This regularly-scheduled sponsored Q&A column is written by Val Sotillo, Northern Virginia-based Realtor and Falls Church resident. Please submit your questions to her via email for response in future columns. Enjoy!

Question: I just lost a competitive offer to an all-cash buyer. How common are cash buyers in Fairfax County? How much of a disadvantage am I at?

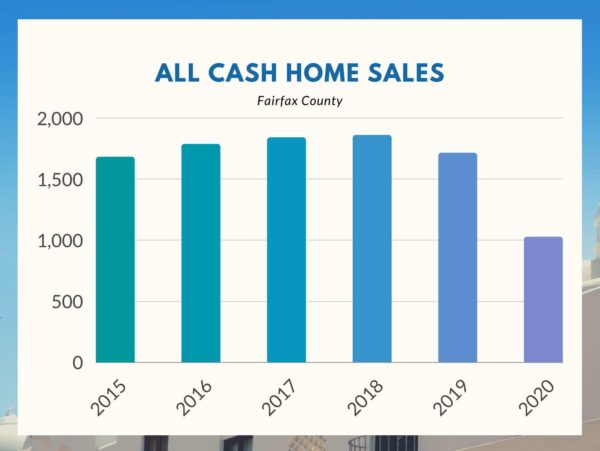

Answer: I have personally experienced this last weekend when I helped buyers write a great offer that lost to an all-cash offer. When I ran the numbers I expected to find a significant increase in the number of cash deals over the last 12-18 months, but I learned that the percentage of homes purchased by all-cash buyers has actually decreased a few percent in the last couple of years. I believe this drop is partly due to the current record low interest rates.

The rate of all-cash purchases seems to be spread pretty evenly across all price-points and housing types. In the past five years, condo sales have steadily been only 30% of all-cash deals, and 80% of those were sub-$400k condos.

The chart below shows the number of homes sold in Fairfax County that were bought by all-cash buyers since 2015.

Cash vs Financing a Mortgage — What’s the Difference?

The idea of getting a cash offer sounds exciting, but what exactly does it mean? After all, a dollar from a lender is worth the same as a dollar from a savings account.

- Contingencies: Cash buyers don’t need the contractual protection of a financing or appraisal contingency because they don’t need a lender to approve/review anything. This is appealing for sellers because it decreases the possibility of something going wrong that disrupts the sale.

- Speed: Cash deals can close faster, often in one week or less, than financed deals which usually take at least 3-4 weeks due to the time it takes to process the loan.

- Security: Cash deals are considered more secure because the purchase funds are already available.

- Cost: Cash deals have lower buyer closing costs because there are no lender fees or lender’s title insurance. Lenders also require a substantial about (usually 1-1.5% of purchase price) of money be pre-paid into an escrow account for future property tax payments and homeowner’s insurance.

Given how competitive the current housing market is, many buyers using a mortgage take steps to make their offers as cash-like as possible by removing the appraisal and financing contingencies and/or working with lenders who can close quickly. For buyers that have taken these steps, there’s very little difference to sellers between their offer and a cash offer.

If you are a seller considering a cash offer, make sure you verify the existence of the cash funds the same way you would verify a buyer’s mortgage qualification with a pre-approval letter. The most common method of verification is to request bank statements, but a letter from the buyer’s bank should also suffice.

If you’d like to discuss buying or selling strategies, don’t hesitate to reach out to me at [email protected].

Val Sotillo is a licensed Realtor in Virginia, Washington D.C., and Maryland with Real Living At Home, 4040 N. Fairfax Drive, Suite #10C Arlington, VA 22203, 703-390-9460.