is my favorite and it’s the best bang for your buck.

- If you have a front porch, make it look like an outdoor oasis by installing ceiling fans and hanging a set of sheer curtains.

I hope these backyard ideas inspire you to make your yard your favorite place this summer!

I also want to take a moment to wish a Happy Fourth of July to all! May this day be a symbol of hope, prosperity and happiness in your lives. Be safe, be kind, and take care of your family, friends and community.

If you’d like more information, or would like a question answered in my column, please reach out to [email protected]. I hope to hear from you soon.

Val Sotillo is a licensed Realtor in Virginia, Washington D.C., and Maryland with Real Living At Home, 4040 N. Fairfax Drive, Suite #10C Arlington, VA 22203, 703-390-9460.

This regularly-scheduled sponsored Q&A column is written by Val Sotillo, Northern Virginia-based Realtor and Falls Church resident. Please submit your questions to her via email for response in future columns. Enjoy!

Question: We’re considering buying a house and we’ve been attending a few virtual open houses. There is one property we really liked, and the agent mentioned the seller needs to do a rent-back for 4 weeks after selling. How does a rent-back work?

Answer: A Seller’s Post-Settlement Occupancy, more commonly referred to as a rent-back, allows a home owner to sell their home, collect the proceeds and continue living in the home for a pre-determined period of time after closing.

The most common scenarios for a rent-back are:

- The seller has a need for the sale proceeds quickly; such as applying them towards the purchase of their next home. A word of caution on this strategy for sellers — they have to make sure that they’ll be able to find and close on their next home before the rent-back period ends.

- Moving out is burdensome and/or highly disruptive to the seller’s family and/or job that they don’t want to start the process until they’re under contract and all buyer contingencies have expired.

- Sellers need to remain in their home until the school year is finished.

- Sellers want to avoid a double move, first to interim housing and then to a new home. It can be costly to store belongings, and moving twice can be a huge inconvenience.

- Buyers are flexible with their move-in date, or their current lease doesn’t end until weeks after settlement.

How Rent-Backs Work

The Northern Virginia Association of Realtors contracts (as well as other regional contracts) provide a standard form for a Seller’s Post-Settlement Occupancy Agreement so you don’t need to worry about hiring an attorney. It functions as a short-term lease including how much the seller will pay the buyer for the rent-back, how long the rent-back lasts, a security deposit and a penalty for staying past the rent-back period.

Buyers will conduct a pre-closing walk-through before they purchase the home where they have all the rights provided to them in a normal sale. At the end of the rent-back, the new owners will conduct another walk-through once the previous owners move out, which is similar to that of a walk-through at the end of a normal rental period.

If the buyers are financing the home as a primary residence, the rent-back has a limit of 60 days per the buyer’s loan regulations.

If the previous owners caused damage during the move-out, the new owners can make a claim against the security deposit, generally held by the Title Company who handled the sale.