Things are getting better for Tysons’ economy, but slowly.

For offices around Tysons, the boom anticipated with the opening of the Metro in 2014 has been more of a trickle as growth continues at a more sluggish pace than initially anticipated.

The Office Submarket Report on Tysons Corner (their wording, not ours) by Ryan Rauner, an associate broker with Realty Markets, shows a market experiencing steady, if unremarkable, growth.

“Despite slow demand growth at the metro level, some has trickled down to Tysons, helping vacancies improve slightly over the past few years,” the report said. “An explosion in the residential population has not yet been matched by strong office-demand growth, despite four Metro stations opening in the submarket.”

While the expansion of the Capital One facility was a welcome boon, the report notes that most tenants are not actively expanding their footprint and there has been a spate of large move-outs, specifically pointing to public affairs consulting group Interel’s decision to leave Tysons for Washington D.C.’s East End Submarket.

Which isn’t to say there haven’t been plenty of new clients coming into Tysons. Apian announced in April it would be moving to Tysons while Cvent announced it would be expanding its local offices. Facebook is also reportedly looking for space at Tysons II to occupy between 75,000-85,000 square feet.

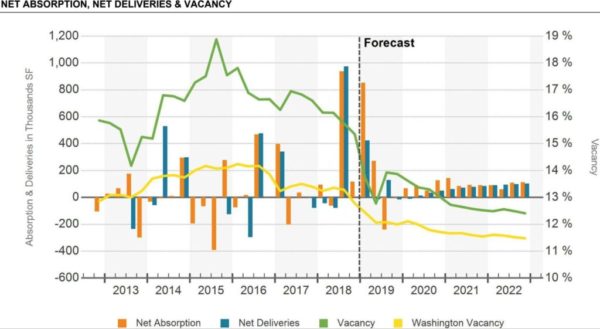

In 2015, office vacancies in Tysons were near 18 percent. Since then, vacancies have steadily fallen to 15.6 percent. Forecasts for the market show vacancies taking a dip in middle-2019 then continuing a steady decline.

The high supply of office and relatively low demand led office rents in Tysons to face a steep decline from 2012-2014. There’s been some growth there, averaging about 2 percent from 2015-2018, but the report also warned not to view that growth as a trend.

“High vacancies could continue weighing on growth,” the report said. “Rents have continued their increase this year but at a relatively slow pace — as of early December, rents had increased by roughly 2 percent for the year. At the metro level, rents surpassed their pre-recession peak in 2015, but those in [Tysons] are just now reaching that point.”

The report did note that Tysons isn’t alone in its lackluster rent growth, that several other locations across Fairfax have also faced similar low rents.

None of this has slowed construction, however. There was 1.2 million square feet of new office space created between 2014-2017. Last year also saw a record high of office space opening with Capital One’s 975,000 square foot expansion.

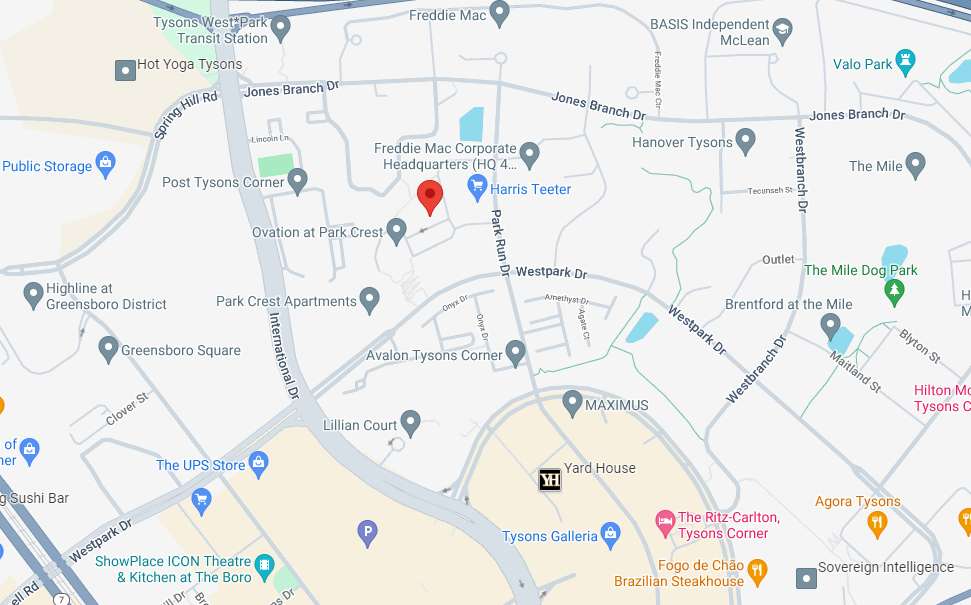

The report notes that there are two notable projects underway: The Boro and View at Tysons.

The Boro is anticipated to include 582,000 square feet of new office space. Boro Tower, the main office component of the project, is currently 70 percent pre-leased and is expected to be ready sometime this year.

The View at Tysons is further out in development but is expected to include 570,000 square feet of office space and the region’s tallest building as part of a 2.8 million-square-foot mixed-use development.