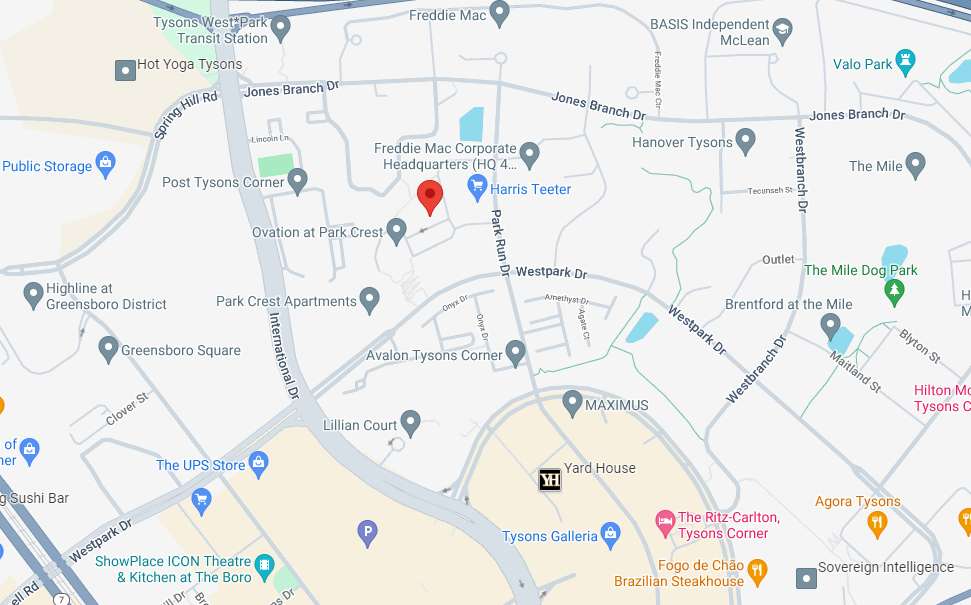

This is a sponsored column by attorneys John Berry and Kimberly Berry of Berry & Berry, PLLC, an employment and labor law firm located in Northern Virginia that specializes in federal employee, security clearance, retirement and private sector employee matters.

By John V. Berry, Esq.

The President recently proposed a new federal rule which will affect the wages of employees who earn tips.

The new rule was proposed on October 8, 2019 by the Department of Labor (DOL) and would permit employers to require widespread sharing of tips with other types of co-workers. One of the major industries affected would be the foodservice industry. The newly proposed rule would permit employers to share wait staff tips with food preparation staff and others (e.g. dishwashers, food delivery personnel).

Difficulties With the New Tip-Pooling Rule

A problematic part of the newly proposed rule would give employers newfound flexibility in assigning non-tipped assignments to workers who rely on gratuities for the major portion of their income. The restaurant lobbying industry has sought these types of changes for some time. Former President Obama’s Administration had previously mandated that tips belonged to the workers that received them.

One of the major problems with the new rule, for employees that earn tips is that it takes funds earned by them and transfers them to employees that don’t earn tips. By doing this, restaurant owners are potentially able to compensate food staff (non-tip earners) with lower salaries.

Tipped Employees Wages will be Affected

The DOL, in their proposal, even acknowledges that the new rule will result in tipped employees spending more time on lower-paying duties:

“The removal of the twenty percent time limit may result in tipped workers such as wait staff and bartenders performing more of these non-tipped duties such as ‘cleaning and setting tables, toasting bread, making coffee, and occasionally washing dishes or glasses.’ …Tipped workers might lose tipped income by spending more of their time performing duties where they are not earning tips, while still receiving cash wages of less than minimum wage.”

Employers will Gain

Employers will gain from the situation and may be able to provide lower salaries to non-tip earners, offsetting the loss with tip income. The DOL also provides the real rationale for the change in the proposed regulation: “[E]mployers that had been paying the full minimum wage to tipped employees performing related, non-tipped duties could potentially pay the lower direct cash wage for this time and could pass these reduced labor cost savings on to consumers.”

The proposal should become final in about 6 weeks and could have some changes in the final version. However, if a new administration comes in, the tip-pooling policy could potentially change once again.

Conclusion

If you are in need of employment law representation or advice, please contact our office at 703-668-0070 or through our contact page to schedule a consultation. Please also visit and like us on Facebook or Twitter.