This is a sponsored column by 3Summit Investment Management, LLC based in Vienna, VA. 3Summit designs custom, modern investment portfolios and has unique expertise in managing investment risk.

By Dan Irvine | Principal, 3Summit Investment Management

This is not a fashion column; we are here to talk about investing.

But have you ever thought about what influences your fashion decisions? How many times have you looked back at old pictures and laughed at the clothes they were wearing? No one wants to be thought of as a follower, but that is probably the reason for your questionable fashion choices of the past… everyone else was wearing the same thing.

Humans are pack animals; we are tribal beings. Mob psychology, our innate drive to follow the crowd, influences not only our fashion decisions but also our investment decisions. Our tendency to follow the pack has been key to our evolutionary success, but also makes us terrible investors by default.

Unfortunately for investors, instinct usually wins out over smarts. Despite our self-awareness, we cannot prevent ourselves from being influenced by mob psychology when faced with the powerful emotions of fear and greed that we experience when making investment decisions.

While the impact of mob psychology is the source of most investors’ losses and biggest investment failures, for the well-informed, disciplined investor, mob psychology is a fantastic and robust source of superior, long-term investment returns.

An Investment Strategy Designed to Profit From the Crowd

While impossible to prove, human psychology and our tendency to follow the herd is almost certainly the primary driver of stock market price movements. Humans are highly irrational when fear or greed lead us to follow the crowd, our irrational behavior make financial markets impossible to predict.

However, what we can predict is the certainty that market participants will continuously succumb to mob psychology, this behavior with ultimately drive a new boom and bust cycle that we see repeat over-and-over again in financial markets.

Trend following is a time-tested quantitative investment strategy that seeks to systematically profit from mob psychology by identifying trends in price movement, up and down, and then investing with the trend when investors are greedy and exiting the market when investors are fearful.

Trend following is a form of momentum investing in that when the price of a security is in motion in one direction the price tends to remain in motion in that same direction. Price momentum is driven by the human tendency to follow the crowd.

For example, when one stock is outperforming most other stocks, investor greed lures investors to buy the outperforming stock with the hope of making outsized profits. When investors pile into the same trade on a large scale, the result is significant upward price momentum that is completely detached from the fundamentals of the individual company that the investor is investing in.

Trend following is not a method of predicting stock market movements. The objective of trend following strategies is to identify when a strong upward price trend has been established, then to follow the crowd into the trade. As soon as signs appear that price momentum is slowing or reversing direction, the strategy then quickly exits the trade and cuts losses to protect from the potentially very large losses stocks are prone to delivering.

3Summit considers trend following to be an essential component of a well-designed, diversified portfolio. Trend following strategies usually have low correlations to other stock strategies, but also, they add a unique source of returns that contribute to helping a diversified portfolio produce more consistent returns over time.

High quality trend following strategies add many other benefits to a portfolio including being capable of producing enhanced returns, protecting portfolios from large losses, insulating portfolios from behavioral bias by removing human discretionary decision-making and strategically shifting a portfolio’s exposure between domestic and international stock markets.

Trend following concepts have been used for more than a century by some of history’s most famous traders, however, advanced technology and the ability to process large volumes of data quickly have aided in the speed and effectiveness of modern trend following strategies. Trend following strategies provide a systematic approach to cutting your losses short and letting your winners run.

Learn More

If you would like professional assistance in evaluating your investment portfolio and strategy, we happily provide free consultations and analysis. Also, consider gaining more unique investing insights by listening to our popular podcast or viewing our investing video series.

3Summit Investment Management is a fiduciary, fee only investment advisor providing clients with an alternative to outdated, conventional investment portfolios. We design custom, modern portfolios capable of delivering greater wealth accumulation with much lower levels of risk. To learn more about how we can help you improve your long-term investing results call (571) 565-2161, email ([email protected]) or visit 3Summit.com.

This is a sponsored column by 3Summit Investment Management, LLC based in Vienna, VA. 3Summit designs custom, modern investment portfolios and has unique expertise in managing investment risk.

By Dan Irvine | Principal, 3Summit Investment Management

U.S. stocks are generally the highest returning assets in a portfolio and therefore often make up the largest percentage of an investment portfolio.

The problem U.S. stocks present investors is that while historically they generate high returns, they are also very risky and are usually the primary contributor to portfolio losses. Many investors are not comfortable losing 30%, 50% or more of their total assets during market downturns, therefore some level of risk management is required to prevent such large losses.

Conventional diversification seeks to mitigate the risk of U.S. stock ownership by investing in other asset classes including foreign stocks, U.S. and international bonds, commodities, real estate and many others. The investment theory behind this risk management technique is that historically the value of different asset classes rarely move in perfect tandem with the value of U.S. stocks, in some cases, the value of other asset classes move in the opposite direction to the value of U.S. stocks.

The varying degrees of independence in the value of different asset classes helps to reduce the risk of loss because when U.S. stocks are suffering large losses, it becomes likely that other asset classes are losing less or possibly even generating positive returns.

In either case, the size of the total portfolio loss is reduced through conventional diversification because the portion of the portfolio not invested in U.S. stocks is likely to be generating either smaller losses or offsetting U.S. stock losses through positive returns. Conventional diversification is the investing equivalent to the old saying, “don’t put all your eggs in one basket”, which sounds good but does it always work for investors?

Why Conventional Diversification Fails When You Need It Most

Conventional diversification is not the risk management panacea that the investment management industry would have you believe.

Unfortunately, during periods the U.S. stock market is suffering its worst losses, conventional diversification does little to protect a portfolio from capturing larger than expected losses. It gets worse, when U.S. stocks are experiencing their largest gains, conventional diversification works against portfolios by limiting the gains captured.

To summarize, conventional diversification tends to fail when you need it most and drags down your gains when you need it least. Almost all investors use conventional diversification as the only risk management technique to help lower their risk of loss. The ubiquity of conventional diversification makes it very important that investors understand why it often fails to protect from large losses while at the same time lowering returns during large U.S. stock market rallies.

Below is a brief explanation of why conventional diversification often fails investors, but to get a full explanation, I recommend listening to our podcast episode that dives much deeper into this very important investing topic.

PODCAST: Conventional Diversification Fails Again

Conventional diversification fails during extreme market events because the normal relationship in how the values of each asset class move relative to U.S. stocks breaks.

Asset classes that usually do not move strongly in the same direction as U.S. stocks, suddenly begin to move in near lockstep and in the same direction as U.S. stocks. When this occurs, conventional diversification fails to reduce portfolio losses and instead increases losses beyond what an investor would expect.

To make matters worse, when the U.S. stock market is generating abnormally high returns, conventional diversification also fails by reducing the size of portfolio returns. During normal markets asset classes that usually move more strongly in the same direction as U.S. stocks begin to move in a less coordinated fashion and sometime in the opposite direction, therefore dragging down portfolio returns.

Learn More

If you would like professional assistance in evaluating your investment portfolio and strategy, we happily provide free consultations and analysis. Also, consider gaining more unique investing insights by listening to our popular podcast or viewing our investing video series.

3Summit Investment Management is a fiduciary, fee only investment advisor providing clients with an alternative to outdated, conventional investment portfolios. We design custom, modern portfolios capable of delivering greater wealth accumulation with much lower levels of risk. To learn more about how we can help you improve your long-term investing results call (571) 565-2161, email ([email protected]) or visit 3Summit.com.

This is a sponsored column by 3Summit Investment Management, LLC based in Vienna, VA. 3Summit designs custom, modern investment portfolios and has unique expertise in managing investment risk.

By Dan Irvine | Principal, 3Summit Investment Management

Most likely you have heard of ETF’s, also known as Exchange Traded Funds.

I am frequently asked what ETF’s are and how they differ from better-known mutual funds. In short, ETF’s are vastly different securities than mutual funds, and have many advantages over mutual funds.

ETF’s, like mutual funds are pooled investment vehicles, meaning investors can buy shares of a fund with each share representing an undivided interest in the underlying portfolio of assets that the fund holds.

Also, like mutual funds, the majority of ETF’s are regulated under the Investment Company Act of 1940, which provides important protections to investors including oversight by an independent board of directors, a requirement that fund assets be held separately from advisor assets and comprehensive oversight by government regulatory bodies namely the SEC.

This is where the similarities between ETF’s and mutual funds end. ETF’s have many advantages over mutual funds including greater tax efficiency, superior trading liquidity, better transparency and finally ETF’s almost always charge lower fees than mutual funds. While there are exceptions, a major distinction between a mutual fund and an ETF is the approach that the respective fund structures use in investing the fund’s assets.

Mutual funds take an active investment approach by seeking to earn greater returns than a specified index by picking individual securities that analysts and portfolio managers believe will outperform the index. ETF’s take a passive investment approach by investing in the underlying securities of a specific index with the goal of achieving similar returns to the index.

Let’s quickly examine the most important advantages ETF’s provide investors compared to mutual funds.

Greater Tax Efficiency

ETF’s are almost always preferable to mutual funds for taxable investment accounts because they generate less tax liabilities in the form of capital gains distributions compared to a similarly structured mutual fund. ETF’s generate fewer taxable events because of how they are structured to handle shareholder redemptions.

Paying capital gains tax on an unprofitable position is not simply unappealing it is a very inefficient way to grow wealth, yet a common scenario with mutual funds.

Better Liquidity

The primary reason ETF’s are more liquid than mutual funds is that they trade on an exchange intra-day. This means ETF shareholders may buy or sell their shares at the net asset value of the fund anytime throughout the trading day. Mutual fund shares can only be traded after markets close and the trades are executed directly with the fund provider instead of over an exchange.

Greater Transparency

ETF’s are generally more transparent than mutual funds because in most cases ETF’s provide transparency into underlying holdings daily versus a mutual fund that generally reports holdings quarterly. The daily transparency ETF’s provide makes it easier to evaluate and monitor the management of individual ETF’s. Additionally, ETF’s generally provide full transparency into the security selection and trading process and the security selection is systematic, meaning manager discretion does not really play a role in how an ETF is managed.

Lower Fees

The most important fee difference between ETF’s and mutual funds is that ETF’s do not carry sales loads. Most actively managed mutual funds charge a sales load when shares are purchased, charging anything from 1% to more than 5% for simply having the pleasure of buying the mutual fund. Furthermore, mutual funds carry a management fee that is charged as a percentage of assets invested per year, according to Morningstar as of 2018 mutual fund management fees averaged .67% for actively managed mutual funds compared to .15% for ETF’s.

Learn More

Replacing any mutual funds you hold with ETF’s is one of the easiest ways to improve your investment portfolio and dramatically reduce investment expenses.

To learn more about why ETF’s are one of the most important financial innovations in decades and how 3Summit uses them in the management of investment portfolios, read our article here or listen to our podcast episode on the subject.

If you would like professional assistance in evaluating your investment portfolio and strategy, we happily provide free consultations and analysis. Also, consider gaining more unique investing insights by listening to our popular podcast or viewing our investing video series.

3Summit Investment Management is a fiduciary, fee only investment advisor providing clients with an alternative to outdated, conventional investment portfolios. We design custom, modern portfolios capable of delivering greater wealth accumulation with much lower levels of risk. To learn more about how we can help you improve your long-term investing results call (571) 565-2161, email ([email protected]) or visit 3Summit.com.

This is a sponsored column by 3Summit Investment Management, LLC based in Vienna, VA. 3Summit designs custom, modern investment portfolios and has unique expertise in managing investment risk.

By Dan Irvine | Principal, 3Summit Investment Management

I believe investing and gambling are distinctly different activities, therefore I generally shy away from making comparisons between the two.

However, in this case I believe a gambling comparison may be helpful in explaining the advantages that can be gained by investing in what are called quantitative investing strategies.

If you have ever been to Las Vegas and seen the billion-dollar casino buildings, it becomes clear that the house has the advantage. Casino games, by design, put players at a statistical disadvantage. Worse yet, they are also designed to exploit psychological traps, further pushing the odds against players and forcing them into destructive decision-making patterns.

Despite the statistical odds of casino games being against the players, there have been many gamblers who have consistently won in casinos.

Gamblers who have managed to consistently win, have done so by using the same mathematical and systematic approach applied in quantitative investing strategies. Successful gamblers develop a detailed understanding of the psychological traps and the statistical probabilities of the game they play, then create detailed rules that systemize their decision-making process.

Systematic decision-making eliminates the need for the gambler to make discretionary decisions, which can be negatively biased by the emotions that arise from risk taking. The rules created to systematize the playing of the casino game are designed to ensure each action taken by the player maximizes the odds of a successful outcome, thereby getting the odds as close to even as possible.

The odds can never be fully in the gamblers favor, to make winning possible the rules the gambler follows are also designed to manage risk by systematically changing the size of the bets depending on how close to even the odds are for the gambler. This way, when the odds are more favorable the bet sizes are increased along with the potential winnings and when the odds are less favorable, bet sizes are decreased and so are the potential losses.

The gamblers only role in playing the game is to follow the carefully designed system without exception and place bets according to the defined rules. By applying the rules consistently, many people have been successful winning money playing casino games, despite the statistical odds being against them.

Quantitative investing strategies work using the same principles described in the gambling analogy. Strategies are designed within a rigid framework of rules that can be quantified to systematize investment decisions and always seek the highest probability of a successful outcome. Quantitative investing strategies eliminate the single largest point of failure for any investor, emotional decision-making.

Finally, quantitative investing strategies do not use investment expertise to try and predict the direction of markets or individual securities, but instead to design carefully crafted, evidence-based investment rules that are repeatable and can therefore be applied consistently over long periods of time.

Learn More

If you would like professional assistance in evaluating your investment portfolio and strategy, we happily provide free consultations and analysis. Also, consider gaining more unique investing insights by listening to our popular podcast or viewing our investing video series.

3Summit Investment Management is a fiduciary, fee only investment advisor providing clients with an alternative to outdated, conventional investment portfolios. We design custom, modern portfolios capable of delivering greater wealth accumulation with much lower levels of risk. To learn more about how we can help you improve your long-term investing results call (571) 565-2161, email ([email protected]) or visit 3Summit.com.

This is a sponsored column by 3Summit Investment Management, LLC based in Vienna, VA. 3Summit designs custom, modern investment portfolios and has unique expertise in managing investment risk.

By Dan Irvine | Principal, 3Summit Investment Management

Investors today are experiencing some of the highest levels of economic uncertainly that we have seen in a generation.

In the United States, there are at least 22 million people unemployed and climbing, the S&P 500 has logged 24 trading days since February with daily gains or losses greater than 3% and so far this year the S&P 500 has experienced a loss greater than 30% from the highs.

To be successful in these uncharted markets requires investors to develop realistic expectations regarding the risks and challenges they are likely to encounter as a result of powerful economic headwinds confronting financial markets.

Developing realistic investing expectations is an intellectual exercise that helps the best investors manage market adversity and prepare for the discomfort that volatile markets will undoubtably impose on them. Setting your investing expectations involves identifying economic risk factors that may negatively impact your portfolio and then evaluating how each risk factor is likely to affect your specific investment approach.

Having well-formed investing expectations is so important because when an investor has evaluated the risks they face ahead of negative economic events, they are less likely to be surprised by volatile markets and the portfolio losses that inevitably follow. Investors that have carefully thought through risks in advance, provide themselves a solid anchor to rely on during market chaos that helps to limit fear and focus their decision making away from short-term noise and towards rational long-term investment plans.

Identifying Current Risk Factors That May Impact Your Portfolio

Your investing expectations should be developed based on risk factors you have identified that are supported by economic history and sound science.

To help you develop your own investing expectations, below are some of the possible risk factors we have identified that relate to the current market uncertainty brought about by the global pandemic.

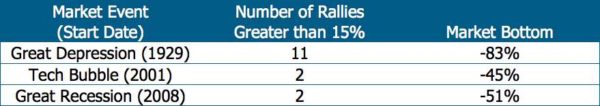

1. Our economy is in a recession so investors should not be complacent about the recent market rally in the S&P 500. Stock market rallies of greater than 15% after large losses are common, but during recessions the rallies often fade and the market then descends to even greater losses. The possibility of deeper losses is a risk factor for investors in the year or two ahead.

The table below shows historical market events where stocks rallied more than 15% multiple times before heading towards their ultimate bottom.

2. As reported by The New York Times science and health reporter Donald McNeil Jr., COVID-19 is not likely to go away with hot weather or on its own. Our lives and therefore our economy will most likely not be able to return to normal until a vaccine is developed and broadly administered or a majority of the population has been infected.

The record for the fastest vaccine development is the mumps vaccine which took four years. Technology and eliminating some safety protocols could obviously speed up the process of developing a COVID-19 vaccine, however even 18 months is a very aggressive estimate. Our economy will struggle until we can return to our normal lives, a potentially protracted recession is a major risk factor confronting investors.

3. The government is printing and borrowing record amounts of money to limit the economic impact of the pandemic, the success of those efforts and any economic side effects they may cause are unknown. Inflation and more austere government spending after this crisis are an economic risk factor facing investors and could further lengthen the amount of time it takes the economy to recover.

Despite how unsettling the risk factors above may seem, spending time evaluating them sets the ground work for developing realistic investing expectations for your portfolio that will impower, and mentally prepare you to weather any economic storm that may come.

It is easier to stay calm and make good decisions when you expect and plan for losses and long recoveries. Well-formed investing expectations based on a detailed understanding economic risks will provide you the clarity to evaluate market events as they happen from a long-term prospective and free yourself from the emotions of short-term market volatility.

In life and investing, there is comfort and wisdom that comes from being prepared for the worst, but usually the ultimate outcome is less severe than you might have imagined. However, you can only benefit from this truth if you have developed the appropriate expectations to support the emotional fortitude required to stay the course and stick with your investment plan.

Learn More

If you would like professional assistance in evaluating your investment portfolio and strategy, we happily provide free consultations and analysis. Also, consider gaining more unique investing insights by listening to our popular podcast or viewing our investing video series.

3Summit Investment Management is a fiduciary, fee only investment advisor providing clients with an alternative to outdated, conventional investment portfolios. We design custom, modern portfolios capable of delivering greater wealth accumulation with much lower levels of risk. To learn more about how we can help you improve your long-term investing results call (571) 565-2161, email ([email protected]) or visit 3Summit.com.

This is a sponsored column by 3Summit Investment Management, LLC based in Vienna, VA. 3Summit designs custom, modern investment portfolios and has unique expertise in managing investment risk.

By Dan Irvine | Principal, 3Summit Investment Management

The recent pandemic has delivered a sudden and deep economic shock to local businesses in the Tysons/Vienna region.

There are several government programs that have been created or expanded through the CARES Act, which was recently passed through Congress and signed into law by the President to help small businesses cope and survive this health and economic crisis.

This column is to assist small business owners to better understand the emergency support programs available to them through the Small Business Administration and to help them decide the program that may be best for their business.

I will start by saying any business owner that is suffering lost revenue and other business challenges as a result of COVID-19 should absolutely take advantage of one of the SBA loan programs we are going to cover. Both programs include either loan forgiveness or a financial grant that results in financial assistance for your business that does not need to be re-paid!

SBA Paycheck Protection Program (PPP)

The first program is the Paycheck Protection Program (PPP), which seeks to underwrite two months of payroll and related expenses to help business retain and pay their employees during the pandemic crisis.

The most important feature of a PPP loan is that any portion of the loan that is used for qualified expenses during the 8-weeks after the loan is originated are eligible to be forgiven and do not need to be paid back!

Here are a few key details of the PPP loan program:

- Businesses operating on February 15, 2020 with less than 500 employees that can qualify for a PPP loan include business entities, sole proprietorships and specific categories of nonprofits.

- Qualified expenses that you may use the loan proceeds to cover and that are eligible for loan forgiveness include payroll, group health insurance premiums, rent, utilities and mortgage interest payments.

- Your business is eligible to borrow the lesser of $10 million or 2.5 times the average payroll costs you incurred during the prior year before the date the loan is made. There are many details to how the average payroll cost is calculated, you should work with your accountant and loan originator to ensure you understand the calculation.

- The amount of debt that is eligible to be forgiven decreases if your business lowers wages in excess of 25% or decreases the number of full-time equivalent employees during the initial 8-week period after loan origination. Employees laid off and re-hired by June 30, 2020 will not reduce the loan forgiveness amount.

- Any portion of the loan that does not qualify for loan forgiveness will become a maximum 10-year loan with an interest rate not to exceed 4%. There is a 6-month deferment on the first loan payment.

The PPP loan program is on a first come first serve basis with loans being distributed until the $339 billion in funds allocated have been depleted. If you believe your business qualifies for a PPP loan, you should begin the application process by contacting a commercial banker and your accountant. You must go through an authorized SBA 7(a) lender to apply.

This is a sponsored column by 3Summit Investment Management, LLC based in Vienna, VA. 3Summit designs custom, modern investment portfolios and has unique expertise in managing investment risk.

By Dan Irvine | Principal, 3Summit Investment Management

Many investors who have looked at their investment account recently are stunned by both the size of the losses they have experienced and how quickly those losses happened.

In late February, stock markets around the world descended into bear market territory (losses greater that 20%) in the shortest period in history. That is right, our markets declined to bear market territory faster than during the Great Depression!

Worst of all, conventional diversification techniques of holding stocks, bonds, and precious metals has not helped lessen the pain. The chart below shows the returns of different asset classes from their highs through March 23, 2020.

Asset Class Losses from Highs Through March 23, 2020

The only true safe haven in this market route has been cash. Investors often do not realize that conventional diversification usually fails during severe bear markets until they look at their investment account balances during times like these.

Lowering the Risk of Large Losses

If conventional diversification fails, what can an investor do to protect their portfolio against large losses in bear markets? The best solution is to add additional sources of diversification not found in conventional portfolios but actively used in modern portfolio design.

Investment strategies like trend following are designed to protect portfolios against rare events like we face today. Trend following strategies reduce the amount of stocks in a portfolio when markets begin generating large losses and start to trend down. Trend following strategies are a time-tested method to help avoid large portfolio losses, and they have been successful once again in this bear market.

This is a sponsored column by 3Summit Investment Management, LLC based in Vienna, VA. 3Summit designs custom, modern investment portfolios and has unique expertise in managing investment risk.

By Dan Irvine | Principal, 3Summit Investment Management

The large stock market losses over the last few weeks are a great opportunity to better understand the impact losses have on your investment portfolio and your long-term wealth.

Improving your knowledge of how investment losses work can help you safely navigate the dangerous and uncertain markets we are facing with greater confidence.

When investors are asked why they choose to invest their money, a common answer is they want their money to work for them and grow over time by benefiting from the powers of compounding. Regrettably, most investors fail to realize that compounding works in both directions and compounded losses can permanently reduce the wealth you accumulate from investing.

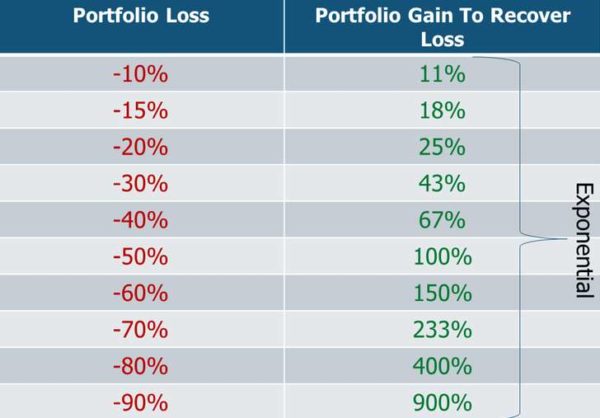

Being successful at anything in life usually comes down to the fine details, profitable investing is no different. As you watch the markets from day-to-day it is easy to make critical miscalculations. For example, if your portfolio losses 1% today, thanks to compounding you must earn more than 1% tomorrow to recover from your loss. Simply stated, whenever your portfolio takes a step back, it must take more than a step forward to get back to where it started.

Unfortunately, the news about compounded losses gets worse. The larger the loss your portfolio suffers, the exponentially larger your gains must be in the future to recover and get back to even. This means that the returns you need to earn to recover from losses grow faster than the losses themselves. The table below shows the returns you must generate (right column) to recover from different size investment losses (left column).

Returns Required to Recover from Investment Losses

Source: 3Summit Investment Management

The impact losses have on a portfolio is a detail commonly ignored because of a misunderstanding of the math behind how investment returns work. Sometimes a short video is worth a thousand words. View the quick video below to learn why you must earn higher returns than what you lost to get your portfolio back to even.

This is a sponsored column by 3Summit Investment Management, LLC based in Vienna, VA. 3Summit designs custom, modern investment portfolios and has unique expertise in managing investment risk.

By Dan Irvine | Principal, 3Summit Investment Management

The financial services industry suffers from significant ethical challenges, but most people do not realize the extent to which their interests directly conflict with the interests of their financial advisor or how those conflicts impact their wealth.

For example, only 9% of financial advisors are both obligated to provide investment advice that is in their client’s best interest and are not permitted to be compensated through commissions or sales charges.

Why should you care if your financial advisor is obligated to act in your best interest or how your advisor gets paid? The U.S. Department of Labor estimated in 2016 that conflicted investment advice may cost Americans as much at $17 Billion a year! One way to avoid paying the potentially high costs of receiving conflicted investment advice from a trusted financial advisor is to only work with an advisor bound by a fiduciary duty to you and works on a fee-only basis.

What is a Fiduciary?

A fiduciary financial advisor is bound by an ethical obligation to act only in their client’s best interest. A fiduciary must avoid conflicts of interest and clearly disclose any possible conflicts to their clients.

Common Conflicts of Interest

Financial advisors can have many conflicts of interest that are likely to harm your financial success and cost you a fortune in fees. Here are two examples of common conflicts you should be aware of when working with a financial advisor:

- Fee-Sharing Agreements — Many financial advisors enter into fee-sharing agreements with mutual fund providers. A mutual fund provider can charge investors in their mutual funds an annual sales fee that may then be given to a financial advisor as a kickback for investing their clients in the providers funds. Fee-sharing is a huge conflict of interest because financial advisors are incentivized to only invest their clients in mutual funds that kickback fees to them, instead of investing in funds with the best management and lowest fees or better yet, not buy mutual funds at all for their clients.

- Commissions on the Sale or Trading of Financial Products — Many advisors receive large commissions for investing their clients in mutual funds, insurance policies and annuity products. It is common for advisors to recommend expensive annuities and other insurance products because they earn very large commissions by selling them to their clients.

Also, earning commissions on the trading of mutual funds through up-front fees can incentivize an advisor to “churn” investment accounts. Churning occurs when an advisor trades excessively in order to extract additional commissions from their clients. Upfront fees on a mutual fund (called front-end loads) can be as high as 5% of the value of the trade.

If you have a half a million-dollar account and an advisor invests the entire account in several 5% front-end load mutual funds, you just paid $25,000 dollars in fees out of your retirement savings and your financial advisor receives a portion of those fees as sales commissions. When the advisor decides to switch funds in the future you are likely to pay front-end load fees again!

This is a sponsored column by 3Summit Investment Management, LLC based in Vienna, VA. 3Summit designs custom, modern investment portfolios and has unique expertise in managing investment risk.

By Dan Irvine | Principal, 3Summit Investment Management

In 2019, the S&P 500 returned 31.49%!

Performance this good is rare, the S&P 500 has only generated annual returns this high 11 out of the past 83 years. Given these spectacular returns investors should beware, the most common and often damaging investing mistake after blockbuster years like last year, is to give into the temptation to chase performance.

A traditional diversified investor with a portfolio of around 60% in stocks and 40% in bonds, most likely generated returns around half the S&P 500 in 2019. Returns of around 14% for diversified portfolios, while excellent, do not usually make investors happy compared to what the broader S&P 500 returned.

Following periods of abnormally high returns, investors naturally compare their portfolio to widely publicized index returns, like the S&P 500, despite the irrelevance of the comparison. This comparison can trigger investor greed as the fear of missing out on a continuation of unusually high returns drives investors to chase those potential returns by increasing their allocation to stocks.

Missing out on unusually high returns, like we saw last year, can be as psychologically tormenting to investors as watching their portfolio suffer very large losses. Often the urge to chase performance hoping to earn higher returns can prove to be too much for investors leading to a cascade of mistakes.

The temptation of a diversified investor to chase performance can result in two distinct, but equally damaging investing mistakes. The first mistake is dramatically increasing the risk of a diversified portfolio by buying more stocks at already high prices, in hopes of increasing returns. Investors who make this mistake usually plan to return to a diversified strategy in the future when the stock market begins to encounter challenges and negative returns, which is the definition of a market timing strategy.

The second mistake happens when the very risky portfolio takes large losses, which then can cause a panic, pushing the investor to reduce their allocation to stocks at lower prices in order to de-risk the portfolio to slow or stop losses. What should be clear from this all too common scenario is that the urge to chase performance pushes investors to change investment strategies and become market timers. Sadly, market timing almost always results in buying high and selling low, which is the opposite of a good investment strategy.

To succeed at a market timing strategy, an investor must be right about both the future direction of the stock market and the timing of when the stock market direction will change. They must be right about direction and timing when both increasing and decreasing their allocation to stocks. If you are counting, market timing success requires four correct predictions in a row!